Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 30 January 2023 00:23 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The week ending 27 January saw secondary market bond yields see saw, decreasing during the early part of the week and increasing once again towards the later part, ahead of two Treasury bond auctions due today.

The week ending 27 January saw secondary market bond yields see saw, decreasing during the early part of the week and increasing once again towards the later part, ahead of two Treasury bond auctions due today.

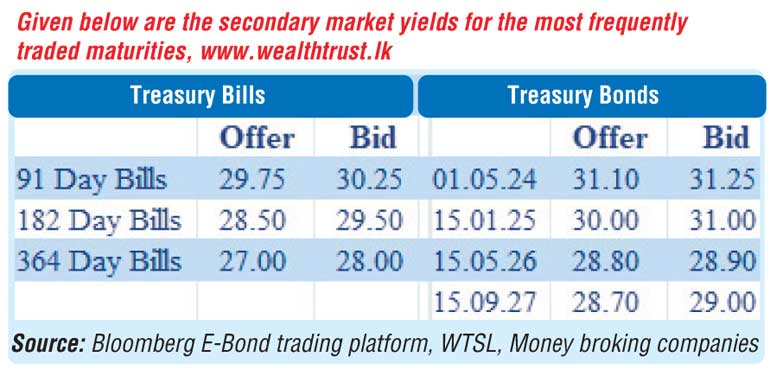

The bullish sentiment which existed at the start of the week was given a boost by China’s offer on debt restructuring to Sri Lanka which led to yields on the liquid maturities of 15.05.26 and 15.09.27 decreasing to intraweek lows of 28.50% and 28.10% respectively against its previous weeks closing levels of 29.20/25 and 28.95/10.

The dip in yields was further supported by the National Consumer Price Index (NCPI) or National inflation announcement for the month of December which saw its point to point decreasing to 52.9% as against 65.0% recorded in November. Furthermore, the all-time high offered volume of Rs. 120 billion at the weekly Treasury bill auction was fully subscribed with weighted average rates decreasing across the board for a seventh consecutive week.

However, selling interest towards the latter part of the week saw yields on the said maturities increasing once again to hit highs of 29.00% and 28.73% respectively, pushing the overall yield curve higher.

The CBSL held its policy rates steady at its first monetary policy announcement held during the week.

Today’s bond auctions will have on offer a total volume of Rs. 70 billion, consisting of Rs. 15 billion of the 01.07.2025 maturity and Rs. 55 billion of the 01.05.2027 maturity, carrying coupon rates of 18.00% each. At the last bond auctions conducted on 12 January 2023, the 15.09.2027 maturity was issued at a weighted average rate of 29.79% while its offered amount of Rs. 110.00 billion was accepted at its 1st phase. A further Rs. 3.63 billion was also issued under its direct issuance window. However, only an amount of Rs. 39.5 billion of the 15.05.2026 maturity was accepted at a weighted average rate of 30.85% against an offered amount Rs. 50 billion.

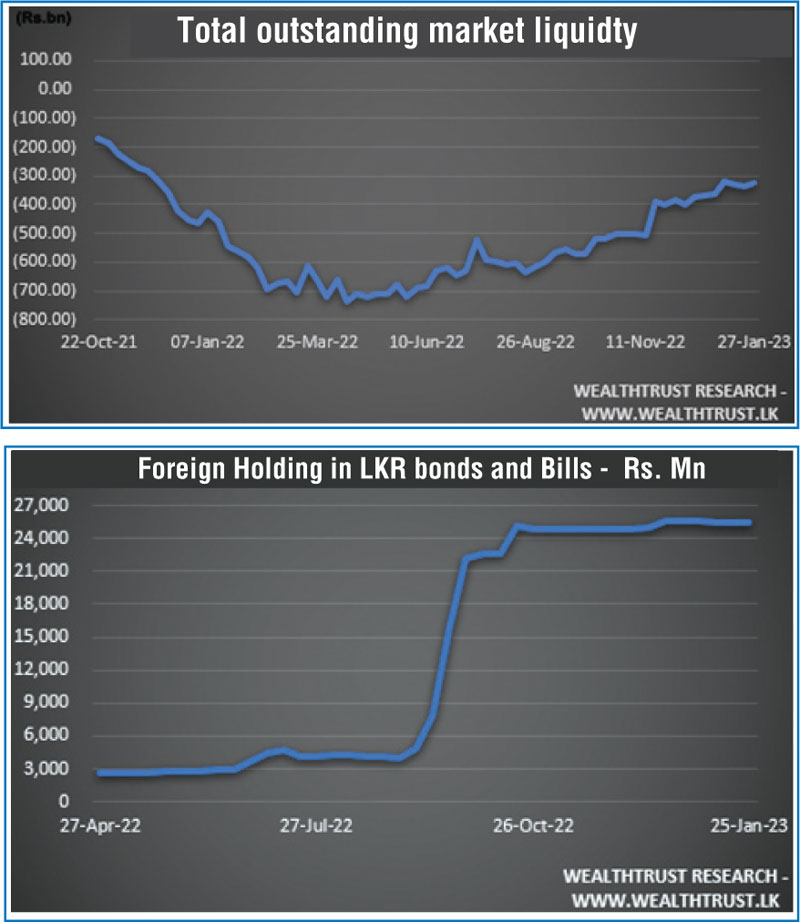

The foreign holding in rupee bonds increased marginally to Rs. 25.47 billion for the week ending 25 January while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 24.22 billion.

In money markets, the total outstanding liquidity deficit was registered at Rs. 326.24 billion by the end of the week against its previous week’s of Rs. 333.59 billion while the CBSL’s holding of Government Securities remained steady at Rs. 2,548.99 billion. The overnight net liquidity continued to fluctuate during the week due to the restriction imposed on CBSL’s Standing Deposit Facility.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts stood at Rs. 362.14 at the end of the week against its previous weeks closing of Rs. 362.1694.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 51.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)