Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 28 February 2023 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

All bids received for the Rs. 15 billion, two-year maturity of 15.01.2025 were rejected at its auction conducted yesterday, the first such instance since December 2022 where bids on the exact same maturity were rejected.

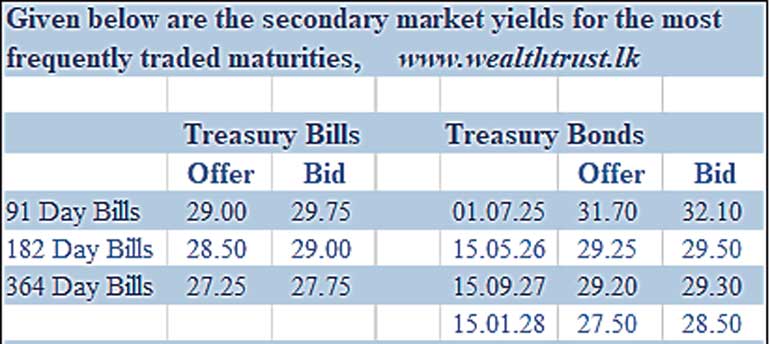

However, the offered amount of Rs. 20 billion on the 4.5 year, 15.09.2027 maturity was fully accepted at its 01st phase of the auction at a weighted average rate of 29.37%. The direct issuance window of 20% will be on offer on this maturity until close of business of the day prior to settlement (i.e. 4.00 p.m. on 28.02.2023).

Meanwhile, activity in secondary bond market picked up following the auction outcomes as the 01.05.27 maturity changed hands at levels of 28.95% to 29.05%.

The total secondary market Treasury bond/bill transacted volume for 24 February 2023 was Rs. 8.27 billion.

In money markets, the overnight net liquidity deficit was Rs. 84.40 billion yesterday as an amount of Rs. 114.82 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50% against an amount of Rs. 30.41 billion being deposited to Central Banks SLDR (Standard Deposit Facility Rate) of 14.50%.

The weighted average rates of overnight call money and REPO was at 15.36% and 15.50% respectively.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally to Rs. 362.4983 against its previous days of Rs. 362.668 while tom and spot contracts were traded within the range of Rs. 361.50 to Rs. 362.50.

The total USD/LKR traded volume for 24 February was $ 101.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)