Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Friday, 24 December 2021 05:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upward momentum in secondary bond market yields continued yesterday, mainly during morning hours of trading driven by continued selling interest.

The upward momentum in secondary bond market yields continued yesterday, mainly during morning hours of trading driven by continued selling interest.

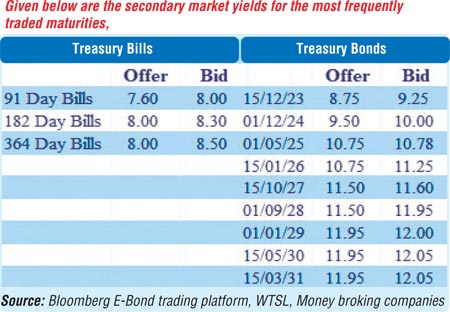

Renewed selling interest on the 01.05.25 and 01.01.29 maturities saw it yields increase to intraday highs of 10.75% and 12.02% respectively against its previous day’s closing levels of 10.25/75 and 11.50/90. In addition, 15.10.27 maturity was seen changing hands at levels of 11.55% to 11.60% as well.

The total secondary market Treasury bond/bill transacted volumes for 22 December was Rs. 34.67 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen conducting an auction yesterday to inject permanent liquidity into the system by way of a reverse repo auction. An amount of Rs. 100 billion was successfully infused for a period of 60 days at a weighted average rate of 7.20%, value today.

The weighted average rates on overnight Call money and REPO stood at 5.95% and 6.00% respectively as a historically high volume of Rs. 534.64 billion was accessed from Central Banks SLFR (Standard Lending Facility Rate) of 6%. The net liquidity deficit was registered at Rs.441.96 billion yesterday as an amount of Rs.92.68 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 5%.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 203 while the overall market remained inactive yesterday.

The total USD/LKR traded volume for 22 December was $ 64 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)