Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 7 March 2022 01:56 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

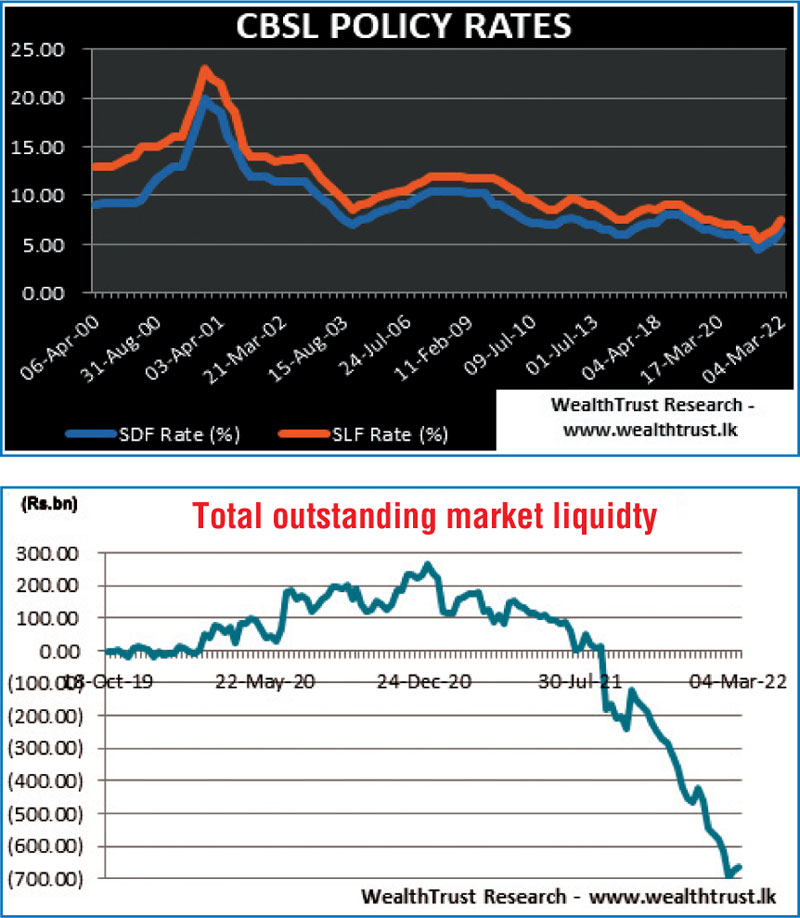

The Central Bank of Sri Lanka was seen tightening its monetary policy stance by increasing its policy rates by 100 basis points at its announcement on Friday, the sharpest increase since January 2001. Its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) stand at 6.50% and 7.50% respectively now.

The Central Bank of Sri Lanka was seen tightening its monetary policy stance by increasing its policy rates by 100 basis points at its announcement on Friday, the sharpest increase since January 2001. Its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) stand at 6.50% and 7.50% respectively now.

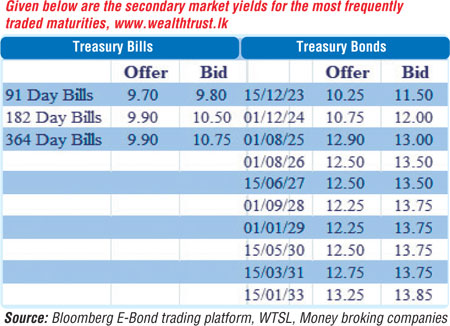

At the weekly Treasury bill auction leading to the monetary policy announcement, demand dipped further as its total accepted volume fell to 65.37% of its total offered volume in comparison to its previous week’s 80.70%. The weighted average rates were seen spiking as well with all three maturities exceeding the 9.00% psychological level for the first time since April-May 2019.

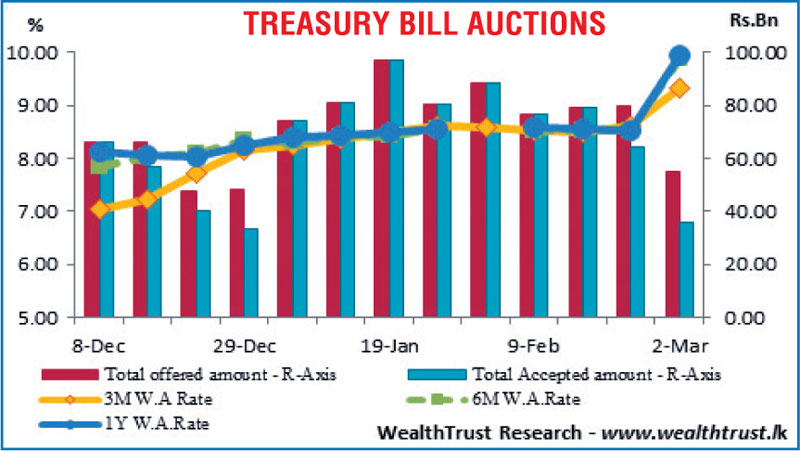

In the meantime, the Colombo Consumer Price Index (CCPI) or inflation for the month of February increased for a fifth consecutive month to 15.1% on its point to point, when compared against its previous month’s figures of 14.2% while its annual average increased as well to 7.9% from 6.90%.

Nevertheless, activity in the secondary bond market remained rather low during the week ending 4 March as a majority of market participants were seen on the sidelines. Limited trades were seen on the liquid 01.08.25 maturity at levels of 12.95% to 13.00% while 3 June 2022 bill was traded within the range of 8.85% to 9.95% in the secondary bill market.

The foreign holding in rupee bonds remained mostly unchanged at Rs. 2.65 billion for the week ending 2 March while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 10.24 billion.

In money markets, the base rate change saw the weighted average rate on overnight call money and repo increasing to 7.45% and 7.50% respectively on Friday against its previous three days average of 6.48% and 6.50%.

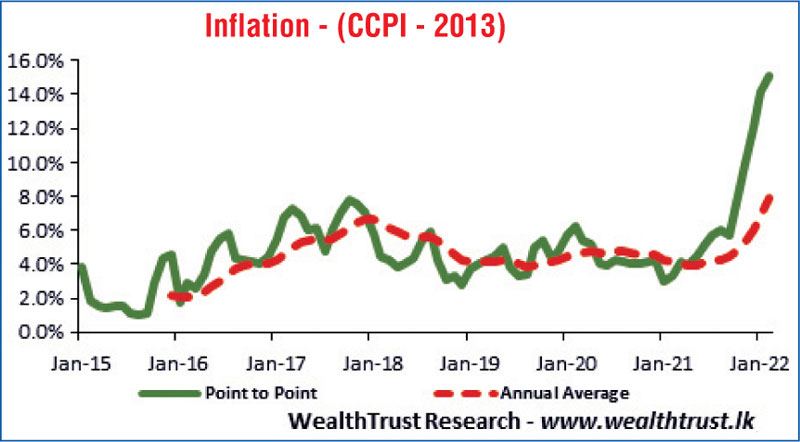

The total outstanding liquidity deficit was recorded at Rs. 664.67 billion by the end of the week against its previous weeks of Rs. 673.90 billion while CBSL’s holding of Govt. Security’s stood at Rs. 1,529.19 billion against its previous weeks of Rs. 1,511.37 billion.

Forex market

In Forex markets, overall activity continued to remain moderate during the week while limited trades were witnessed on the USD/LKR spot contracts at a level of Rs. 202.97 to Rs. 202.99.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 91.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)