Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 24 November 2020 01:32 - - {{hitsCtrl.values.hits}}

The Continuous Professional Development Committee of the Association of Professional Bankers Sri Lanka in collaboration with Boston Consulting Group held an inspiring banking symposium on ‘Digital Transformation –End to End Digitalisation of Banking Products’. The virtual webinar, held on 14 October # aimed at discussing and answering pressing questions.

How can banks undergo holistic transformation to stay competitive, be efficient, and drive growth?

How should they cater to the digital demands of consumers in the age of increased internet penetration and smartphone usage?

What can be the potential impact of replacing physical customer experience with digital on the bank’s overall business?

Digital interactions across industries are slowly becoming ubiquitous as customers increasingly leverage digital channels to meet their myriad needs. The current pandemic has further underscored the relevance of digitisation and revealed the significant opportunity that it presents to the banking sector. As highlighted by BCG Managing Director and Senior Partner Ruchin Goyal, “The Asian financial services market has witnessed severe disruption over the last decade as firms, both within and outside the financial services sector, launched digital products for the banking customer”. For example, in India, the Unified Payments Interface (UPI) was launched to facilitate digital payments.

The initiative has met with great success with nearly 30% of all payments made in India last year being done through UPI. However, it is interesting to note that nearly 90% of these payments were originated by technology giants like Google pay, Phone Pe, etc., and not Indian banks. Similarly, in China, the digitisation journey started with the e-commerce giant Alipay which has now ventured into payments, lending, insurance, and wealth management to become a full-fledged mobile bank.

In doing so, it has not only expanded the market size for digital payments in the county but has also taken away market share from traditional banks. In Indonesia, a company named OVO, which started its journey with digital payments and has now entered lending, insurance, and other banking products is disrupting the market. To put its success into perspective, “it has managed 100 million downloads in a country with a 250 million population”. Innovation is happening around the world and Sri Lanka too is ripe for digital disruption whether it be in terms of mobile penetration, internet users or active debit cards. The question is whether this disruption will be led by banks or will it be other players that will come in and disrupt the market.

Banking has metamorphosed over the last decade and is unlikely to remain the same as we move forward. The pandemic has only accelerated a change that was already underway. For the future, banks need to focus on bold transformations that would require a focus on end-to-end customer journeys. They will need to think front to back end, eschew implementing digital solutions in silos, and adopt agile ways of working.

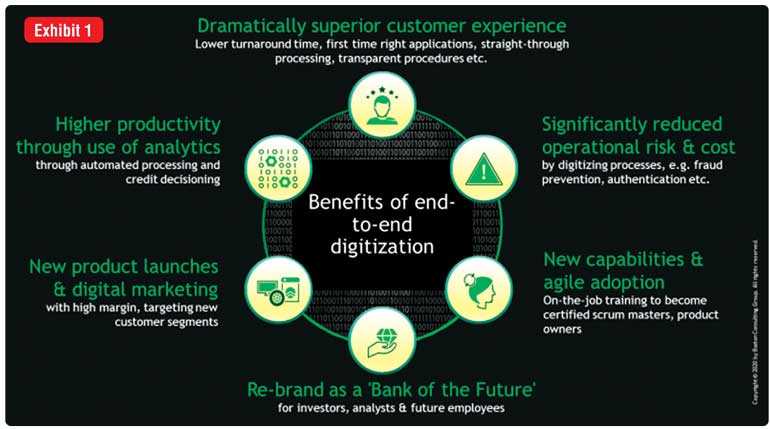

According to Ruchin, this would entail, “People across functions coming together to proactively adopt and implement digital solutions.” If done judiciously, digitization could accrue several benefits (Refer Exhibit 1) to banks ranging from superior customer experience and increased profitability to growing the market size.

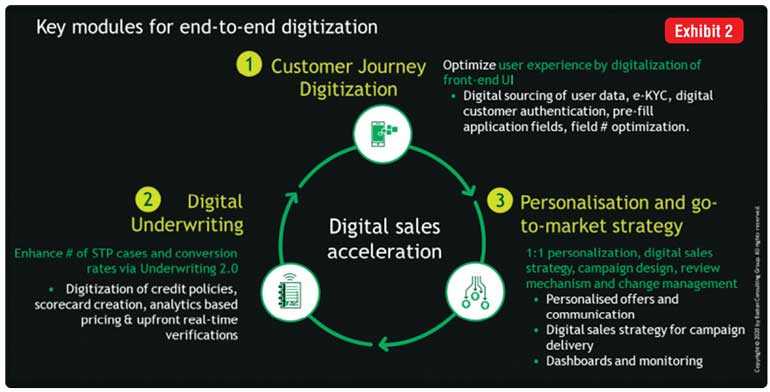

Digital transformation entails three key modules. These include i) customer journey digitisation, ii) digital underwriting, and iii) personalisation (Refer Exhibit 2). Underlying these three modules is robust data analytics. Banks have access to a humungous amount of transactional data that tells them about the nuanced requirements of their customers. “By optimally leveraging data, banks can better understand their customers and offer personalised services and solutions, enhance underwriting decisions, and improve fraud detection,” believes Ruchin. Further, digitisation needs to be supported by robust technology infrastructure, a good vendor ecosystem, a digital centre of excellence, and a strong governance process.

