Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 10 November 2021 01:49 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly bill auction due today will see a total volume of Rs. 52 billion on offer, down by Rs. 14 billion than its previous weeks’ total offered volume. This will consist of Rs. 20 billion on the 91-day maturity, Rs. 15 billion on the 182-day maturity and Rs. 17 billion on the 364-day maturity.

The weekly bill auction due today will see a total volume of Rs. 52 billion on offer, down by Rs. 14 billion than its previous weeks’ total offered volume. This will consist of Rs. 20 billion on the 91-day maturity, Rs. 15 billion on the 182-day maturity and Rs. 17 billion on the 364-day maturity.

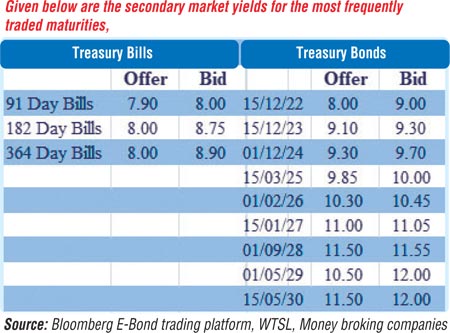

At last week’s auction, the 91-day bill weighted average rate declined for the first time in 40 weeks, recording a considerable drop of 25 basis points to 8.18%. However, weighted average rates on the 182-day and 364-day bills recorded marginal increases of five and eight basis points respectively to 8.21% and 8.26%. In the secondary bond market, a solitary transaction on the 15.01.27 maturity was witnessed at 11.05% yesterday. In secondary bills, the 4 February 2022 maturity changed hands at a level of 8%.

The total secondary market Treasury bond/bill transacted volume for 8 November was Rs. 3.6 billion.

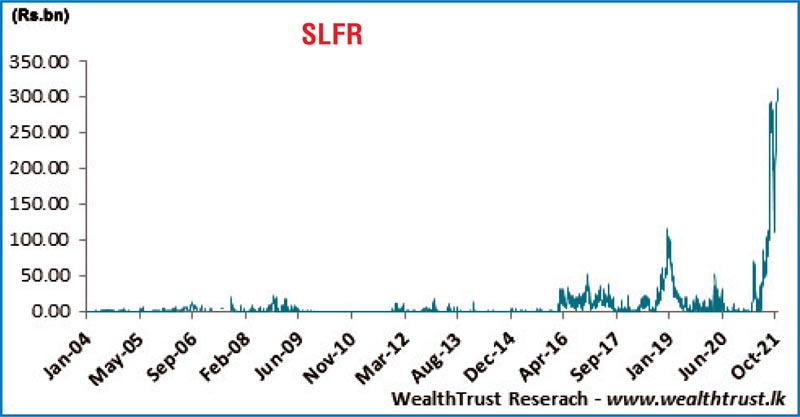

In money markets, a historically high amount of Rs. 310.15 billion was accessed from the Central Banks’ SLFR (Standard Lending Facility Rate) of 6% yesterday, which led to the net liquidity deficit increasing further to Rs. 204.79 billion as an amount of Rs. 77.35 billion was deposited at the Central Banks’ SDFR (Standard Deposit Facility Rate) of 5%.

The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 28 billion by way a of overnight repo auction at a weighted average rate of 5.99%. The seven and 14-day repo auctions for Rs. 10 billion each drew no bids. The weighted average rates on overnight call money and repo stood at 5.93% and 5.92% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts continued to trade within a narrow range of Rs. 202.97 to Rs. 202.99 while the overall market remained inactive yesterday.

The total USD/LKR traded volume for 8 November was $ 93.2 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)