Thursday Mar 05, 2026

Thursday Mar 05, 2026

Monday, 25 April 2022 00:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

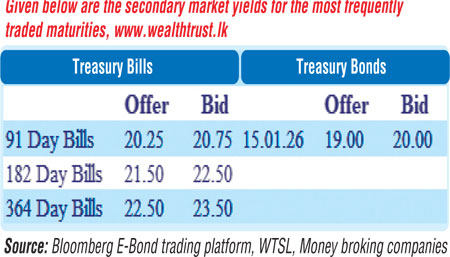

Activity in the secondary bond market remained sluggish during the week ending 22 April with market participants continuing to be on the side lines. Limited activity was witnessed, consisting of the 2025’s (i.e., 15.03.25 and 01.08.25), 15.01.26 and 15.03.30 maturities at levels of 22.00% to 22.50%, 19.80% and 21.00% respectively.

Activity in the secondary bond market remained sluggish during the week ending 22 April with market participants continuing to be on the side lines. Limited activity was witnessed, consisting of the 2025’s (i.e., 15.03.25 and 01.08.25), 15.01.26 and 15.03.30 maturities at levels of 22.00% to 22.50%, 19.80% and 21.00% respectively.

Nevertheless, the secondary bill market remained active during the week with July and October 2022 maturities and April 2023 maturity trading at levels of 20.00% to 21.00%, 22.00% to 24.00% and 22.50% to 24.00% respectively.

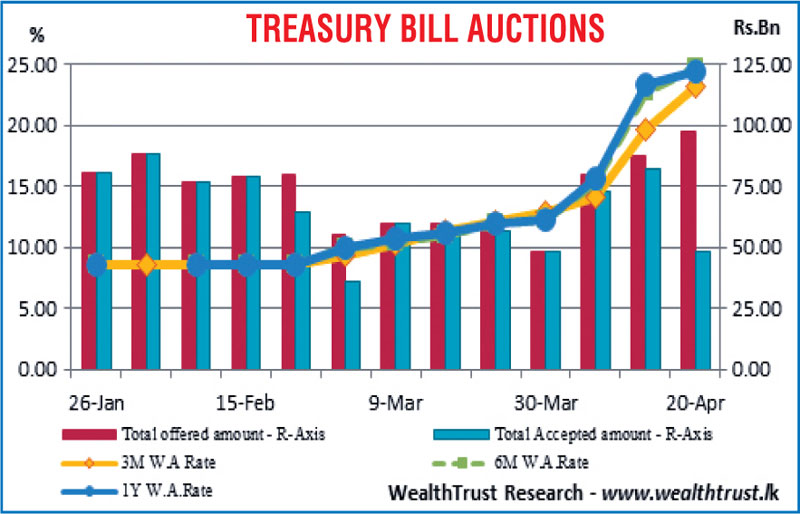

At the weekly bill auction, the accepted amount decreased to a 32 week low of 49.30% of its total offered amount while weighted average rates increased across the board by 350, 204 and 100 basis points respectively to 23.21%, 24.77% and 24.36% on the 91day, 182 day and 364 day maturities.

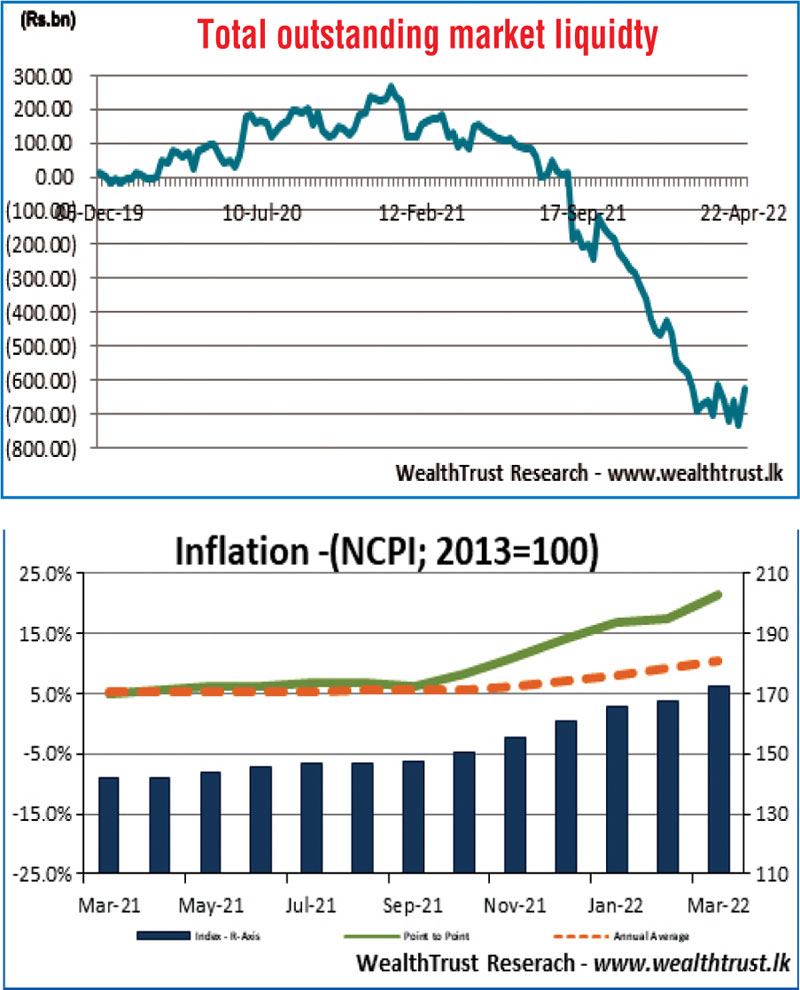

Furthermore, the National Consumer Price Index (NCPI base:2013=100) for the month of March spiked to a high of 21.50%, exceeding 20.00% for the first time in its history.

The foreign holding in rupee bonds was at Rs. 2.71 billion for the week ending 20 April while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 10.65 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 624.11 billion by the end of the week against its previous weeks of Rs. 735.46 billion while CBSL’s holding of Gov. Security’s stood at Rs. 1,870.65 billion against its previous weeks of Rs. 1853.01 billion.

The weighted average rates on call money and repo remained mostly unchanged at 14.50% each for the week.

Forex market

In Forex markets, activity continued to remain moderate during the week while limited trades were witnessed on the USD/LKR cash, tom and spot contracts at levels of Rs. 335.00 to 346.60.

The daily USD/LKR average traded volume for the four trading days of the week stood at $ 23.71 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)