Sunday Mar 01, 2026

Sunday Mar 01, 2026

Tuesday, 3 October 2017 00:00 - - {{hitsCtrl.values.hits}}

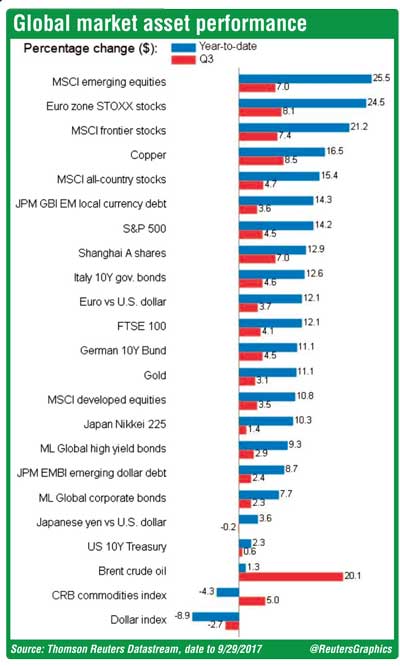

London (Reuters): World stocks have gained for sixth straight quarters to chalk up their best run since 1997, while a 20% rebound in oil has turned around one of its worst starts to a year on record.

It may just be the looming end of the great global easing experiment, but as this graphic shows, investors have spent another quarter piling into risk assets.

Emerging market stocks have added almost 7%. Wall Street and MSCI’s 46-country world share index have both risen 4%, with the latter on its longest run of gains since late 1997, when 11 rising quarters came to an end.

Debt from some of the world’s most politically strained countries has also rallied.

Analysts ascribe this to a mix of higher global growth, cheap and plentiful central bank liquidity, subdued inflation, and until the last few weeks, a weak dollar.

“The market moved already considerably in the first half of the year, so it has been a consolidation of the gains,” said ABN Amro chief investment officer Didier Duret. “The last three months were a kind of intermediary zone, between the hopes (for stimulus) generated by the US administration and the confirmation that we have a strong recovery globally.”

A standout change since the end of the first half has been in the price of oil. Crude was down 16.5% at the end of June, but its 20% rebound has hoisted it back into positive territory for the year. It has had its best quarter since the second quarter of 2016, marking its fifth quarterly gain of 20% or more in the last decade.

Metals have also shone. Industrial bellwether copper has added almost 8% and zinc and nickel have jumped 14 and 11% respectively.

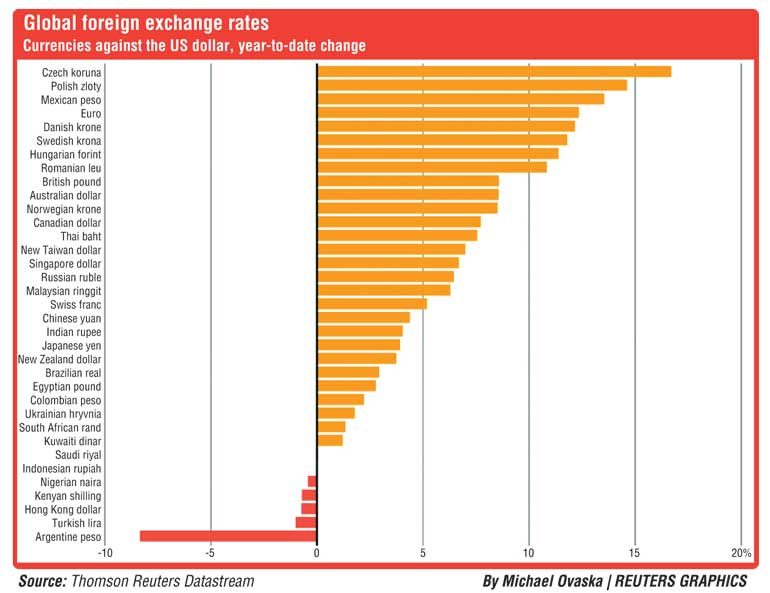

Those commodity gains have been helped by the weak dollar, which is still down for the year against most world currencies. The 2.4% quarterly fall in the dollar index has been a relative improvement, though. It has also regained ground against the euro, the yen, China’s yuan and Mexico’s peso in recent weeks. The latter remains the world’s second-best performer of 2017. The euro, boosted by European Central Bank talk of winding down its more than 2 trillion-euro stimulus program, is up more than 3% since the start of July and nearly 12% year-to-date.

Debt in domestic emerging-market currencies has rallied. Average yields - which broadly reflect borrowing costs - measured by a widely tracked JPMorgan index are now less than percentage point above all-time lows. “The market does seem a bit frothy in some areas,” said State Street Global Advisors’ Abhishek Kumar.

Japan’s heavyweight Nikkei stock index has eked out a token 1% as the yen has stayed steady.

But emerging markets and the so-called FANGs - Facebook, Amazon, Netflix and Alphabet, or Google - again have made the eye-catching moves.

Brazilian stocks have recovered from the country’s latest political scandal to jump 20% in dollar terms. China is up over 13% and Russia has surged more than 14%, though it is still down for the year.

Netflix is up 20%, Facebook 10%, Apple 6% and Google 4%, reflecting not just a global tech addiction but also the cheap money sloshing round markets.

Britain may well be stuck in messy negotiations over quitting the European Union and an even messier domestic power struggle, but the pound has scored its third straight quarterly gain against the dollar and squeezed out a miniscule one against the euro.

At the bottom of the performance league table again is Greece. Its all-too-familiar worries have taken 14% off its stock market, although news in recent days that banks there will be spared another stress test, at least for now, has eased some of the pressure.

Reuters: Shares rose for a third straight session on Monday to end at their highest close in seven weeks led by banks and diversified shares, while continued foreign buying in the market underpinned positive sentiment.

The Colombo stock index ended 0.51% up at 6,470.96, its highest close since 14 August.

The index gained 0.2% last week, recording its third straight weekly gain.

Foreign investors bought a net Rs. 11 million ($ 71,895) worth of shares on Monday, extending their year-to-date net foreign inflow to Rs. 18 billion worth of equities. Turnover stood at 549.4 million rupees, less than two-third of this year’s daily average of Rs. 914.8 million. “We expect the overall positive sentiment in the market to continue for a few more days,” said Dimantha Mathew, head of research at First Capital Holdings.

“High net worth and retail investor participation was seen in plantation sector, though it did not impact the overall market. Meanwhile, institutions and foreign investors were looking to buy blue chips.”

Analysts said the market shrugged off a statement by the International Monetary Fund, which on Friday said Sri Lanka’s central bank should be ready to tighten monetary policy to contain inflation and credit growth.

Shares of Ceylon Tobacco Company Plc rose 3 percent while, Lanka ORIX Leasing Company Plc ended 4% firmer while Hatton National Bank Plc gained 2.1%.

On Tuesday, the Sri Lankan central bank held its key rates steady, saying past steps were keeping inflation and credit growth under control, as policymakers focus on supporting an economy hit by extreme weather.