Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 25 January 2021 00:00 - - {{hitsCtrl.values.hits}}

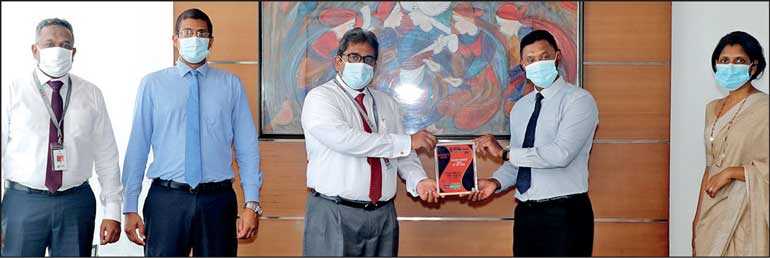

From left: Seylan Bank Head of Islamic Banking Sameer Mohamed, Seylan Bank Chief Operating Officer Ramesh Jayasekara, Seylan Bank Director/Chief Executive Officer Kapila Ariyaratne, UTO Group of Companies Group Executive Director Usama Zaid and Seylan Bank Chief Manager – Project Finance Dulani Rodrigo

Seylan Bank PLC’s Islamic Banking Unit has placed Sri Lanka prominently in the world of Islamic Finance, securing the joint Gold Award for Deal of the Year 2019 at the recently concluded Sri Lanka Islamic Banking and Finance Industry (SLIBFI) Awards 2019 and Bronze for the same deal at the regional Islamic Finance Forum of South Asia (IFFSA) Awards 2020. Seylan Bank was recognised for successfully financing a Diminishing Musharaka Facility to Timex Bukinda Hydro (U) Ltd. as part of a syndicate facility.

The SLIBFI Awards, the premium industry awards for Islamic finance in Sri Lanka, are presented in conjunction with KPMG, whose key role is to ensure an impartial evaluation process. An independent panel of judges of repute assist in the final adjudications, under the guidance of KPMG.

The IFFSA Awards recognise the high achievers in the South Asian region for their efforts in Islamic banking and finance during 2019 with industry leading practitioners from Pakistan, Bangladesh, Maldives, India, and other South Asian countries competing alongside Sri Lanka for accolades.

“Islamic banking is broadly adopted around the world and the preferred choice for some of our clients. Seylan Bank’s Islamic Banking Unit takes pride in being able to facilitate such an important deal for our client. Furthermore, this multiple award-winning deal has also placed Sri Lanka firmly in the global Islamic finance map,” said Seylan Bank Chief Operating Officer Ramesh Jayasekara.

The Timex Bukinda Hydro (U) Ltd. project transaction has resulted in Sri Lanka understanding the proficiencies and capabilities of Islamic banking and financing which has a mere 20-year history in the country. It also portrays Sri Lanka’s own management expertise and engineering capabilities in establishing hydro power plants overseas, thereby putting Sri Lanka on the global Islamic banking map.

Speaking on the dual awards, Seylan Bank Head – Islamic Banking Unit M.Z. Sameer Mohamed stated, “We are very humbled by the recognition this transaction has received from the wider Islamic Finance community. It has firmly placed Sri Lanka as a partner of choice for future cross border transactions via Sharia compliant platforms, and also created confidence in foreign investors and other leading islamic financial institutions to obtain more syndicate financing facilities in achieving their corporate goals, which as a result would promote Islamic finance.”

Seylan Bank, the Bank with a Heart, operates with a vision to offer the ultimate banking experience to its valued customers through cutting-edge technology, innovative products, and best-in-class service. The Bank has a growing clientele of SMEs, Retail and Corporate Customers and has expanded its footprint with 173 branches across the country and an ATM network of 216 units.

Seylan Bank has been endorsed as a financially stable organisation with performance excellence across the board by Fitch Ratings, with the bank’s national long-term rating revised upward, from ‘A-(lka)’ to ‘A (lka)’. The bank was ranked second among public listed companies for transparency in corporate reporting by Transparency Global.

Seylan Bank has also been named the Most Popular Banking Service Provider in Sri Lanka in Customer Experience by LMD consecutively in 2019 and 2020. These achievements are a testament to Seylan Bank’s financial stability and unwavering dedication to ensure excellence across all endeavours.