Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 16 September 2021 04:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

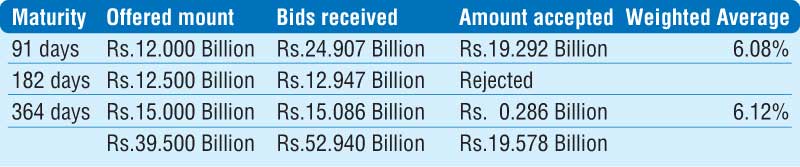

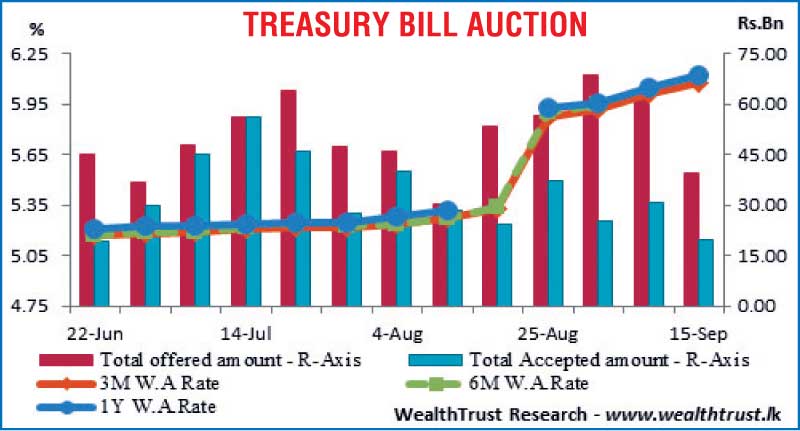

The weekly Treasury bill auction conducted yesterday went undersubscribed for a ninth consecutive week, as only 49.56% of its total offered amount was accepted. The 91-day bill maturity represented 98.54% of the total accepted amount. The weighted average rates on the 91-day and 364-day maturities increased by seven basis points each to 6.08% and 6.12% respectively, while all bids received on the 182-day maturity was rejected for a second consecutive week.

The weekly Treasury bill auction conducted yesterday went undersubscribed for a ninth consecutive week, as only 49.56% of its total offered amount was accepted. The 91-day bill maturity represented 98.54% of the total accepted amount. The weighted average rates on the 91-day and 364-day maturities increased by seven basis points each to 6.08% and 6.12% respectively, while all bids received on the 182-day maturity was rejected for a second consecutive week.

In the secondary bond market, 15.06.24, 15.01.26 and 15.03.31 maturities were seen changing hands at levels of 8.09%, 8.95% to 8.96% and 10% to 10.09% respectively, while on the very short end of the yield curve, the 15.03.22 maturity changed hands at levels of 6.30% to 6.35%.

The total secondary market Treasury bond/bill transacted volume for 14 September was Rs. 1.05 billion.

In money markets, the net liquidity deficit was registered at Rs. 185.05 billion yesterday with an amount of Rs. 80.39 billion being deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) against an amount of Rs. 265.43 billion withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate). The weighted average rates on overnight call money and REPO remained steady at 5.96% and 5.92% respectively.

USD/LKR

In the Forex market, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 14 September was $ 6 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)