Wednesday Mar 04, 2026

Wednesday Mar 04, 2026

Monday, 1 March 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields were seen increasing once again during the shortened trading week ending 25 February on the back of renewed selling interest amidst a slowdown in activity towards the latter part of the week.

The secondary market bond yields were seen increasing once again during the shortened trading week ending 25 February on the back of renewed selling interest amidst a slowdown in activity towards the latter part of the week.

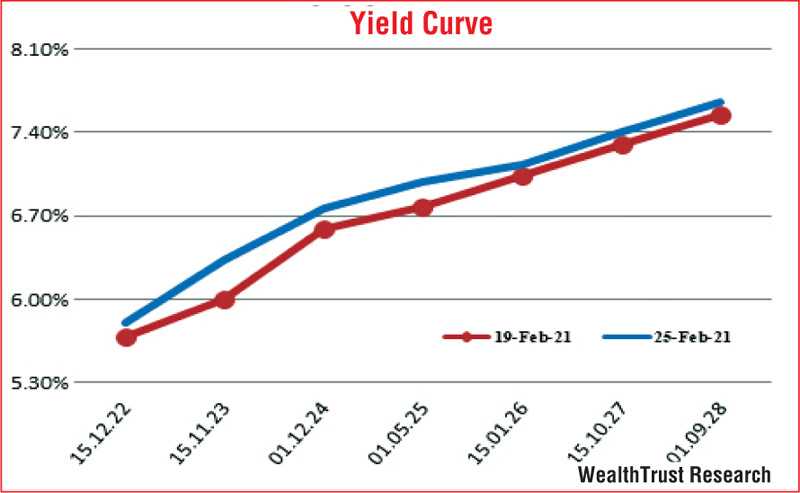

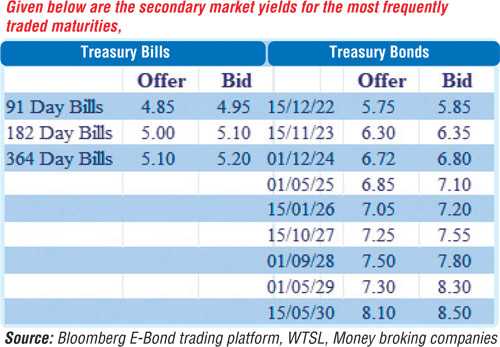

Yields increased across the curve on the liquid maturities of 2022’s (i.e. 01.10.22, 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 15.12.23), 2024’s (i.e. 15.09.24 and 01.12.24) and 01.02.26 to weekly highs of 5.80% each, 5.85%, 5.90%, 6.45%, 6.78%, 6.73% and 7.14%, respectively, against its previous weeks closing level of 5.60/70 each, 5.65/70, 5.70/80, 6/10, 6.55/65, 6.55/63 and 7/10, reflecting an upward shift of the overall yield curve on a week on week basis.

In addition, maturities of 2021’s (i.e. 01.08.21 and 15.12.21), 15.03.23, other 2023’s (i.e. 01.09.23 and 15.11.23), 01.01.24 and other 2024’s (i.e. 15.03.24 and 15.06.24) changed hands at levels of 4.84% to 5.10%, 5.97%, 6.25% to 6.35%, 6.45% to 6.48% and 6.70% to 6.75%, respectively.

The bearish sentiment was supported by the outcome of the primary auctions during the week, where the accepted amounts fell short of the offered amounts. The weekly Treasury bill auction saw only Rs. 16.81 billion accepted against an offered amount of Rs. 42.50 billion while the four Treasury bond auctions saw Rs. 90.95 billion accepted in total against an offered total of Rs. 125 billion.

