Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 5 February 2021 00:02 - - {{hitsCtrl.values.hits}}

|

| People’s Bank Senior Deputy General Manager Payment and Digital K.B. Rajapakse

|

Sri Lanka’s banking sector is successfully leading the country’s transition to a more inclusive digital economy from the cash-based economy in the line with the Government’s vision and under the

guidance of the Central Bank (CB) while capitalising on recent consumer behavioural trends emerged with the COVID-19 outbreak, the Senior Vice President of Association of Professional Bankers (APB) affirmed.

In a recent discussion, the Association of Professional Bankers (APB), Senior Vice President and People’s Bank Senior Deputy General Manager – Payment and Digital K.B. Rajapakse asserted that the country’s banking sector recognised its pivotal role as an industry to lead the country’s transition towards a digital economy, which has become already evident in digital investments.

“The country is rapidly transforming to become a digital economy under the vision the country’s new Government leadership. The banking sector plays a crucial in the economy in particular fulfilling needs of entrepreneurs in terms of capital funding and working capital requirements to grow their businesses, while catering to needs of retail customers and depositors and specialise for SME section. Therefore, the digitalisation drive in the banking sector is to cut costs associated with printing and distributing physical currency, reduce paper usage, increase employee productivity, efficient customer service, and finally leading to efficiency in processes and overall productivity. Therefore, we strongly feel that we have a responsibility and duty to contribute to the Government’s development agenda ‘Visions of Prosperity’ and the vision which is also mirrored in the Central Bank’s vision,” he elaborated.

Rajapakse highlighted that the CB’s QR-code based payment initiative which was embraced by the banking sector would play an important role in supporting the country’s SMEs and allowing them to play a key role in the envisaged digital economy.“This is convenient for both consumers and merchants to carry out real-time digital transactions on the spot. The small-scale vendors could save capital expenditure on POS machines and other related costs associated with it .This will also be helpful to bring them into formal fin tech sector,” he pointed out.

The banking sector has been able to get almost 170,000 merchants to this platform from large State-owned corporations to private sector supermarket chains to small-scale vendors.

Apart from the CB’s initiatives to popularise QR-based payment method among the general public and the merchants, banks on individual level are also launching their own marketing efforts.

In addition to standard digitised products, the banking sector also launched range of digital products including products to process customer loan applications entirely on digital channels, Account opening, mobile payment apps, e-wallets etc.

Further, the association also expects several innovation products come through the CB’s FinTech regulatory sandbox.

Touching upon the impact of COVID-19 had on consumer behaviour, Rajapakse outlined that consumers irrespective of the age, Sri Lankan consumers largely embraced digital products, in particular during the lockdown periods.

“There was a perception among the industry that only younger generation’s keen on digital products. However, not only young customers, but also customers in all age segments utilised our products during these lockdown periods. Therefore, I believe Sri Lankan consumer has grasped the benefits of the digital products,” he added.

Illustrating an example, he noted that banks saw a record tenfold increase in retail transactions though digital channels in 2020 compared to the previous year.

Rajapakse emphasised that the country’s banking sector plans to capitalise on these trends. Commenting on the future of Sri Lanka’s banking sector, he expects Sri Lanka to make a gradual transition to digital channels, while keeping some of brick and motor channels alive for human touch.

“Sri Lankans are making a gradual transition to digital channels, unlike the rapid transition that we are seeing in Europe and other Western countries. Some of our customers still prefer the human touch as it’s important for them to build further the trust and confidence. That means we won’t be 100% digitalised and will keep our traditional banking channels open to serve these customers,” he elaborated.

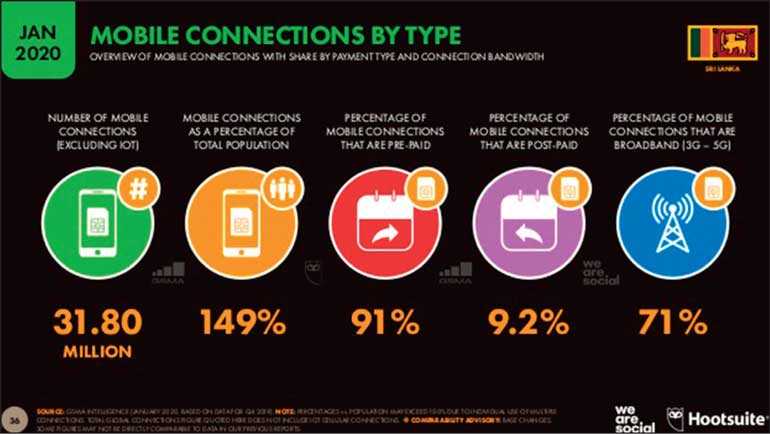

As at January last year, the number of mobile connections (excluding IoT) stood at 31.8 million, indicating 149% penetration, according to popular Social Media Management Tool, Hootsuite.

A total of 91% of these mobile connections were pre-paid while remaining 9% were post-paid connections.

Further, Rajapakse highlighted that 71% of these mobile connections could be considered as broadband (3G-5G) connection, which indicates the immense growth potential for digital banking products in Sri Lanka.

In concluding, Rajapakse urged consumers to beware of attempts by certain fraudulent individuals to scam out of their funds, in particular on social media platforms: “I want to urge customers not to share their confidential data with any third parties, because there are so many scams taking place both online and offline targeting vulnerable customers.”