Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 29 April 2020 03:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

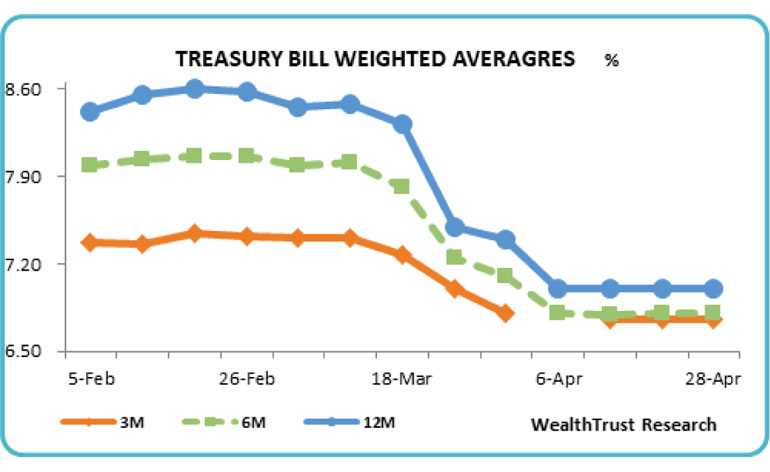

The weighted average rates at the weekly Treasury bill primary auctions conducted yesterday remained steady with a total amount of Rs. 23.35 billion being accepted against its previous week’s Rs. 22.13 billion. This resulted in a shortfall of Rs. 6.65 billion against its total offered amount of Rs. 30 billion.

The 91-day bill represented 73% of the total accepted amount. The weighted average rates of the 91-day, 182-day and 364-day maturities were steady at 6.75%, 6.80% and 7.00% respectively while the bids to offer ratio increased to five weeks high of 1.88:1.

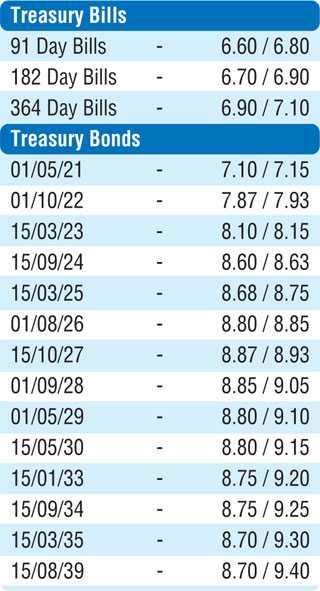

In the secondary bond market, yields were seen decreasing yesterday with the liquid maturities of 01.10.22, 2023s (i.e. 15.03.23 and 15.12.23), 2024s (i.e. 15.03.24, 15.06.24 and 15.09.24), 15.03.25 and 15.10.27 hitting intraday lows of 7.92%, 8.12%, 8.28%, 8.58%, 8.62%, 8.60%, 8.70% and 8.90% respectively against is previous day’s closing levels of 8.00/05, 8.20/35, 8.35/42, 8.65/70, 8.68/70, 8.67/70, 8.77/82 and 8.95/00. In addition, maturities of 15.12.21 and 01.08.24 were traded at levels of 7.45% and 8.72% respectively as well.

Today’s Treasury bond auctions, in lieu of a Treasury bond maturity of Rs. 110.09 billion, will have in total an amount of Rs. 110 billion on offer. This will consist of Rs. 35 billion each on a new 2 year and 8 months maturity of 15.01.2023 and a 5 year maturity of 01.05.25 while a further Rs.40 billion is on offer on a 7 year and 05 months maturity of 15.10.2027.

The weighted average yields at the auctions conducted on 8 April for the maturities of 01.09.2023, 15.09.24 and 15.10.2027 were recorded at 8.50%, 8.70% and 8.90% respectively.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auction yesterday as the overnight net liquidity surplus in the system stood at a high of Rs.152.67 billion. The weighted average rates on overnight call money and repo recorded at 6.41% and 6.56% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 192.80 yesterday.

The total USD/LKR traded volume for 27 April was $ 29.62 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)