Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 23 November 2020 01:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

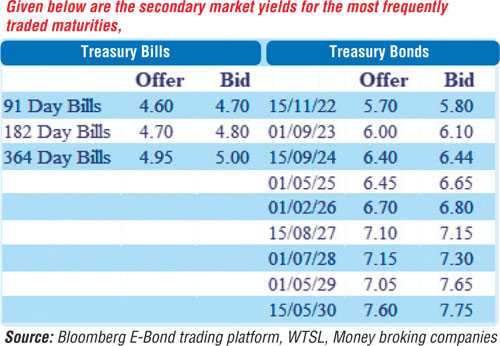

The secondary bond market yields increased further during the week ending 20 November, continuing the upward momentum witnessed over the previous week.

The secondary bond market yields increased further during the week ending 20 November, continuing the upward momentum witnessed over the previous week.

The persistent reduction in demand at the weekly Treasury bill auction which went undersubscribed for a fourth consecutive week coupled with the prevailing dull sentiment in the market were seen as the reasons that led to the upward momentum.

Yields of the liquid maturities of 15.12.22, 15.12.23, 15.09.24, 15.08.27 and 01.07.28 increased to weekly highs of 5.87%, 6.10%, 6.43%, 7.12% and 7.22% respectively against its previous weeks closing level of 5.70/75, 6.05/10, 6.27/33, 7.02/04 and 7.15/30, admit moderate trades while two-way quotes on the rest of the curve were seen increasing as well to reflect an upward shift of the yield curve.

The short dated maturities of January and February 2021 bills and August and December 2021 bonds traded at levels of 4.62%, 4.72% to 4.75%, 4.84% to 4.85% and 5.04% to 5.05% respectively.

