Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 2 January 2019 00:00 - - {{hitsCtrl.values.hits}}

NEW YORK (Reuters): Equities around the world rose on Monday as possible progress in resolving the trade dispute between the United States and China engendered some investor optimism in what has been a punishing end of year for markets.

The US benchmark S&P 500 stock index advanced in light trading volume after US President Donald Trump said he held a “very good call” with China’s President Xi Jinping on Saturday to discuss trade and said “big progress” was being made.

Chinese State media were more reserved, saying Xi hoped the negotiating teams could meet each other halfway and reach an agreement that was mutually beneficial.

The rise in US equities mirrored that in Asian and European markets, which were also buoyed by trade optimism.

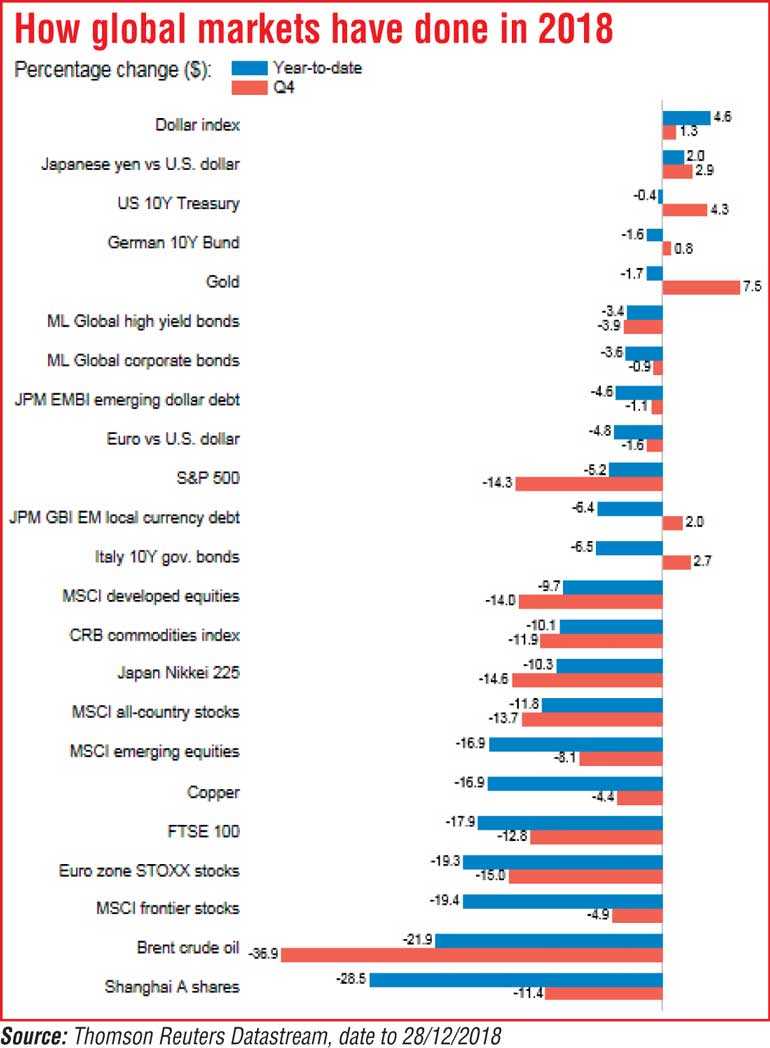

Despite Monday’s advance, equities ended the year largely in the red, victims of investor anxiety over trade tensions and slowing economic growth. Asian and European shares had been sluggish for much of the year, and in recent months, US stocks followed suit.

“If the European economy continues to decelerate and the Chinese economy decelerates because of tariffs, there is definitely going to be spillover to the United States,” said Shannon Saccocia, chief investment officer at Boston Private.

The S&P 500 dropped more than 9% in December, its largest decline since the Great Depression. For the year, the index slid more than 6%, its biggest drop since the 2008 financial crisis.

Asia-Pacific shares outside Japan ended down 16% for the year, while the STOXX 600 was more than 13% lower. MSCI’s gauge of stocks around the globe fell 11.1% in 2018.

A further blow to the Chinese economy could spur a quicker resolution to the US-China trade dispute and thus boost global equities, Saccocia said. Survey data on Monday showed Chinese manufacturing activity contracting for the first time in two years even as the service sector improved.

On Monday, the Dow Jones Industrial Average rose 265.06 points, or 1.15%, to 23,327.46, the S&P 500 gained 21.11 points, or 0.85%, to 2,506.85 and the Nasdaq Composite added 50.76 points, or 0.77%, to 6,635.28.

MSCI’s emerging markets index rose 0.32%, while the MSCI world stock index gained 0.66%.

No more hikes

Yields on US Treasuries fell on Monday, keeping with the trend over the past two months as investors moved to lower-risk investments.

Benchmark 10-year notes last rose 15/32 in price to yield 2.686%, compared with 2.738% late on Friday.

The fall in Treasury yields reflects expectations of a slowdown, if not a pause altogether, in the Federal Reserve’s progression of interest-rate hikes.

The precipitous drop in yields has undermined the US dollar in recent weeks. The dollar index, which measures the greenback against a basket of six other currencies, was down 0.3% and on track to end December with a loss. It is, however, still set for its highest yearly percentage gain since 2015.

On Monday, the dollar fell to a six-month low against the yen.

The euro was up 0.2% to $1.1459, on track to end the year down nearly 5% against the dollar.

Oil posted its first year of losses since 2015, with Brent crude futures down 19.5% and US West Texas Intermediate crude futures down 24.8%.

On Monday, Brent crude settled 59 cents higher, or 1.11%, at $53.80 a barrel. US crude settled up 8 cents, or 0.18%, at $45.41 a barrel.