Friday Feb 13, 2026

Friday Feb 13, 2026

Monday, 8 June 2020 04:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

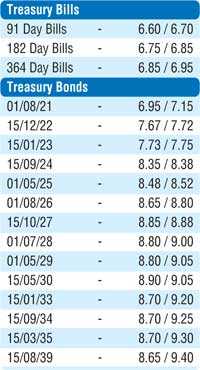

The shortened trading week ending 4 June commenced on a bearish note then turned negative the following day with yields increasing due to the announcement of two Treasury bond auctions. However, subsequent to the bond auctions, the market was seen closing the week on a positive note as yields decreased once again on renewed buying interest.

Yields of the market favorite maturities of 01.10.22, 15.01.23, 2024s (i.e. 15.03.24, 15.06.24 & 15.09.24), 01.05.25 & 15.10.27 hit weekly highs of 7.75%, 7.95%, 8.42%, 8.43%, 8.50%, 8.60% and 8.92% respectively against its previous weeks closing level of 7.35/40, 7.72/75, 8.32/38, 8.37/40 each, 8.50/55 and 8.80/90. Yields declined towards the latter part of the week on the maturities of 15.12.22, 15.01.23, 2024s (i.e. 15.03.24, 15.06.24 & 15.09.24) and 01.05.25 to weekly lows of 7.70%, 7.75%, 8.32% each, 8.39% and 8.55% respectively while two way quotes on the rest of the yield curve decreased as well.

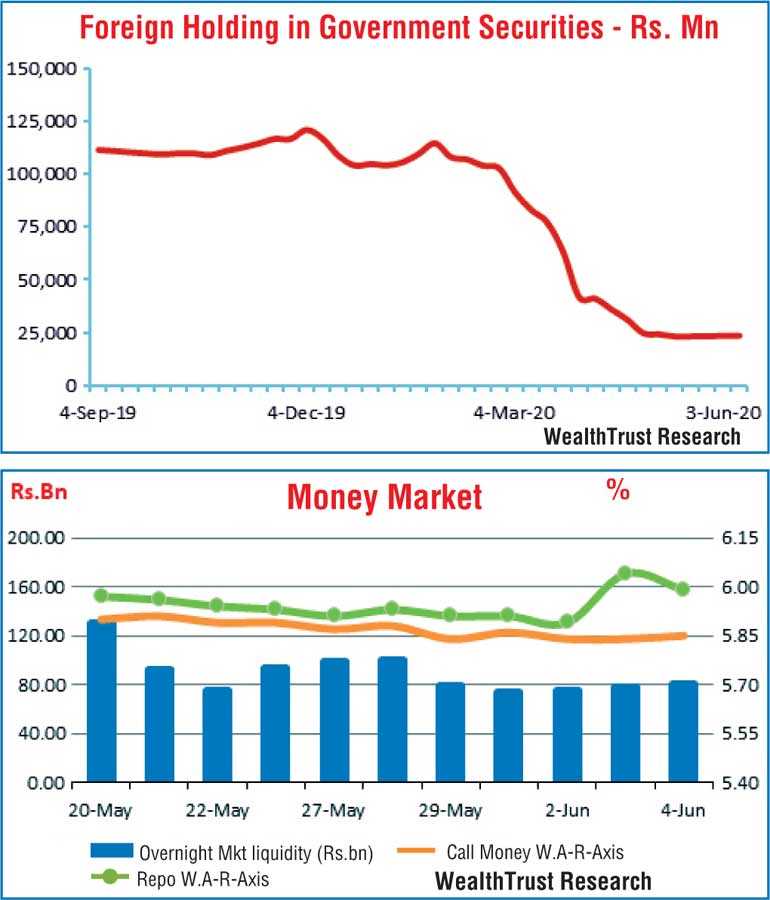

In the bill market, August to December 2020 maturities were seen changing hands at levels of 6.65% to 6.82% while January 2021 and May 2021 maturities changed hands at levels of 6.90% to 6.92%. The foreign holding in rupee bonds recorded a marginal decrease of Rs. 50 million for the week ending 3 June.

