Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 1 November 2021 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

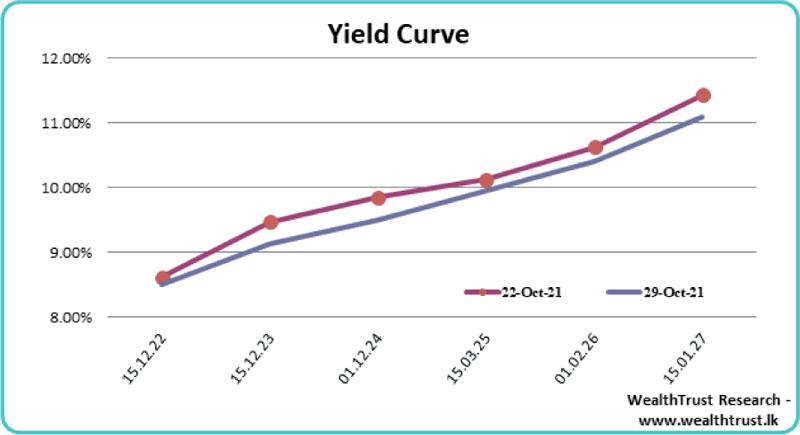

The secondary bond market witnessed renewed buying interest during the week ending 29 October, mainly subsequent to the primary auctions conducted during the week, which led to yields decreasing across the yield curve.

The secondary bond market witnessed renewed buying interest during the week ending 29 October, mainly subsequent to the primary auctions conducted during the week, which led to yields decreasing across the yield curve.

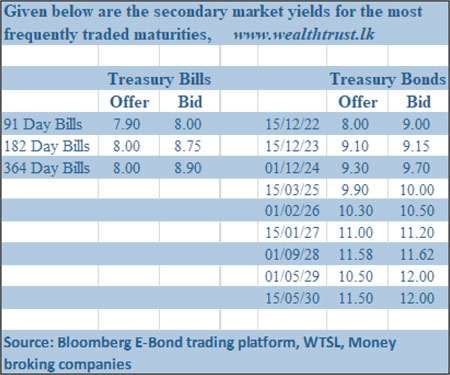

At the weekly primary auction, the weighted average rate on the market favorite 91-day bill was seen increasing by only four basis points to 8.43% while in the secondary market the 91-day bill was seen dipping to an low of 7.90%, subsequent to the auction. At the Treasury bond auctions, the 15.03.2025 and 01.09.2028 maturities recorded impressive weighted averages of 9.94% and 11.61% respectively, below its secondary market rates prior to the auctions.

Trades were mainly seen on the maturities of 15.12.23 and 15.01.27 as its yields were seen hitting weekly lows of 9.10% and 11.10% respectively against its previous weeks closing levels of 9.42/52 and 11.40/45. In addition, maturities of 15.11.23 and 01.09.28 traded at levels of 9.20% and 11.58% to 11.62% respectively as well.

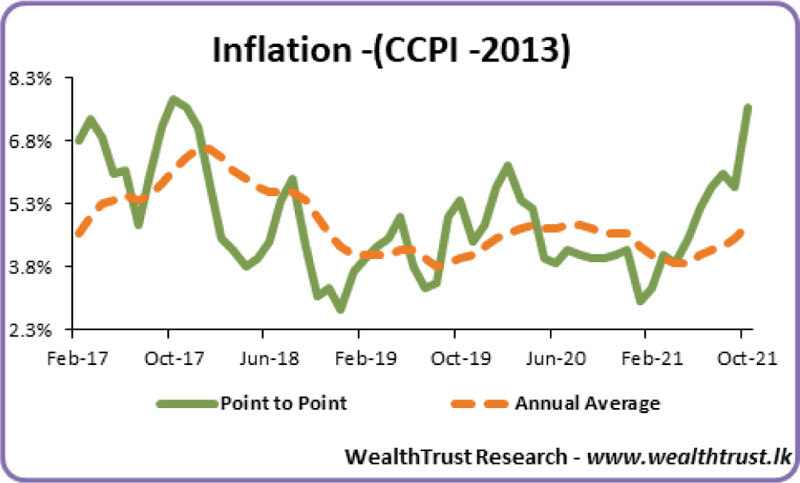

Meantime, the Colombo Consumer Price Index (CCPI) or inflation for the month of October increased considerably to a four year high of 7.6% on its point to point, when compared against its previous month’s figures of 5.7% while its annual average increased as well to 4.8% from 4.5%.

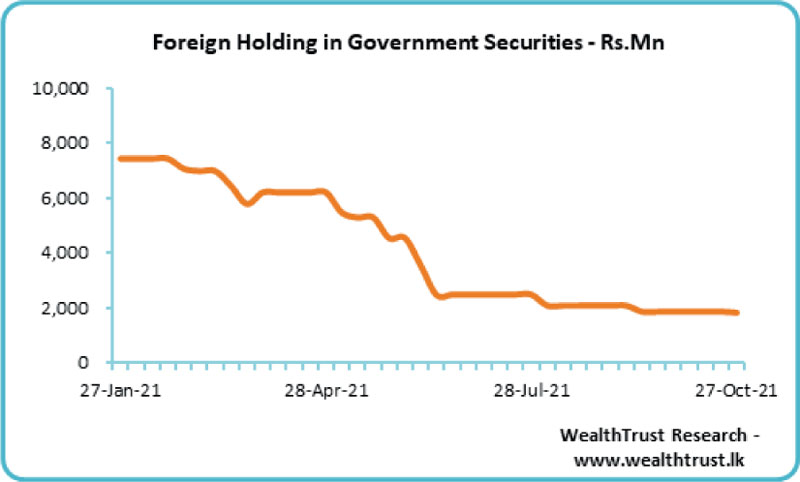

The foreign holding in rupee bonds decreased with an outflow of Rs. 39.46 million for the week ending 27 October and the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 14.74 billion.

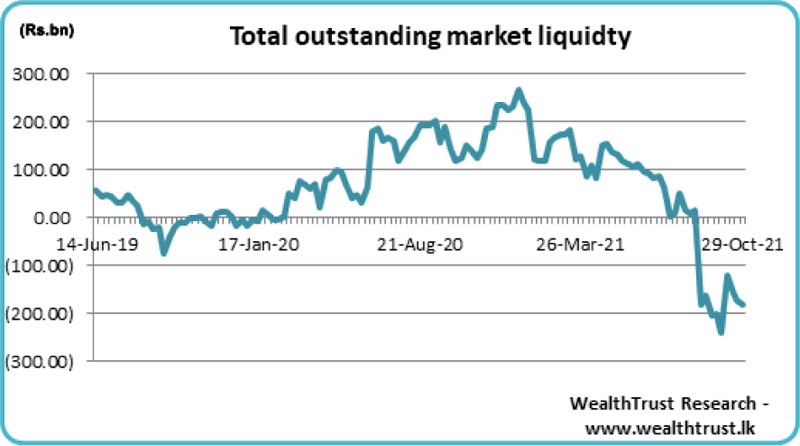

In money markets, the total outstanding liquidity shortage at the end of the week stood at Rs.183.95 billion against its previous weeks Rs. 171.84 billion while CBSL’s holding of Gov. Securities decreased marginally to Rs. 1,466.84 billion.

The Domestic Operations Department (DOD) of Central Bank drained out liquidity during the week by way of overnight to seven-day repo auctions at weighted average yields ranging from 5.98% to 5.99%. The weighted average rates on overnight call money and repo was 5.91% and 5.95% respectively for the week.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 202.97 to Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 35.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)