Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 21 January 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

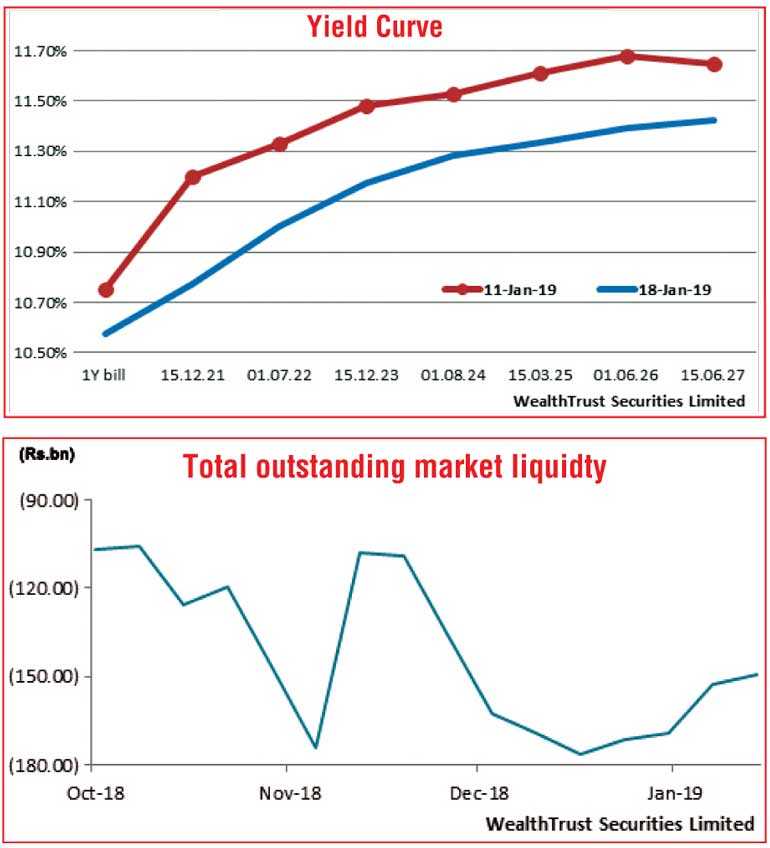

The secondary market bond yield curve recorded a parallel shift down during the week ending 18 January, driven by the declining trend in the weekly Treasury bill weighted averages, renewed foreign buying in Rupee bonds towards the latter part of the week and an improving liquidity position in the money market.

Activity was witnessed across the curve with yields on the liquid maturities of 15.12.21, 15.12.23, 15.03.25, two 2026’s (i.e. 01.06.26 & 01.08.26) and 01.09.28 dipping to intra week lows of 10.76%, 11.14%, 11.35%, 11.40%, 11.34% and 11.40% respectively against its previous weeks closings of 11.15/25, 11.45/50, 11.58/63, 11.65/70, 11.61/68 and 11.60/70. Furthermore, considerable buying interest in the secondary bill market saw December 2019 maturities changing hands from a weekly high of 10.60% to a low of 11.49% while the 364 day bill was brought down to 10.60%.

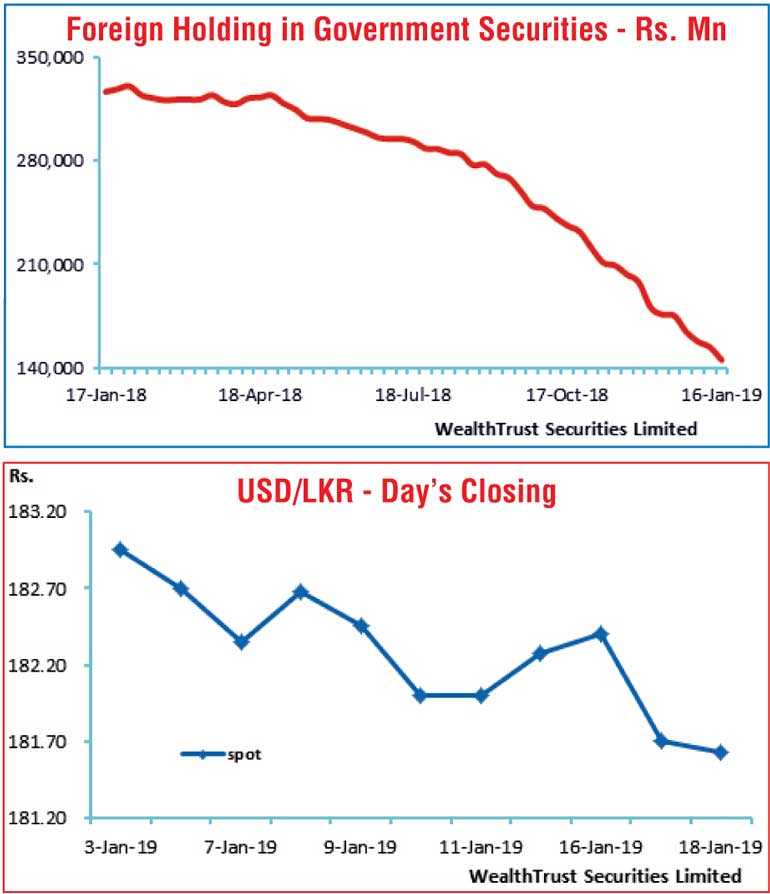

The foreign holding of rupee bonds recorded an outflow of Rs. 8.75 billion for the week ending 16 January.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 16.95 billion.

The total outstanding market liquidity shortfall was seen improving for a fourth consecutive week to record Rs. 149.31 billion by the end of the week reflecting an improvement of Rs. 27.1 billion over the past four weeks.

The OMO (Open Market Operation) Department of Central Bank continued to inject liquidity during the week on an overnight basis at weighted average of 9.00% as the average net overnight liquidity shortfall in the system stood at Rs. 100.25 billion for the week. The overnight call money and repo rates averaged 8.99% for the week.

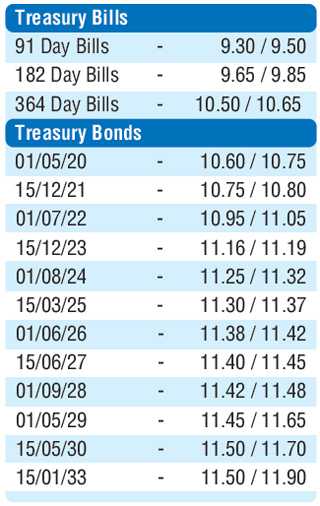

Rupee closes stronger

The rupee was seen appreciating for a second consecutive week to close at Rs. 181.60/65 against its previous week of Rs. 181.90/10 driven by inflows to the rupee bond market, export conversions and selling interest by banks.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 100.45 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 182.65/85; 3 Months - 184.30/60 and 6 Months - 187.35/65.