Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 2 September 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

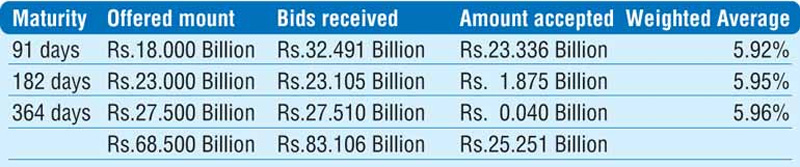

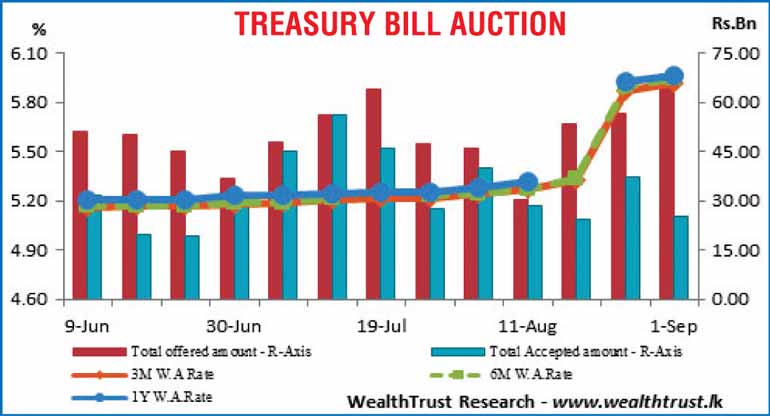

The weekly Treasury bill auction conducted yesterday went undersubscribed for a seventh consecutive week as only 36.86% or Rs. 25.21 billion was accepted in total against a total offered amount of Rs. 68.5 billion.

The weekly Treasury bill auction conducted yesterday went undersubscribed for a seventh consecutive week as only 36.86% or Rs. 25.21 billion was accepted in total against a total offered amount of Rs. 68.5 billion.

All three weighted average rates continued to rise, recording increases of five basis points each and three basis points on the 91-day, 182-day and 364-day maturities respectively to 5.92%, 5.95% and 5.96%. The bids-to-offer ratio decreased to 1.21:1.

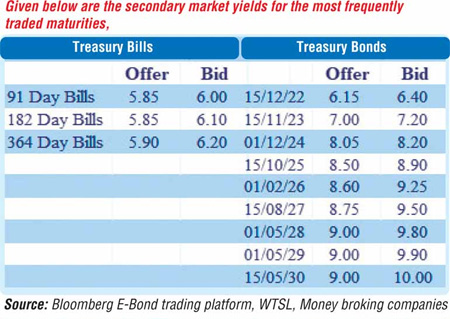

The dull to lethargic sentiment in the secondary bond market continued yesterday as well, with only the short tenure 15.03.22 maturity changing hands at a level of 5.90%. In secondary bills, 10 September maturity traded at a level of 5.90%, pre-auction.

The total secondary market Treasury bond/bill transacted volume for 31 August was Rs. 0.77 billion.

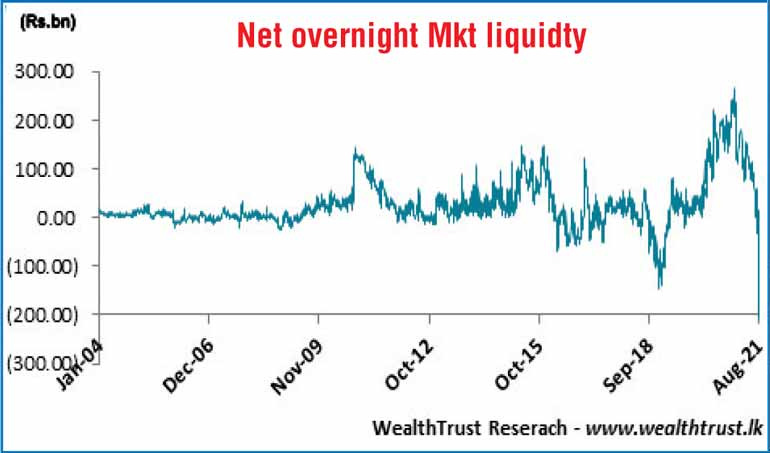

In money markets, the increase in the SRR with effect from yesterday saw the overnight net liquidity shortage in the system increasing to a mammoth volume of Rs. 205.61 billion yesterday, the highest level seen since January 2004. An amount of Rs. 72.37 was deposited at Central Banks SDFR (Standard Deposit facility Rate) of 5 % against an amount of Rs. 277.98 billion been withdrawn from Central Banks SLFR (Standard Lending facility Rate) of 6%. The weighted average rates on overnight call money and repo increased marginally to 5.88% and 5.80% respectively, while the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auctions for a second consecutive day.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 31 August was $ 10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)