Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Tuesday, 14 September 2021 01:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The total accepted volume at yesterday’s bond auction was seen increasing to a high of 83.56% of its total offered volume as its bids-to-offer ratio increased as well to 1.9:1. A total amount of Rs. 41.78 billion was accepted in comparison to Rs. 4 billion accepted at its previous round of auctions conducted on the 29 July and against a total offered amount of Rs. 50 billion on each instance. The auction maturities of 15.06.2024 and 15.03.2031 registered weighted average rates of 8.10% and 10.05% respectively against its stipulated cut-off rates of 8.10% and 10.10%.

The second phase for the 15.06.2024 maturity opened at its weighted average rate due to its offered amounts of Rs. 22.5 billion not been fully subscribed at the first phase of the auction. However, the offered amount of Rs. 27.5 billion on the 15.03.2031 maturity was fully subscribed at the first phase of the auction, which led to a further amount of 20% (Rs. 5.50 billion) been offered on this maturity at its weighted average by way of a direct issuance window until close of business today (i.e., 4:00 p.m. on 14 Sept.).

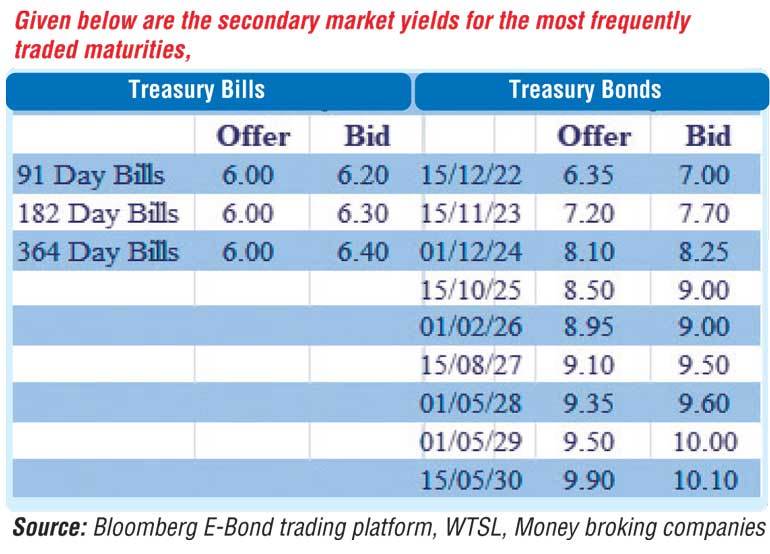

At the start of a fresh trading week, buying interest following the outcome of the bond auctions saw the maturities of 15.01.26 and 01.07.28 change hands at levels of 8.98% and 9.51% respectively in the secondary bond market.

The total secondary market Treasury bond/bill transacted volume for 10 September was Rs. 1.13 billion.

In money markets, the net liquidity deficit decreased further to Rs. 158.21 billion yesterday with an amount of Rs. 94.34 billion been deposited at Central Banks SDFR of 5% against an amount of Rs. 252.55 billion withdrawn from Central Banks SLFR of 6%. The weighted average rates on call money and repo stood at 5.97% and 5.90% respectively.

Rupee trades on spot contracts

In the Forex market, the USD/LKR rate on spot contracts was traded at level of Rs. 200 yesterday while the overall market continued to remain inactive.

The total USD/LKR traded volume for 10 September was $ 37.26 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)