Considering the changes happening around us, inevitably, the Sri Lankan banking industry has already embarked upon its digital transformation journey. Highlighting the evolution of Sri Lanka’s banking industry Hatton National Bank PLC Managing Director/CEO Jonathan Alles shares, “From the basic systems of the 1980s to the advent of online banking introduced by foreign banks to LankaPay today, Sri Lanka’s banking sector has taken significant strides towards digitisation”.

He further adds, “In an attempt to automate and digitise the banking industry, the Sri Lankan central bank formed LankaPay which has introduced several digital interventions including JustPay, an online payment platform.” Since then, banks have started launching their apps focused on payments and wallets to provide seamless customer experience such as the HNB SOLO app. Further, mobile companies like Dialog and Mobitel have introduced Easy Cash and m-Cash to enable digital payments. This has transformed the payments industry.

The central bank has been seen leading banks across multiple digital interventions ranging from fintech to blockchain. It has created an environment for fintech to enter, display their abilities on open banking, APIs, etc. and provide plug and play solutions to banks. Many more interventions and initiatives will be spearheaded by the central bank to create a digital payments ecosystem to make Sri Lanka a ‘less-cash’ economy. However, it is important that the digitisation journey of the banks is holistic and not siloed in nature.

According to Jonathan Alles, “It is important to focus on end-to-end digital transformation as opposed to simply focusing on digital channels and digital products. Banks should aim to offer a holistic and seamless experience to customers.” With the onset of COVID-19, customers and merchants are increasingly moving to digital channels of communication. Banks need to ensure that customers continue digital banking and progress further towards end-to-end digitisation.

When it comes to digitising banking journeys, there is an opportunity to transform not just retail banking but also corporate banking. According to BCG Managing Director and Partner Prateek Roongta, “Banks around the world are now focusing on digitising the experience of their corporate customers and digitising their offerings.” (Refer Exhibit 3)

Digitisation of a corporate bank offers multiple benefits. Firstly, it can help grow the lending book and have a positive impact on deposits. “We have seen examples where digitisation increased the revenue of a corporate bank by 10-30% as compared to a legacy corporate bank,” shares Prateek. Secondly, digitisation brings efficiency in operations and improves employee throughput, thereby reducing costs by as much as 20-40%. Historically, most corporate banks have relied on lending products to increase growth.

However, through digitisation, banks will be able to diversify their earnings by increasing emphasis on fee income and transaction banking products. “In our experience, a digital corporate bank has 20 to 30% higher fee income than a legacy corporate bank,” adds Prateek. Thirdly, banks can leverage data analytics to better predict defaults in their loan portfolio which can help them better provide for loan losses and in some cases, even reduce them. Fourthly, digitisation can help banks reduce costs and improve productivity. Cumulatively, this will lead to higher customer satisfaction, business growth, and improved profitability. Sri Lanka’s corporate banking digital transformation rests on five main pillars.

These include:

Empower relationship managers with relevant digital tools to better serve the customers.

Create dynamic pricing tools which can offer customised price proposals to corporate clients based on the nature and depth of the relationship and the type of product.

Build integrated digital customer platforms to address the disjointed customer experience for corporate clients and make their interactions seamless.

Re-design customer journeys to offer a faster turnaround time and better customer experience.

Build a robust digital technology architecture.

Inarguably, digitisation of the banking sector is the future. Not only are the needs of the existing customer base changing but also the customers are changing with the millennials and the Generation Z now vying for financial services. However, in their rush to adopt digital solutions, banks should ensure that the measures they take are relevant and value accretive. According to Seylan Bank PLC Senior Deputy General Manager Ramesh Jayasekara, “There are three key elements to ensure a successful digital transformation.”

Digital transformation needs to be holistic with digital becoming a part of the DNA of the organisation. This can be enabled by a top-down approach and a deliberate digital strategy at the top incorporating all aspects such as budgets and recruitment.

Digital transformation needs to be end-to-end and should ideally cut across all departments in the bank from front to back.

Performance measurement is imperative. It is important to create a digital P&L to understand the success of digital strategies and ascertain tangible outcomes.

“Digital transformation needs to focus on two important areas: customers and internal processes,” believes Ramesh Jayasekara. “Banks can leverage the massive data available to them to create customised solutions, cross-sell, up-sell, and elevate customer engagement,” he adds. Further, internal processes need to be digitised and optimised by adopting Robotic Process Automation (RPA). This can help banks identify and ease bottlenecks, thereby reducing the turnaround time.

Digital transformation offers banks a tremendous opportunity to create value for their customers and cater to their changing needs. If done right, it can potentially disrupt the sector while bringing more customers under the purview of banking and banking services.