Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 8 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

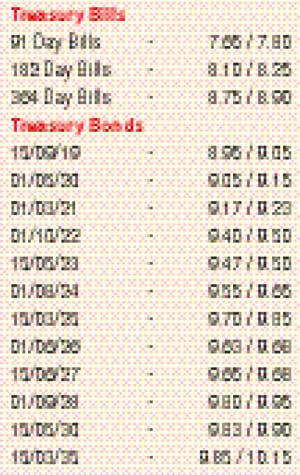

The secondary bond market opened the year on a bullish note and continued throughout the week ending 5 January 2018, as yields were seen tumbling to over two year lows on the back of local buying interest to levels last seen in December 2015. Buying interest across the yield curve from the beginning of the year and week saw yields on the liquid maturities of 01.03.21, 15.05.23, two 2026’s (i.e. 01.06.26 and 01.08.26), 15.06.27 and 15.05.30 dipping to lows of 9.16%, 9.45%, 9.60% each, 9.62% and 9.80% respectively against its previous weeks closing levels of 9.58/68, 9.90/05, 10.05/12, 10.02/10, 10.07/12 and 10.32/37 reflecting a parallel shift downwards of the overall yield curve.

Furthermore, activity was seen on the 15.09.19 and 01.05.20 maturities within the range of 8.97% to 9.28% and 9.10% to 9.35% respectively as well. However, profit taking at these levels curtailed any further downward movement with yields closing marginally higher.

This was despite the 364 day bill weighted average remaining steady for the first time in five weeks at the weekly Treasury bill auction at 8.90%. Furthermore, an outflow of Rs. 2.36 billion was witnessed in the foreign holding of Rupee bonds for the first time in seventeen weeks, reversing sixteen consecutive weeks of inflows.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 12.88 billion.

In money markets, the Open Market Operations (OMO) Department drained out liquidity throughout the week on an overnight basis at a weighted average of 7.25% in addition to mopping up in total an amount of Rs. 43.5 billion on a permanent basis by way of auctions for outright sales of Treasury bills and term repo auctions at weighted averages ranging from 7.31% to 7.62% for duration ranging from 7 days to 77 days. The average net surplus liquidity in the system remained high of Rs. 29.44 billion during the week. The overnight call money and repo rate averaged at 8.16% and 7.53% respectively for the week as well.

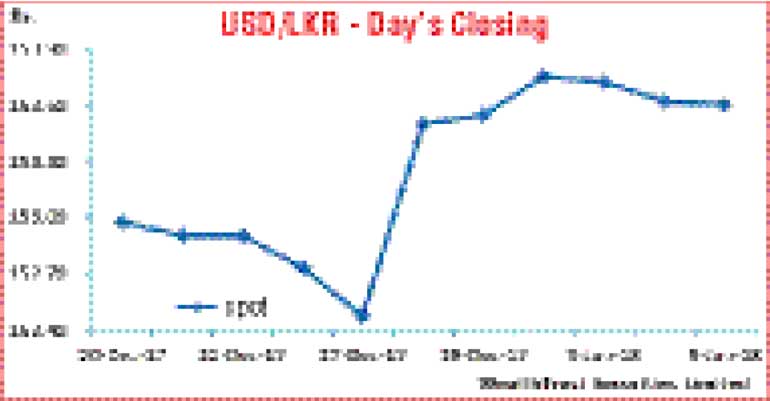

Rupee Dips marginally

The USD/LKR rate on spot contracts depreciated marginally during the week to close the week at Rs. 153.55/65 against its previous weeks closing levels of Rs. 153.50/60 subsequent to trading at a high of Rs. 153.49 to a low of Rs. 153.80.

The daily USD/LKR average traded volume for the three days of the week stood at $ 39.96 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 154.45/55; 3 months - 156.30/45 and 6 months - 158.85/95.