Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 20 June 2022 03:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The activity levels in the secondary bill and bond market reduced during the week ending 17 June as most market participants opted to be on the sidelines while yields increased.

The activity levels in the secondary bill and bond market reduced during the week ending 17 June as most market participants opted to be on the sidelines while yields increased.

On the back of limited activities, selling interest on the liquid maturities of 01.06.25, 01.05.27 and 15.01.28 saw its yields hit weekly highs of 20.50%, 20.15% and 20.75% respectively against its previous weeks closing levels of 19.90/20, 19.75/00 and 20.00/10. Secondary bill maturities of September 2022 and May 2023 also traded at highs of 21.00% and 22.27% respectively as well.

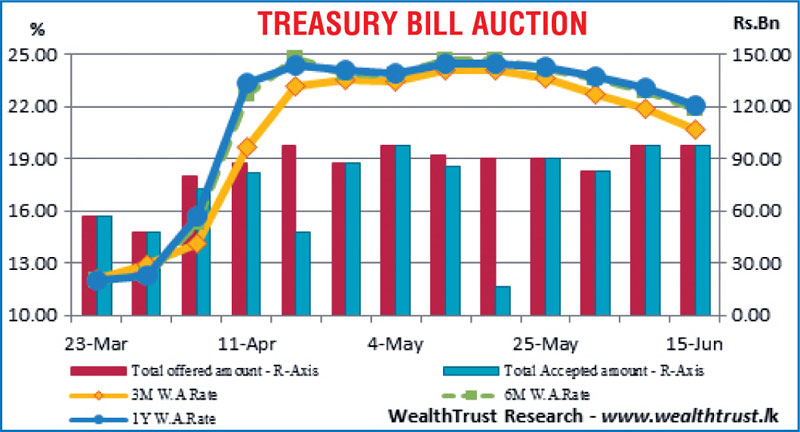

Nevertheless, the positive momentum at the weekly bill auction continued as weighted average rates decreased sharply for a fourth consecutive week. The market favourite 91-day bill registered the sharpest drop of 118 basis points to 20.73% closely followed by the 182-day and 364-day bills by 99 and 109 basis points respectively to 21.90% and 22.04%.

In addition, the Domestic Operations Department (DOD) of CBSL was seen conducting auctions for outright sales of Treasury bills on Thursday for durations ranging from 189 days to 259 days, totalling Rs. 25 billion. However, only an amount of Rs. 0.50 billion was sold on the 203 day maturity at a weighted average of 21.90%.

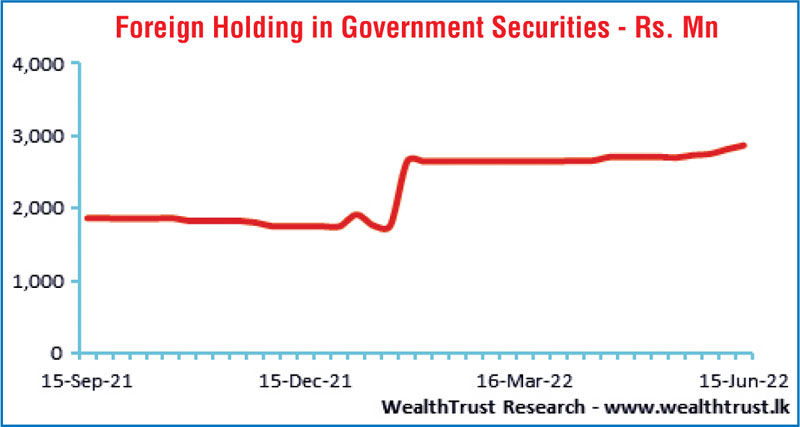

Foreign inflows to rupee bonds continued to trickle in for a fourth consecutive week to the tune of Rs. 54.46 million for the week ending 15 June 2022, accumulating a total inflow of Rs. 168.09 million over the past four weeks.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 28.89 billion.

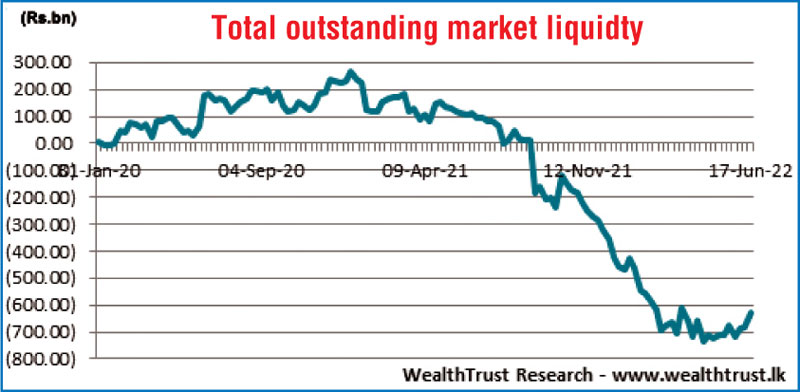

In money markets, the weighted average rates on call money and repo stood at 14.50% each for the week while the total outstanding liquidity deficit reduced to Rs. 629.00 billion by the end of the week against its previous weeks of Rs. 680.84 billion. The CBSL’s holding of Gov. Security’s increased to Rs. 2,045.94 billion against its previous weeks of Rs. 1,969.82 billion.

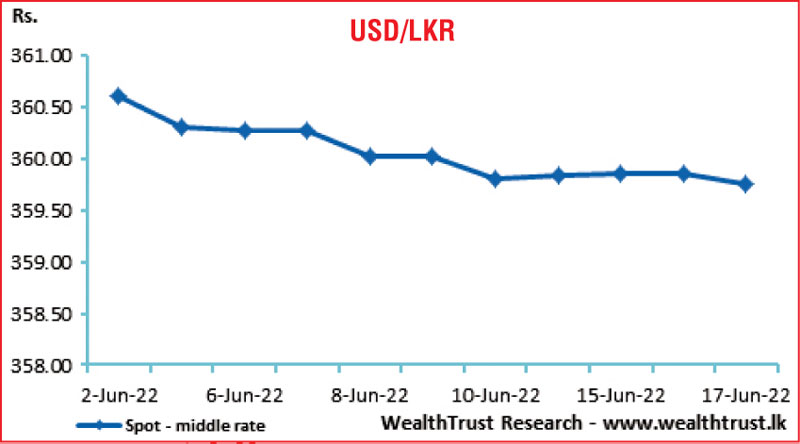

Rupee middle rate appreciates further

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally during the week to close the week at Rs. 359.75 against its previous weeks closing of Rs. 359.80.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 11.71 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)