Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 9 June 2022 01:31 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

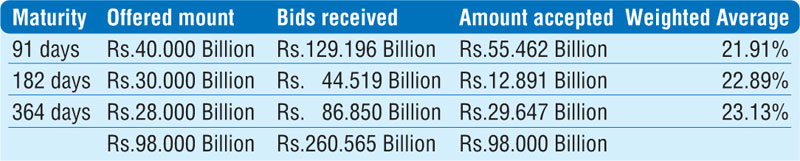

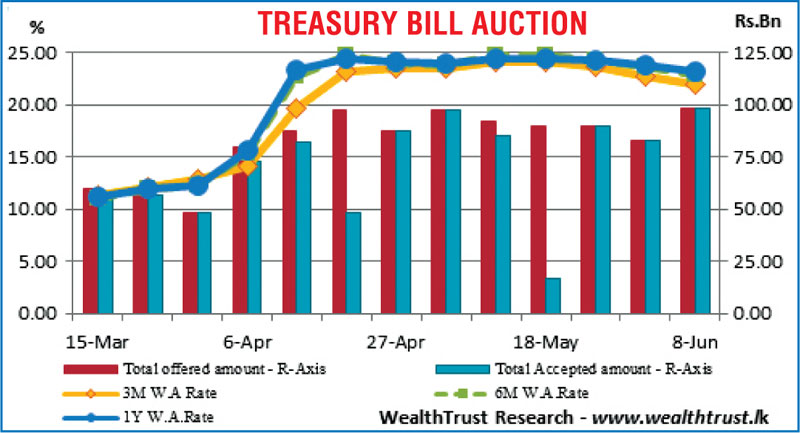

The weekly Treasury bill weighted average rates continued its steep decreasing trend at its auctions held yesterday. The 91-day maturity recorded the sharpest decline of 84 basis points to 21.91%, falling below 22.00% for the first time since the second week of April 2022.

The weekly Treasury bill weighted average rates continued its steep decreasing trend at its auctions held yesterday. The 91-day maturity recorded the sharpest decline of 84 basis points to 21.91%, falling below 22.00% for the first time since the second week of April 2022.

This was followed by the 182 day and 364-day maturities by 71 and 62 basis points respectively to 22.89% and 23.13%. The total offered all time high volume of Rs. 98 billion was successfully taken up at the auction while the bid to offer ratio stood at 2.66:1.

In the secondary bill market yesterday, yields were seen decreasing further, subsequent to the auction results as activity increased. Trades were witnessed on September and December 2022 maturities and June 2023 maturities at lows of 20.80%, 21.50% and 21.90% respectively.

Nevertheless, the secondary bond market was stagnant yesterday. The total secondary market Treasury bond/bill transacted volume for 07 June 2022 was Rs. 2.83 billion.

In money markets, the net liquidity deficit stood at Rs. 535.91 billion yesterday as an amount of Rs. 206.35 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 742.26 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated to Rs. 360.0255 yesterday against its previous day’s Rs. 360.2773.

The total USD/LKR traded volume for 07 June 2022 was $ 29.90 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)