Sunday Feb 08, 2026

Sunday Feb 08, 2026

Thursday, 22 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

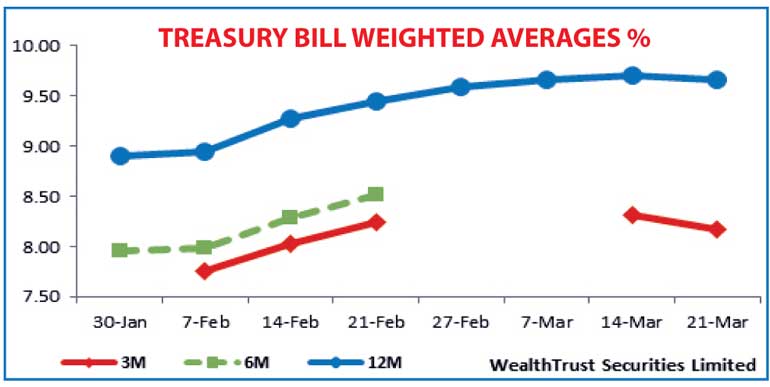

The weekly weighted averages were seen decreasing for the first time in 10 weeks yesterday, reversing its upward trend witnessed previously.

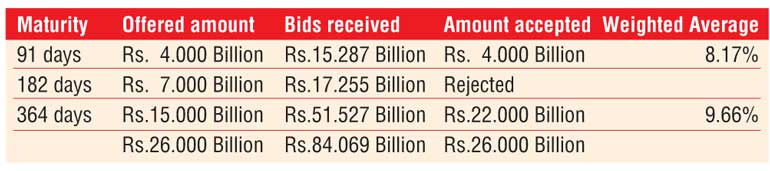

The 91-day bill recorded the sharpest decrease of 15 basis points to 8.17% closely followed by the 182-day bill by four basis points to 9.66%. The 182-day bill was rejected for a fourth consecutive week.

The total offered of Rs.26 billion was fully accepted as the bids to offer ratio was seen hitting a 10-week high of 3.23:1.

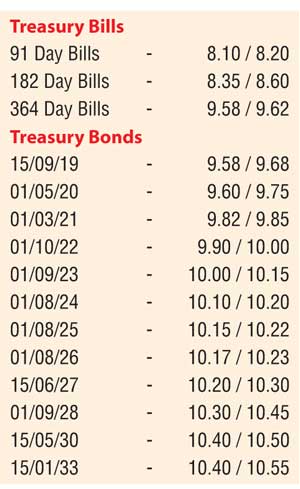

Activity in the secondary bond market continued at a moderate pace with yields decreasing marginally following the outcome of the weekly bill auction. Limited trades were seen on the two 2021 maturities (i.e. 01.03.21 and 01.08.21) within the range of 9.82% to 9.90%.

In the secondary bill market, November 2018, January 2019 and February 2019 maturities were traded at levels of 8.92% to 9.02%, 9.19% and 9.20% respectively with quotes decreasing and narrowing towards the latter part of the day

The total secondary market Treasury bond/bill transacted volumes for 20March was Rs.4.93 billion.

In money markets, the overnight call money and repo rates averaged at 8.14% and 7.62% respectively as the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka drained out an amount of Rs.5.75 billion by way of two repo auctions at weighted averages of 7.27% and 7.42% respectively for periods of one and seven days. The net surplus liquidity in the system stood at Rs.22.12 billion.

Rupee closes steadily

The USD/LKR rate on spot contracts were seen closing the day mostly unchanged at Rs.156.05/15 yesterday, subsequent to appreciating to an intraday low of Rs.155.85 during morning hours of trading.

The total USD/LKR traded volume for 20March was $ 53.60 million. Some of the forward USD/LKR rates that prevailed in the market were one month – 156.85/95; three months – 158.35/45; six months – 160.75/85.