Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 23 May 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

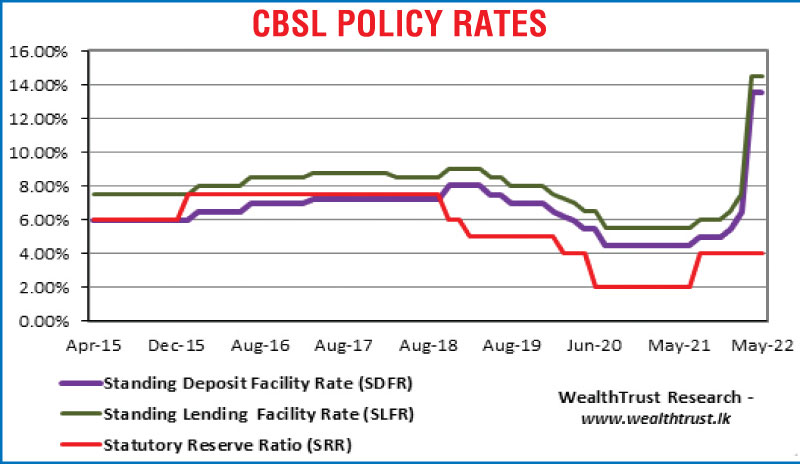

The secondary market bond yields fell while activity picked up towards the latter part of the week ending 20 May following the outcome of the monitory policy announcement at where the Central Bank of Sri Lanka was seen holding rates steady at 13.50% and 14.50% on its Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively.

The secondary market bond yields fell while activity picked up towards the latter part of the week ending 20 May following the outcome of the monitory policy announcement at where the Central Bank of Sri Lanka was seen holding rates steady at 13.50% and 14.50% on its Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR) respectively.

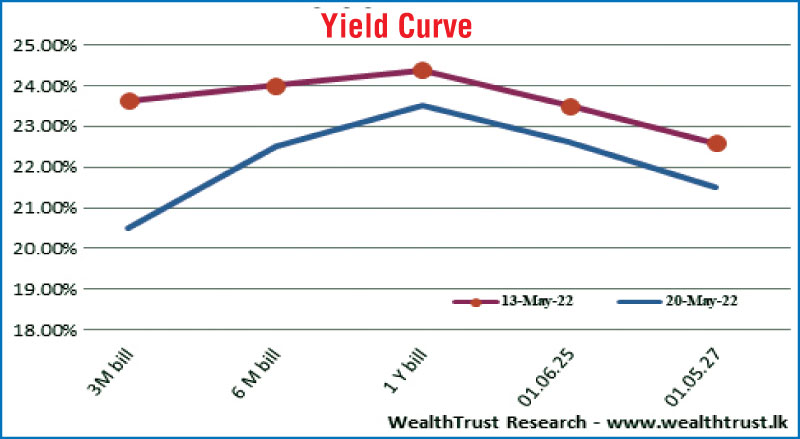

The demand for the three-year maturity of 01.06.2025 and the five-year maturity of 01.05.2027 saw its yields hit weekly lows of 22.75% and 21.50% respectively against its previous weeks’ lows of 23.25/75 and 22.25/90. In the secondary bill market, August 2022 maturities hit a low of 19.75% as well.

