Thursday Mar 05, 2026

Thursday Mar 05, 2026

Monday, 25 September 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

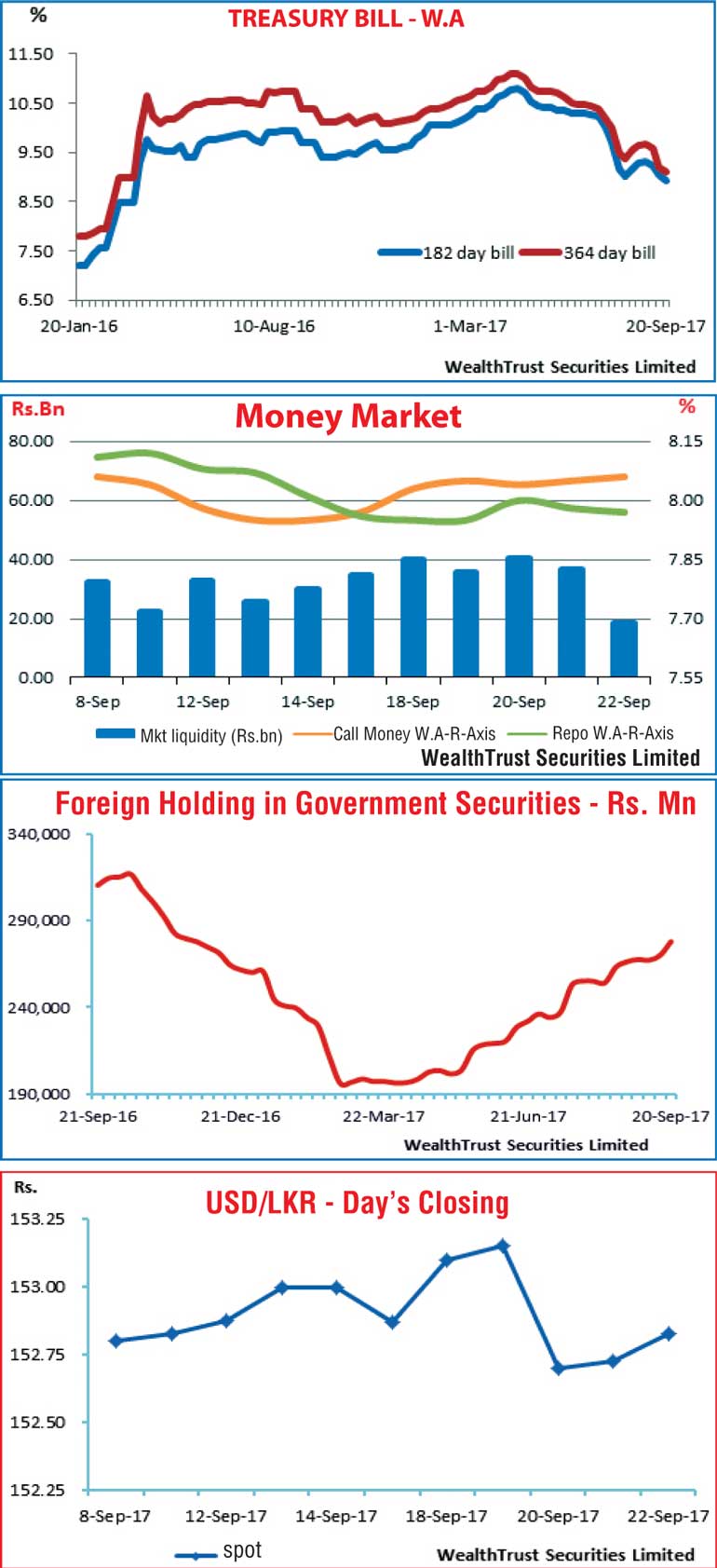

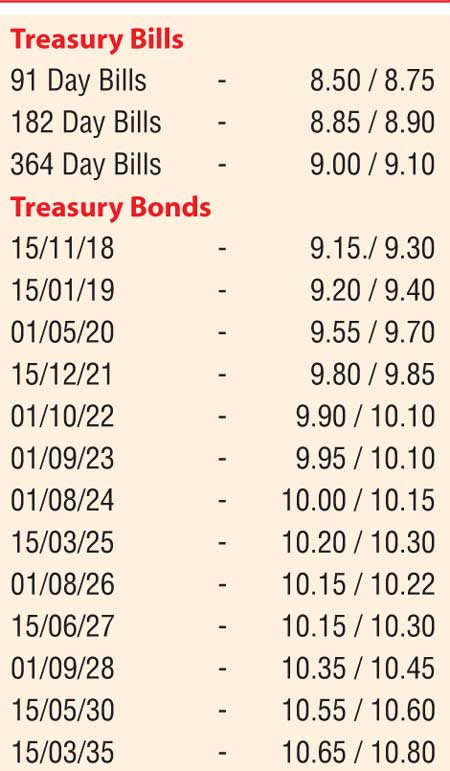

Yields in the secondary bond market see sawed during the week ending 22 September as it initially increased towards the weekly bill auction with the liquid maturities of 01.03.21, 01.05.21, 01.08.26 and 15.05.30 hitting weekly highs of 9.95%, 9.98%, 10.25% and 10.65% respectively against its previous week’s closing levels of 9.90/95, 9.92/00, 10.18/20 and 10.60/70. Thereafter, yields of the said maturities were seen decreasing once again to lows of 9.72%, 9.75%, 10.06% and 10.50% respectively on back of the outcome of the weekly Treasury bill auction and foreign buying interest as activity increased mid-week.

However the yields increased once again towards the end of the week to hit highs of 9.88% each, 10.20% and 10.55% on the back of local selling interest and profit taking outweighing foreign demand. In addition, the maturities of 15.12.21, 01.09.23, 01.08.25 and 01.09.28 were seen changing hands at levels of 9.78% to 9.90%, 9.95% to 10.06%, 10.15% to 10.40% and 10.40% to 10.50% respectively while in the secondary bill market, bills centring the 182 day maturity were traded at levels of 8.85% to 8.90%, post auction as well.

At the weekly Treasury bill auction, the weighted averages declined for a third consecutive week, with the weighted average on the 182 day maturity recording a decrease of 11 bais points to a 79 weeks low of 8.94% and the 364 day maturity by 10 bais points to a low 9.10%.

The market also witnessed continued foreign buying interest of rupee bonds, with an inflow of Rs. 7.8 billion for the week ending 20 September, recording a total inflow of Rs. 10.67 billion over the past two weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 11.01 billion.

In money markets, the Open Market Operations (OMO) Department drained out liquidity throughout the week on an overnight basis at weighted averages ranging from 7.26% to 7.27% in addition to mopping up total an amount of Rs. 17.70 billion on permanent basis by way of auctions for outright sales of Treasury bills at weighted averages ranging from 8.50% to 8.60% for duration ranging from 38 days to 67 days as the average net surplus liquidity in the system remained high of Rs. 34.22 billion during the week. The overnight call money and repo rate averaged at 8.05% and 7.97% respectively for the week as well.

The USD/LKR rate on spot contacts dipped to an intraweek low of Rs. 153.40 during the early party of the week against its previous weeks closing levels of Rs. 152.82/92 before bouncing back to appreciate once again to close the week at Rs. 152.75/90 on the back of inward remittances and dollar selling interest outweighing importer demand.

The daily USD/LKR average traded volume for the four days of the week stood at $ 66.59 million.

Some of the forward dollar rates that prevailed in the market were one month – 153.45/55; three months – 154.95/20 and six months – 157.00/20.