Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 2 July 2020 01:58 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

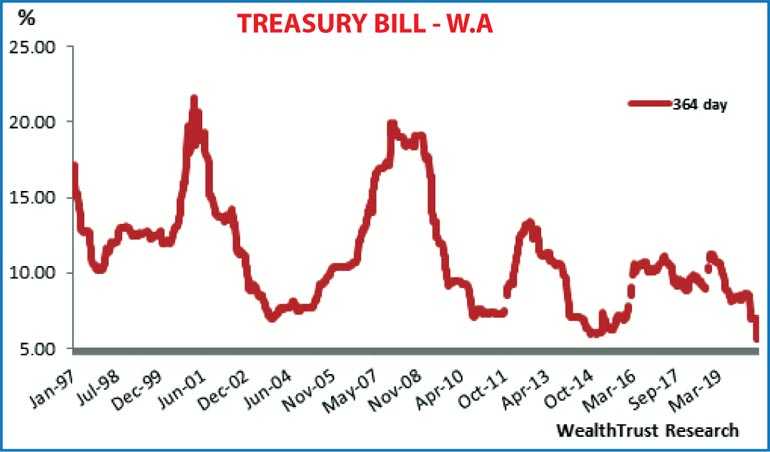

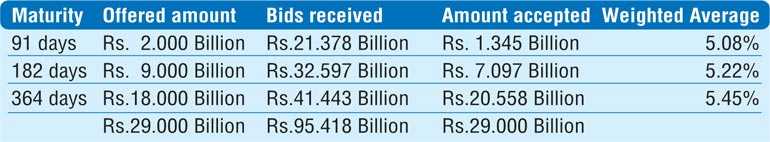

The weekly Treasury bill weighted averages continued its steep decreasing trend at its auctions held yesterday as well, with the 91 day maturity recording the sharpest decline of 42 basis points to 5.08%. This was followed by the 182 day and 364 day maturities by 31 and 21 basis points respectively to 5.22% and 5.45%. The total offered amount of Rs. 29 billion was successfully met at the auctions as an amount of Rs. 20.5 billion was accepted on the 364 day maturity alone against its offered amount of Rs. 18 billion. The bids to offered ratio stood at 3.39:1.

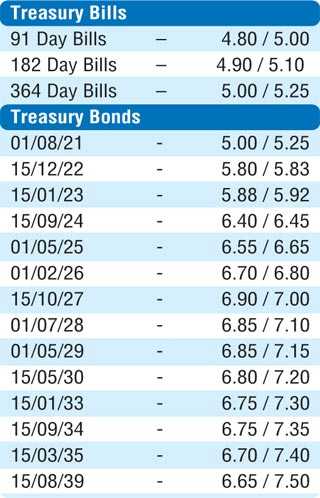

The secondary bond market became active yesterday as renewed buying interest leading to the auction mainly on the liquid maturities of 15.12.22, 15.01.23, 15.09.24, 01.02.26 and 15.10.27 saw its yields dip to intraday lows of 5.75%, 5.88%, 6.38%, 6.69% and 6.88% respectively against its previous day’s closing levels of 5.80/88, 5.90/97, 6.47/52, 6.80/95 and 6.95/10. However, following the auction outcome the downward trend in yields was seen halting. In addition, the 2023s (i.e. 15.05.23, 15.07.23 % 01.09.23), 15.06.24, 2025s (i.e. 15.03.25 & 01.05.25) and 15.06.27 maturities were seen changing hands within the range of 6.00% to 6.05%, 6.45% to 6.50%, 6.55% to 6.60% and 7.01% respectively as well. In the secondary bill market, October 2020 maturity changed hands at levels of 5.00% to 5.10%, pre-auction.

The total secondary market Treasury bond/bill transacted volume for 30 June was Rs. 3.51 billion.

Meanwhile in money markets, the weighted average rates on overnight call money and repo remained steady at 5.52% and 5.55% respectively as the overnight net liquidity surplus in the system stood at Rs. 170.24 billion yesterday.

Rupee appreciates marginally

In Forex markets, the USD/LKR on spot contracts were seen appreciating marginally yesterday to close the day at Rs. 186.15/25 against its previous day’s closing days of Rs. 186.20/30 on the back of selling interest by Banks.

The total USD/LKR traded volume for 30 June was $ 88.54 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)