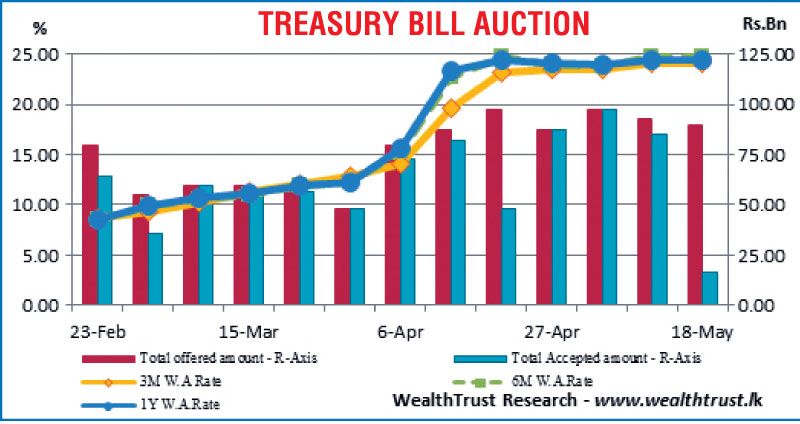

At the weekly Treasury bill auction, conducted a day prior to the monitory policy announcement, weighted averages on all three maturities held steady while the auction went undersubscribed with only a total volume of Rs. 16.47 billion accepted in successful bids against a total offered amount of Rs. 90 billion.

The foreign holding in rupee bonds decreased marginally to Rs. 2.70 billion for the week ending 18 May while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 6.68 billion.

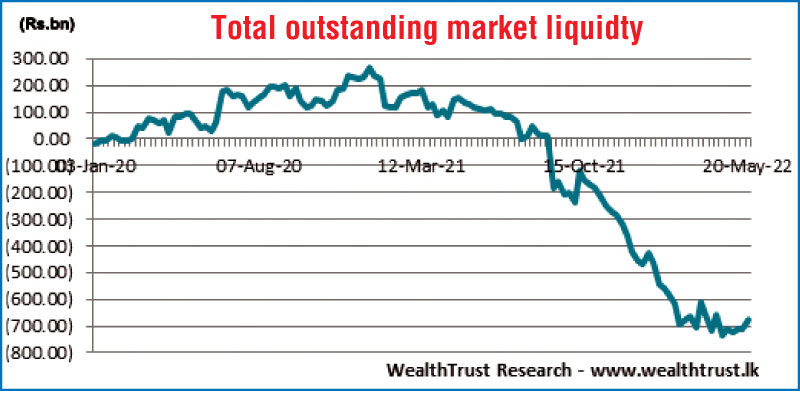

In money markets, the total outstanding liquidity deficit at the end of the week decreased to Rs. 676.38 billion against its previous weeks Rs. 711.56 billion while the Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of 40-day reverse repo auction at a weighted average yield of 22.60%. The weighted average rates on overnight call money and repo were 14.50% each for the week while CBSL’s holding of Gov. Securities increased to Rs. 1,974.13 against its previous weeks closing levels of Rs. 1,911 billion.

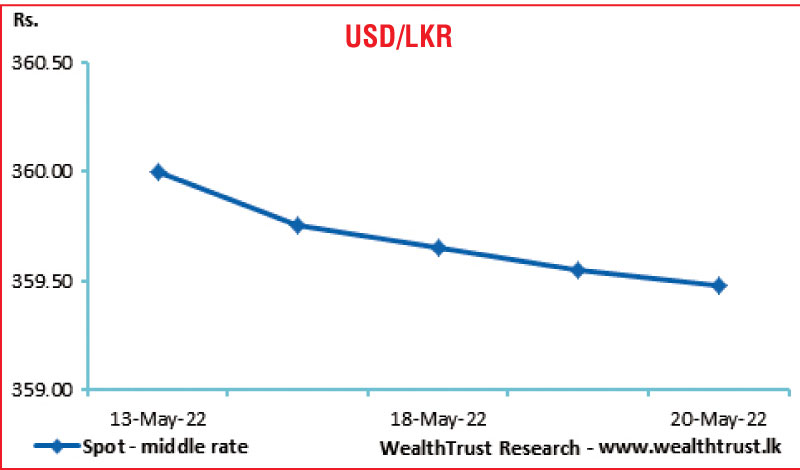

Rupee middle rate appreciates to Rs. 359.475

In the Forex market, the middle rate for USD/LKR spot contracts appreciated during the week to Rs. 359.475 against its previous weeks closing of Rs. 360.00.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 11.81 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)