Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 19 May 2021 00:00 - - {{hitsCtrl.values.hits}}

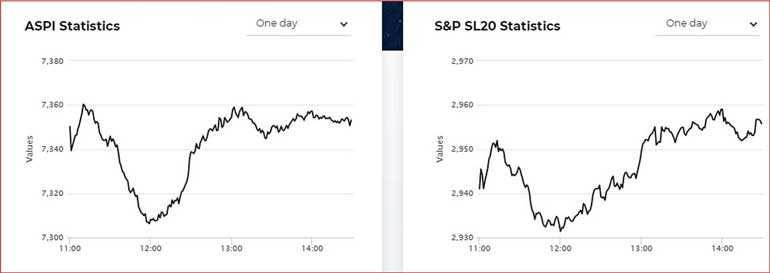

The Colombo stock market managed to close marginally up yesterday after a bearish start dragging indices down most part of the trading.

The All Share Price Index closed up 5 points or 0.07% and the S&PSL20 closed 15 points up or 0.5%. Turnover was Rs. 2.66 billion with 140 million shares traded.

First Capital said the Bourse retained its bullish stance by continuing to lodge in the green region for the fifth consecutive day.

“ASPI surged during the initial minutes of trading and subsequently witnessed a dip during mid- day reaching intraday low of 7,305. Later, market gained the momentum gradually shifting from bearish to bullish over the latter part of session, closing at 7355 gaining 5 points,” First Capital said.

It said turnover was boosted by the capital goods sector followed by the transportation sector with a joint contribution of 40%. Parcel trades accounted 25% of the turnover.

Asia Securities said the indices displayed a recovery during the session following an initial decline and closed in green for the fifth consecutive session.

“The ASPI reached an intra-day low level of 7,306 before witnessing a recovery of 49 points,” it added. Asia said Chrissworld Ltd., the first Empower Board listed SME, began trading and witnessed significant price gains on its debut. It said Capital Goods, Transportation, Food, Beverage and Tobacco and Materials sectors led activity, collectively accounting for 69.5% of turnover.

Foreigners recorded a net inflow of Rs. 186.8 million while their participation increased to 22.7% of turnover (previous day 3.4%). Estimated net foreign buying topped in Hemas Holdings at Rs. 184.9 million and net foreign selling topped in Ceylon Cold Stores at Rs. 14.2 million.

NDB Securities said the ASPI edged up as a result of price gains in counters such as Ceylon Tobacco Company, Sri Lanka Telecom and Nestle Lanka.

It said high net worth and institutional investor participation was noted in Teejay Lanka, Hemas Holdings and Dialog Axiata. Mixed interest was observed in Hayleys Fabric, Royal Ceramics and Distilleries, whilst retail interest was noted in Browns Investments, Chrissworld Limited and Expolanka Holdings.

Capital Goods sector was the top contributor to the market turnover (due to Hemas Holdings) whilst the sector index edged down by 0.02%. The share price of Hemas Holdings recorded a loss of Rs. 0.40 (0.50%) closing at Rs. 80.00 whilst foreign holdings increased by 2,310,638 shares.

Transportation sector was the second highest contributor to the market turnover (due to Chrissworld Limited and Expolanka Holdings) whilst the sector index closed flat 0.00%. The share price of Chrissworld Limited moved up by Rs. 9.60 (128.00%) to close at Rs. 17.10. The share price of Expolanka Holdings closed flat at Rs. 47.00.

Browns Investments and Teejay Lanka were also included amongst the top turnover contributors. The share price of Browns Investments decreased by Rs. 0.10 (1.45%) to close at Rs. 6.80. The share price of Teejay Lanka gained Rs. 0.30 (0.76%) to close at Rs. 40.00.

Separately Dipped Products, Ceylon Cold Stores and Keells Food Products announced their final dividends of Rs. 0.60, Rs. 4.00 and Rs. 2.50 per share respectively.