Wednesday Jul 02, 2025

Wednesday Jul 02, 2025

Friday, 4 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

The upward momentum in secondary market bond yields continued yesterday on the back of selling interest.

The yields on the maturities of 15.03.23, 15.06.27, 01.09.28 and 15.05.30 were seen hitting intraday highs of 10.33%, 10.47%, 10.55% and 10.70% respectively in thin trade once again. In addition, the maturities of 15.09.19, 01.05.20 and 01.03.21 were traded at levels of 9.80%, 9.85% and 10.05% respectively. The total secondary market Treasury bond transacted volume for 2 May 2018 was Rs. 11.38 billion.

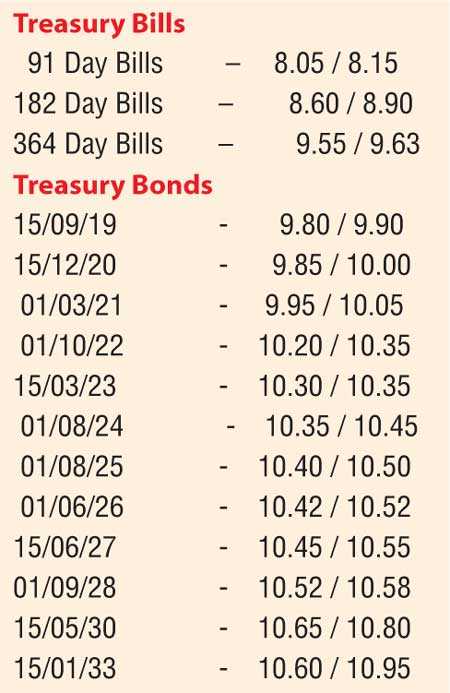

Given below are the closing, secondary market yields of the most frequently traded T-bills and bonds.

Meanwhile in money markets, the overnight call money and repo rates averaged 7.90% and 7.99% respectively as the net surplus liquidity increased to Rs. 10.17 billion yesterday. The Open Market Operations (OMO) Department of the Central Bank drained out an amount of Rs. 8.2 billion on an overnight basis at a weighted average of 7.51%.

The USD/LKR rate on spot contracts were seen trading within a narrow range of Rs. 157.80 to Rs. 157.90 yesterday before closing at a level of Rs. 157.75/85 against its previous day’s closing levels of Rs. 157.75/90. The total USD/LKR traded volume for 2 May 2018 was $ 92.00 million.

Given below are some forward USD/LKR rates that prevailed in the market,

1 month - 158.85/95

3 months - 160.05/20

6 months - 162.20/35

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.