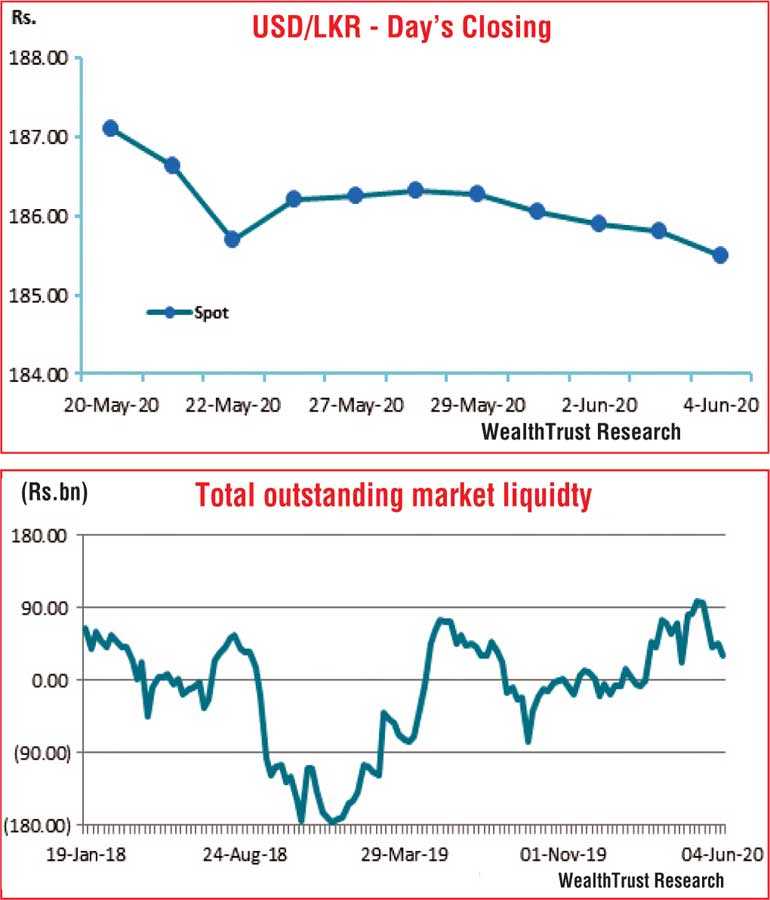

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged Rs. 11.68 billion. In money markets, the weighted average yields on overnight call money and repo rates averaged 5.85% and 5.96% respectively for the week as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka injected liquidity by way of overnight and 8 day reverse repo auctions at weighted average rates of 5.88% and 5.95% respectively. In further injected liquidity for Standalone Primary Dealers by way of an 8 day reverse repo auction at a weighted average rate of 6.48%. The overall money market liquidity dipped to Rs. 30.6 billion against Rs. 45.24 recorded the previous week.

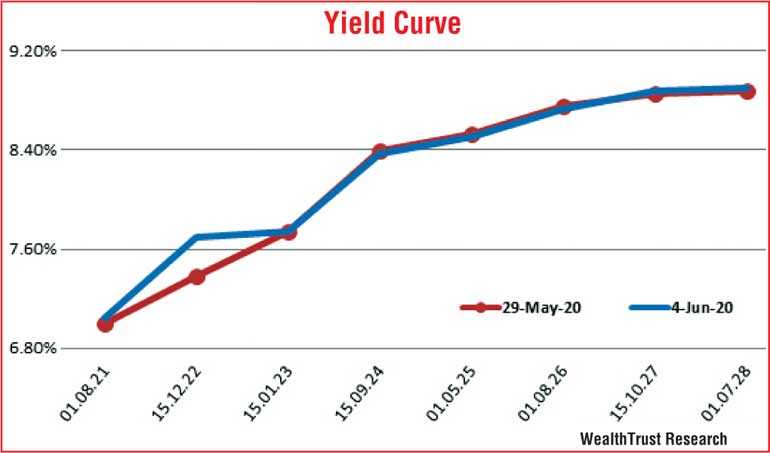

Rupee appreciates sharply

In the Forex market, the USD/LKR rate on spot contracts were seen appreciating during the week to hit a weekly high of Rs. 185.40 before closing the week at levels of Rs. 185.45/55 and in comparison to its previous weeks closing levels of Rs. 186.20/35 due to selling interest by Banks.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 98.54 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond

trading platform, Money broking companies)