Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 7 June 2022 03:42 - - {{hitsCtrl.values.hits}}

Prof. Lee Buchheit

Dinesh Weerakkody

The go-to expert for debt-ridden nations Prof. Lee Buchheit highlights some of the thorny issues involved that can prolong the process in Sri Lanka’s debt restructuring.

The go-to expert for debt-ridden nations Prof. Lee Buchheit highlights some of the thorny issues involved that can prolong the process in Sri Lanka’s debt restructuring.

Excerpts of the Q&A Dinesh Weerakkody had with him recently on some of the thorny issues of debt restructuring.

The two important non-financial clauses in sovereign bond documentation: the ‘collective action clause’ and the ‘pari passu clause’. Does the pari passu clause and CAC adequately address the holdout problem and encourage the orderly restructuring of sovereign debt? The pari passu clause requires the issuer of a bond to maintain the equal ranking of the instrument with its other “senior” indebtedness. It is not a promise by each bondholder to accept equal treatment with its fellow bondholders.

The Collective action clauses (CAC) are undoubtedly helpful to reduce holdout creditor behaviour in a sovereign bond restructuring. But they are not a complete solution. It is sometimes fairly easy for a holdout to acquire — on its own or in collaboration with other similarly-minded investors — a blocking position in a particular bond (typically 25 percent of the principal).

For example, in Greece in 2012, the Hellenic Republic had 35 series of English-law governed bonds, each with its own CAC. Only 17 of those series joined the restructuring. Holdout creditors had acquired blocking positions in the other series.

The holdout creditor problem in sovereign debt workouts is a nightmare. Argentina’s $ 68.8 billion in foreign-bonds and Lebanon’s default on $ 1.2 billion debt. Both remain exposed to the potential cheap tactics of holdout creditors: where funds seek full repayment of their original bonds through litigation, as opposed to participating in debt negotiations. What is your experience given that you have represented nearly every country that has gone bankrupt since the 1980s, and in the process almost single-handedly building up an entire field of international law?

Interestingly, such an inter-creditor promise is to be found in syndicated bank loans. It is called a “sharing clause” and requires any bank that receives a disproportionate payment to share it with the other members of the syndicate. But sharing clauses have never been used in bond issues.

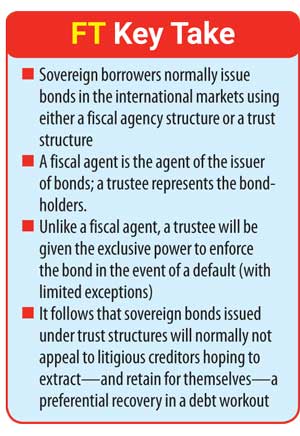

The use of trust structures in sovereign bonds can discourage holdout creditor interest, at least for bonds that have not matured according to their original terms. Fortunately, SL ISBs use a trust indenture.