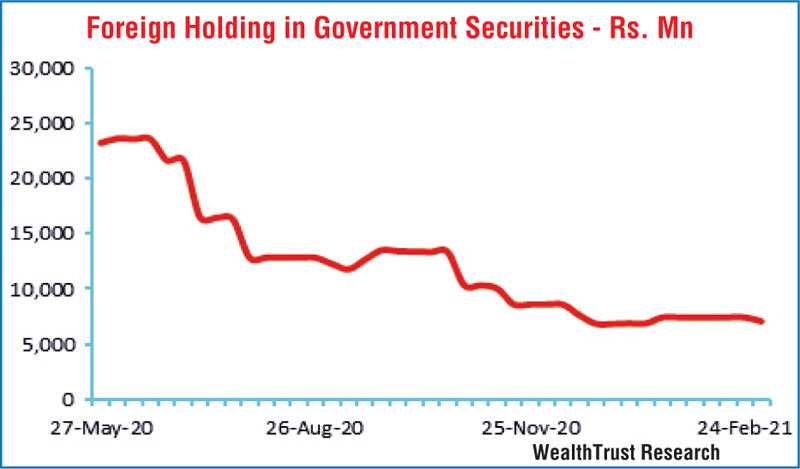

The foreign holding in rupee bonds recorded a decrease of Rs. 362.7 million for the week ending 24 February.

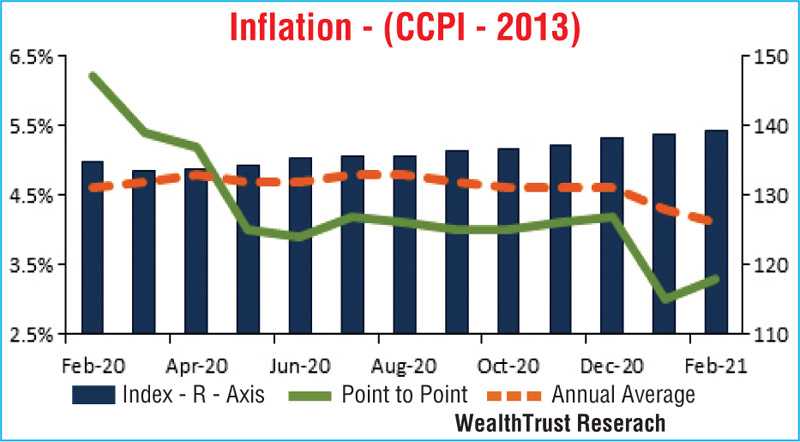

In the meantime, Colombo Consumer Price Index (CCPI) for the month of February increased to 3.3% on its point to point, when compared against its previous month’s figures of 3% while its annual average decreased to 4.1% from 4.3%.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 19.21 billion.

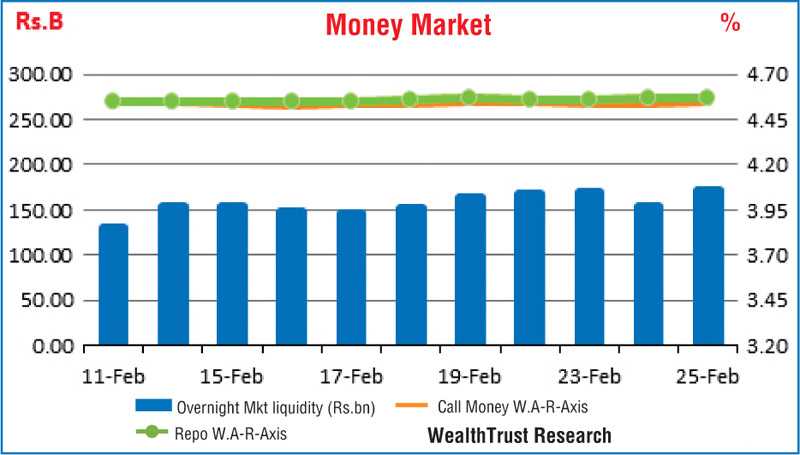

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged to average 4.55% and 4.57%, respectively, for the week while the total outstanding market liquidity increased to Rs. 171.55 billion. The CBSL’s holding of Gov. Security’s too increased to Rs. 809.96 billion.

USD/LKR

In Forex markets, the USD/LKR rate on spot contracts was seen trading within a range of Rs. 193.75 to Rs. 194.90 during the week while more active one-week forward contracts were seen closing the week at Rs. 194.50/195 in comparison to its previous weeks closing level of Rs. 195.50/196.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 50.56 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)