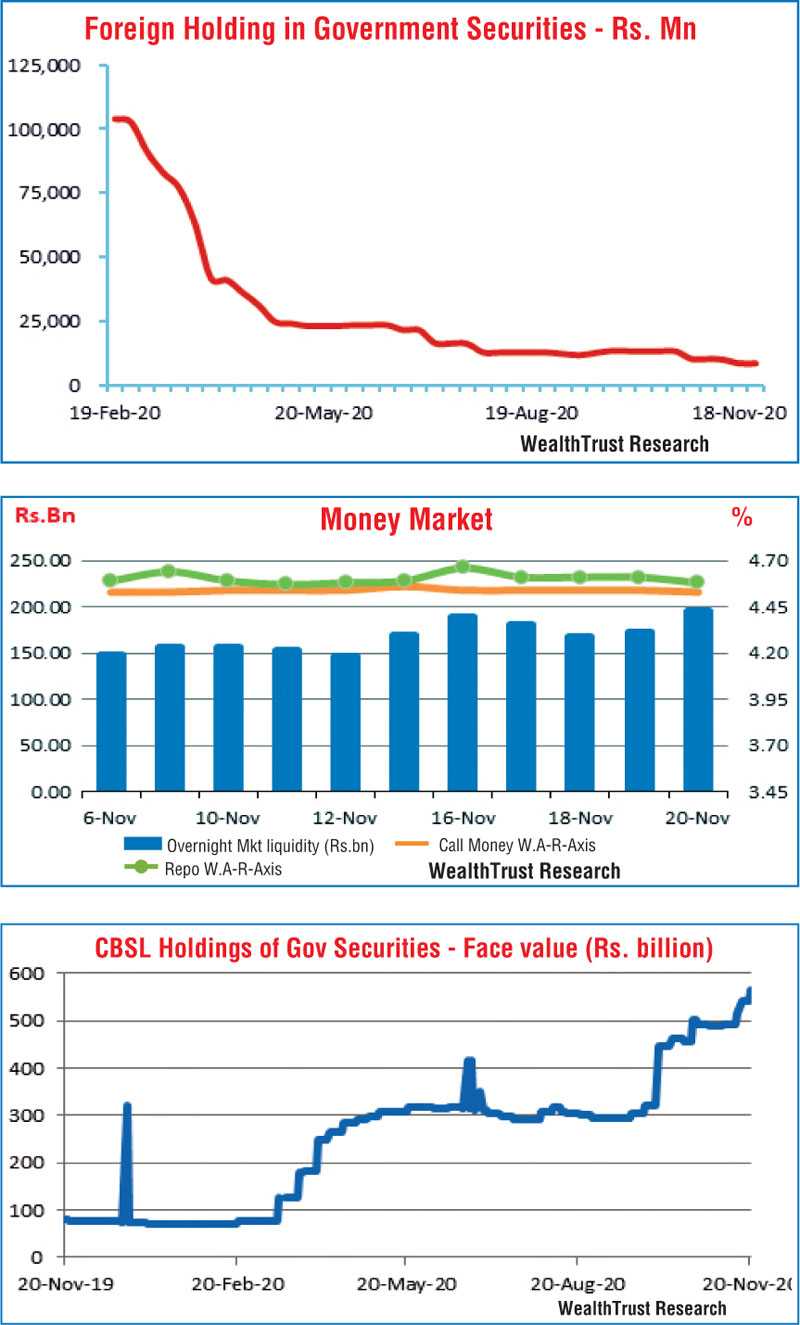

Foreign holding in Rupee bonds remained mostly unchanged recording a meager inflow of Rs. 0.03 million for the week ending 18 November following two consecutive weeks of outflows.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 5.77 billion.

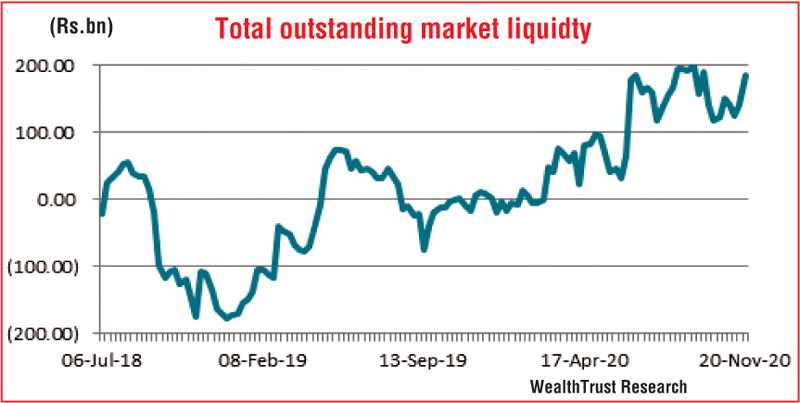

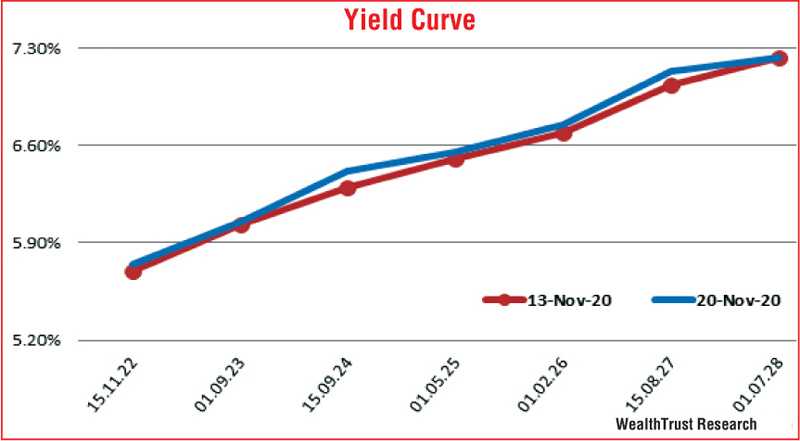

In money markets, the total outstanding market liquidity in the system increased further for a second consecutive week to record an eight-week high surplus of Rs. 185.47 billion against its previous week’s Rs. 140.06 billion.

The weighted average rates on overnight call money and repo remained mostly unchanged at 4.54% and 4.61% respectively for the week as the overnight surplus liquidity was seen increasing to Rs. 195.47 billion by Friday. The CBSL’s holding of Government securities increased to Rs. 566.32 billion.

Rupee continues to depreciate

In Forex markets, the USD/LKR rate on spot contacts dipped to an intraweek low of Rs. 185.40 during the week against its previous week’s closing of Rs. 184.70/80 before activity shifted to spot next contracts to close the week at Rs. 185.50/80.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 67.13 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)