Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 6 January 2022 01:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

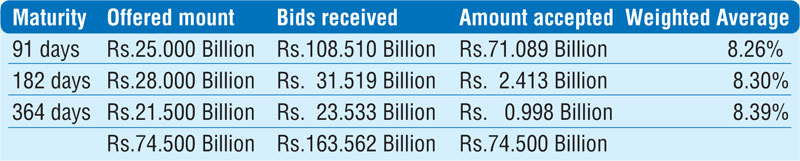

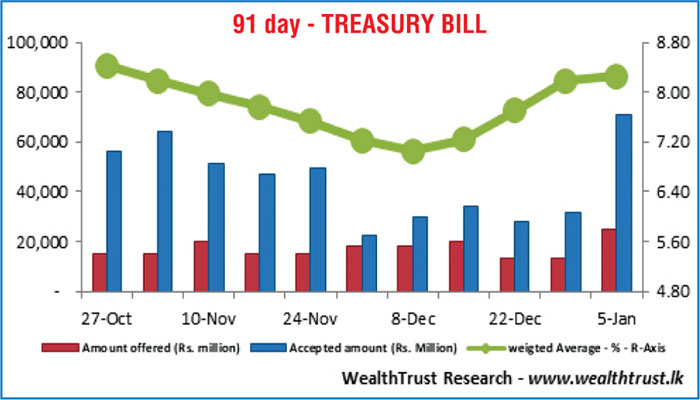

The weekly Treasury bill auction conducted yesterday was fully subscribed for the first time in four weeks, with the market favourite 91-day bill representing 95.42% or Rs. 71.09 billion of the total offered amount of Rs. 74.50 billion. Its’ weighted average rate increased by 10 basis points to 8.26%. The weighted average rate on the 364-day increased by 15 basis points to 8.39%, while on the 182-day maturity it decreased by three basis points to 8.30%. The bids-to-offer ratio increased to a four-week high of 2.20:1. Given below are the details of the auction,

The weekly Treasury bill auction conducted yesterday was fully subscribed for the first time in four weeks, with the market favourite 91-day bill representing 95.42% or Rs. 71.09 billion of the total offered amount of Rs. 74.50 billion. Its’ weighted average rate increased by 10 basis points to 8.26%. The weighted average rate on the 364-day increased by 15 basis points to 8.39%, while on the 182-day maturity it decreased by three basis points to 8.30%. The bids-to-offer ratio increased to a four-week high of 2.20:1. Given below are the details of the auction,

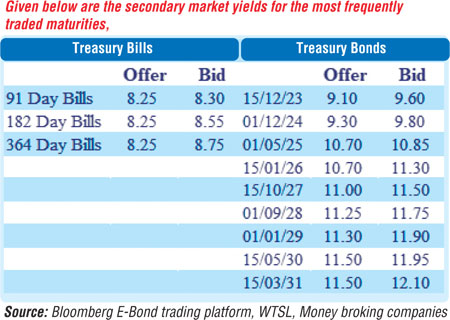

Nevertheless, secondary bond market activity remained dull yesterday with only the 15.05.30 maturity changing hands at a level of 11.765%. In the secondary bill market, February and March 2022 maturities were traded at levels of 6.85% and 7.75% to 7.85% respectively, pre-auction; while 28 January 2022 and the latest 91-day bills were traded at 7% to 7.05% and 8.30% respectively, post-auction.

The total secondary market Treasury bond/bill transacted volume for 4 January 2022 was Rs. 10.64 billion.

In money markets, the weighted average rates on overnight call money and repo were registered at 5.95% each, while the overnight net liquidity deficit increased to Rs. 312.80 billion yesterday.

An amount of Rs. 122.69 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 5%, whilst an amount of Rs. 435.50 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 6%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at a level of Rs. 202.97 yesterday.

The total USD/LKR traded volume for 4 January was US $ 63.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)