Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 27 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

Secondary bond markets witnessed another day of dull trading yesterday as they failed to gather any momentum mainly due to a wait-and-see approach by local market participants and a slowdown in foreign interest.

A limited amount on the maturities of 1.4.18, 1.5.21 and 1.10.22 were changed at levels of 9.09% to 9.15%, 10.10% to 10.15% and 10.11% to 10.20% respectively.

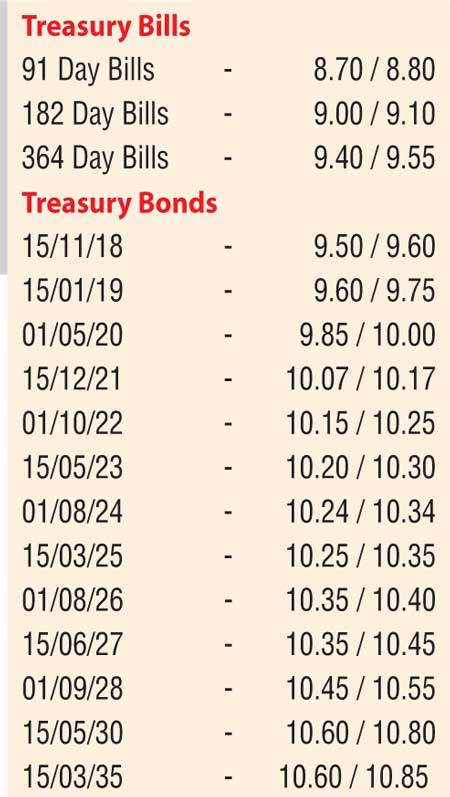

The total secondary market Treasury bond/bill transacted volumes for 25 October was Rs. 7.06 billion. Given below are the closing, secondary market yields of the most frequently traded T-bills and bonds

In money markets, the OMO Department of Sri Lanka was seen draining out an amount of Rs. 14.43 billion on an overnight basis by way of a repo auction at a weighted average of 7.25% as the net surplus liquidity in the system increased to Rs. 21.18 billion yesterday. The overnight call money and repo rates averaged 8.15% and 7.66% respectively.

The USD/LKR rate on its spot contracts was seen appreciating for the first time in seven days to close the day at Rs. 153.55/65 against its previous day’s closing levels of Rs. 153.80/90 on the back of exporter dollar sales outweighing importer demand.

The total USD/LKR traded volume for 25 October was $ 102.85 million.

Given below are some forward USD/LKR rates that prevailed in the market

1 Month - 154.40/50

3 Months - 156.20/30

6 Months - 158.55/65