Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 2 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury bill weighted averages were seen declining for a third consecutive week at its auctions held yesterday, with the thee-month or 91-day maturity dipping below the 7% psychological  level for the first time since 12 January 2016.

level for the first time since 12 January 2016.

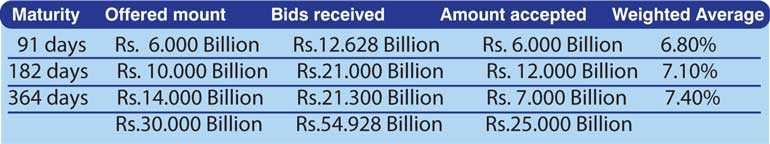

The declines were recorded at 20, 15 and 10 basis points on the 91-day, 182-day and 364-day bills respectively to 6.80%, 7.10% and 7.40%. However, the total accepted amount was seen falling short of the total offered amount for a second consecutive week, as only Rs. 25 billion was accepted against a total offered amount of Rs.30 billion while the bids to offer ratio dipped to a 15-week low of 1.83:1.

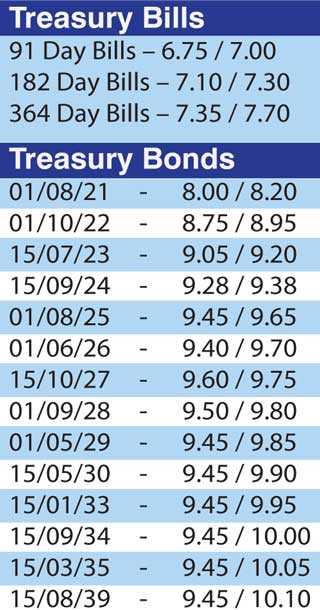

The secondary bond market activity moderated considerably yesterday as limited trades were seen on the 15.09.24 and 01.08.25 maturities at levels 9.40% and 9.70% to 9.85% respectively. In secondary bills, a November 2020 maturity was seen changing hands at a level of 7.65%, pre-auction.

In money markets yesterday, the DOD (Domestic operations Department) of Central Bank was seen infusing liquidity for two days at a weighted average of 6.85% for a volume of Rs. 15 billion. Overnight call money and Repo averaged 6.78% & 6.82% respectively while the overnight liquidity stood at Rs. 53.23 billion

Forex market

The USD/LKR rate was seen traded on its one week forward contract at Rs. 191.50 yesterday in the absence of spot transactions.

The total USD/LKR traded volume for 31 March was $ 45.50 million

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform)