Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 19 January 2021 01:27 - - {{hitsCtrl.values.hits}}

By Dumith Fernando

Down 25% leading up to the COVID-19 lockdown but powerfully bouncing back +48% to close 2020; and up another +14% in value in the first two weeks of 2021. And all this in the backdrop of residual pandemic uncertainty. This is the story of the Colombo Stock Exchange (CSE) in the last 12 months.

Down 25% leading up to the COVID-19 lockdown but powerfully bouncing back +48% to close 2020; and up another +14% in value in the first two weeks of 2021. And all this in the backdrop of residual pandemic uncertainty. This is the story of the Colombo Stock Exchange (CSE) in the last 12 months.

Is questioning the persistent growth of the All Share Price Index (ASPI) of the CSE understandable? Yes, it is. Is concluding that the market is overheated justifiable? No, it is not – not if one takes the time to understand the basic facts behind current market dynamics.

Stock markets are driven by two fundamental factors – i) the earnings generation ability and the asset value of companies whose shares are listed, and ii) investors’ perception of where they can find the best relative (risk-adjusted) return for their funds. At the most basic level, these two things will determine the value of listed shares.

For most investors, the fair valuation of share prices is indicated by valuation multiples. Price to Earnings (P/E) and Price to Book Value (P/B) multiples are most commonly used. These multiples in turn are driven by the growth expectation of a company’s earnings and, therefore, its book value (net asset value). If you assume the P/E or P/B multiple for a certain share is fixed, then the expectation of growth in earnings (E) or the book value (B) in this equation, will lead to growth in the price (P) of the share.

Additionally, if investors compare investment options for their funds and find that other options like fixed income deposits, treasury bills/bonds, debentures, etc. are yielding less in the current low interest environment, and they expect better returns from listed company earnings, you will see additional funds flowing into the share market. This would further increase the P/E and P/B multiples, and in turn boost share prices (even for a fixed expected earnings or book value quantum).

Both these things are happening today and supporting the advance of the ASPI. Then the question becomes, how much is too much?

Where is the CSE valued today in terms of P/E and P/B multiples in historical context?

Where is the CSE valued today in terms of P/E and P/B multiples in historical context?

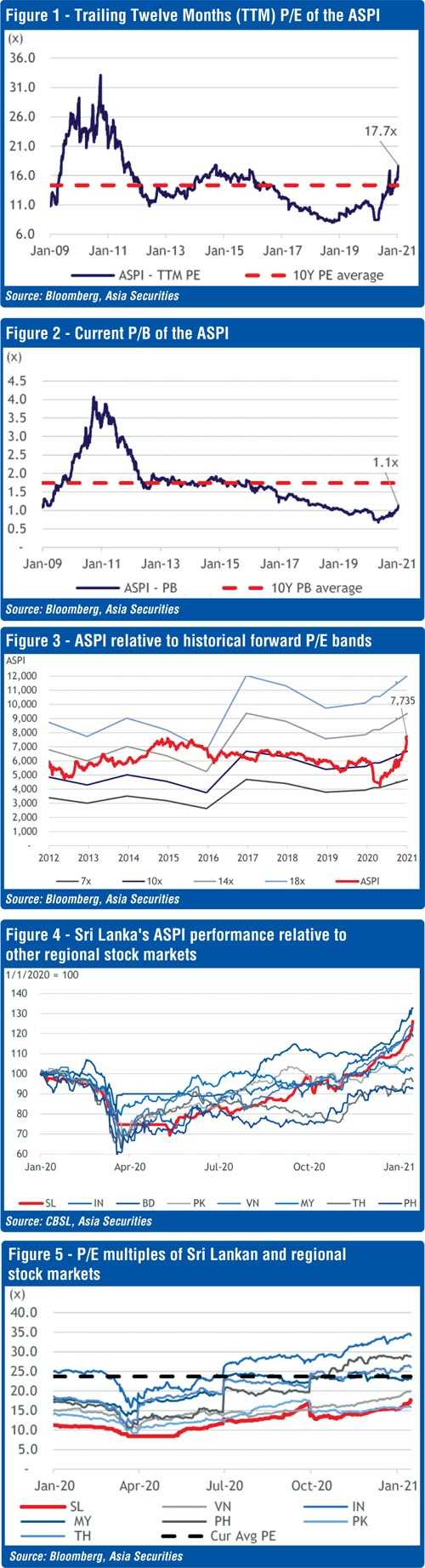

As seen in Figure 1, on the face of it, the trailing P/E at 17.7x seems 23% higher than the historical average of 14.4x. But the more astute observation is that since trailing earnings were abnormally depressed in 2020 due to the pandemic (down about 15% compared to the previous period) this multiple has limited value for comparison purposes. In this context, P/B multiples may be a better benchmark to follow. When observing historical P/B multiples, in Figure 2, it is clear that the current valuations are still at a 34% discount to the 10-year average, and also below 2012-2015 levels.

If you still want to consider P/E multiples, it is best to normalise for future earnings. When analysing forward P/E multiples based on estimated future earnings, we can further observe that the market is not in overvalued territory. On the basis of the already evident earnings bounce back post-pandemic, the valuation of the ASPI is in the middle of the historical P/E valuation multiple range (Figure 3).

How is the CSE valued relative to other regional markets?

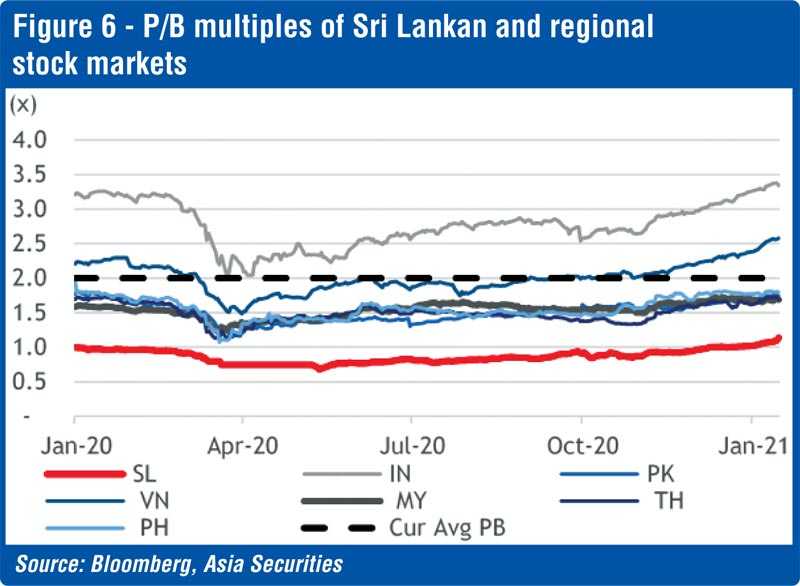

As displayed in Figure 4, the CSE has performed quite strongly since the beginning of 2020 in comparison to Asian markets like India (IN) Bangladesh (BD) Pakistan (PK) Vietnam (VN) Malaysia (MY) Thailand (TH) and Philippines (PH). However, the CSE is still valued relatively cheaper than these other markets on a P/E and P/B basis (Figures 5 and 6). Sri Lanka is not showing any irrational valuation of its listed companies when compared to other countries. It is still at the lower end of valuation multiples regionally.

The conclusions that could be drawn from this multi-country comparison may be multi-faceted and debatable. However, it does suggest that, if and when foreign investors who have exited the CSE in large numbers (similar to what they did in many frontier and emerging markets) consider re-entering these markets, the valuation advantage of the CSE would be quite compelling. The injection of new foreign buying into the CSE would support further valuation upside.

So what has driven the rapid rise in share prices?

It is the expectation of both a strong recovery in corporate earnings in 2021 (and beyond) and continued low interest rates for the foreseeable future. The movement of share prices in tandem with earnings may not be intuitive to all. What do the facts bear out on the correlation between stock prices and interest rates?

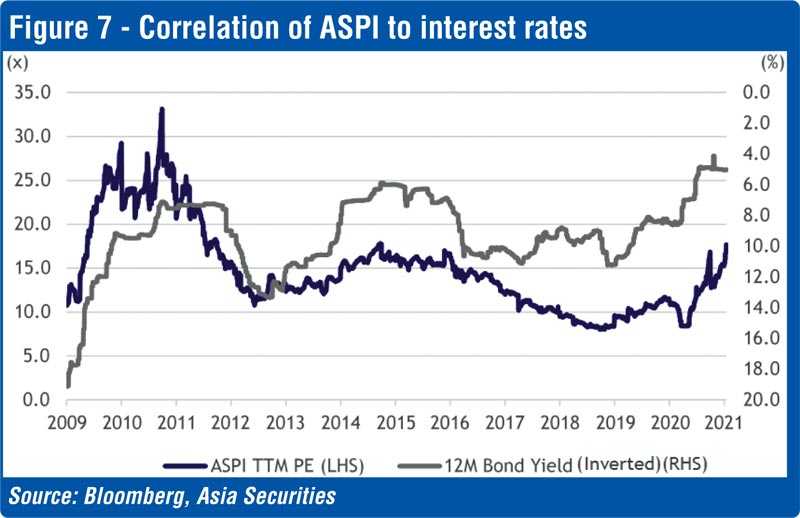

In Figure 7, which plots the ASPI price movement against the inverse of the 12-month Treasury bond rate, we observe that as rates move down, equity prices move in the opposite direction with very good directional correlation. A low interest rate regime helps corporates by reducing their cost of financing, and in turn increasing business activity and earnings. In addition, investors see lesser returns in the fixed income asset class and therefore shift to the share market.

As the average dividend yield of the ASPI is over 2%, with a few percentage points’ share price movement, investors can beat the return they might get in instruments like fixed deposits which are in mid-single digit percentage levels at the moment. Finally, lower interest rates mean that investors who wish to borrow to trade shares (margin trading) also have a lower hurdle rate to beat through their share investments.

All these factors bode well for stock market valuations. Therefore, to the extent that the interest rate environment remains benign and at historically low levels, the support for equity market valuations should be expected.

One cannot be faulted for reflecting on how far the stock market in Sri Lanka has risen in the last eight months and wondering if it is about to run out of steam. However, before making any hasty decisions, investors would be served well to dig a little deeper – deeper than the sometimes less informed, sometimes mischievous commentators would suggest – and understand what substantiates the current market performance.

Investors must remember though that not all shares are the same, and a well-researched, fundamentally strong portfolio of stocks will always perform better in the long-run. But the current debate on the overheating of the stock market may itself be overheated.

The author is Chairman of Asia Securities, an investment services firm. Currently, he is also Chairman of the Colombo Stock Exchange. The opinions expressed in this article are the author’s own. They do not necessarily represent the position of any institution with which the author is affiliated.