Monday Mar 09, 2026

Monday Mar 09, 2026

Tuesday, 11 May 2021 00:41 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The commencement of a fresh trading week saw continued buying interest on the very short end of the yield curve, ahead of today’s weekly bill auction, conducted a day prior due to a shortened trading week.

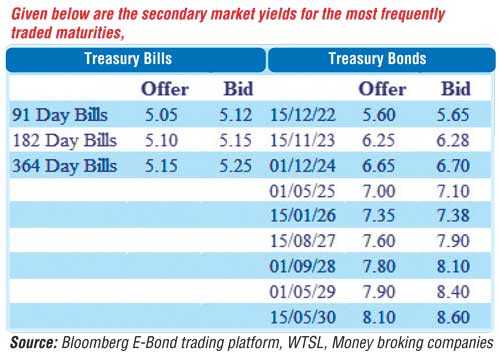

Trading interest was mainly seen on the 2002’s (i.e. 01.10.22 and 15.12.22), 15.11.23 and 01.12.24 maturities, as its yields decreased to daily lows of 5.60%, 5.65%, 6.24% and 6.65% respectively, against its previous trading day’s closing levels of 5.63/70, 5.65/70, 6.30/35 and 6.70/72. In addition, the 15.03.23 and 15.12.23 maturities were seen changing hands at levels of 5.95% and 6.30% to 6.31% respectively as well. Furthermore, considerable volumes of August, October and November 2021 bills changed hands at levels of 5.10% to 5.12% in its secondary market.

Today’s bill auction will have on offer a total amount of Rs. 47 billion, consisting of Rs. 12 billion on the 91-day, Rs. 16 billion on the 182-day and Rs. 19 billion on the 364-day maturities. At its last week’s auction, the weighted average yield on the 91-day bill increased by one basis point to 5.12%, while weighted average rates on the 182-day and 364-day maturities remained steady at 5.14% and 5.18% respectively. The stipulated cut-off rate on the 364-day maturity remained steady at 5.18% for a fourth consecutive week, while the maximum yield rates of the 91-day and 182-day maturities will be decided below the level of the 364-day maturity at the auction.

The total secondary market Treasury bond/bill transacted volume for 7 May was Rs. 8 billion.

In the money market, overnight net surplus liquidity increased to Rs. 139.76 billion yesterday, while weighted average rates on overnight call money and repo was registered at 4.66% and 4.69% respectively.

USD/LKR

In forex markets, the USD/LKR on spot contract were traded at level of Rs. 199.90 yesterday, while one-month forward contracts saw buying interest at Rs. 199.95.

The total USD/LKR traded volume for 7 May was $ 55.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)