Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 8 March 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Yesterday’s launch of the five and ten year sovereign dollar bond issue resulted in the secondary market bond yields decreasing across the yield curve.

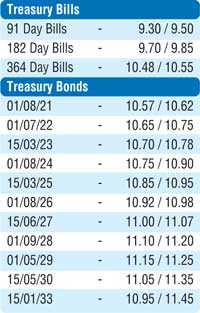

The liquid maturities consisting of the 2021s (i.e. 01.08.21 and 15.12.21), 15.03.23, 01.08.26, 2027s (i.e. 15.01.27 and 15.06.27) and 01.05.29 hit intraday lows of 10.60% each, 10.75%, 10.93%, 10.98%, 11.05% and 11.23% respectively, in comparison to the previous day’s closing levels of 10.72/78, 10.75/80, 10.90/95, 11.12/20, 11.17/22, 11.20/25 and 11.32/37. Furthermore, trades were also witnessed of the 15.10.21, 15.07.23 and 15.03.25 at levels of 10.65%, 10.70% to 10.92% and 11.05% to 11.13% respectively. In the secondary bill market, the latest 364 day maturity was seen trading at a low of 10.49%.

The total secondary market Treasury bond/bill transacted volumes for 6 March was Rs. 9.3 billion.

In the money market, the OMO Department of the Central Bank was seen infusing liquidity for durations of one and seven days, for amounts of Rs. 20 billion and Rs. 5 billion at a weighted average yield of 9 %, as the overnight net liquidity shortfall stood at Rs. 40.12 billion. The overnight call money and repo rates averaged 8.91% and 8.93% respectively.

Rupee loses marginally

The USD/LKR rate was seen depreciating marginally yesterday to close the day at Rs. 178.45/55 against its previous day’s closing level of Rs. 178.30/45 on the back of buying interest.

The total USD/LKR traded volume for the 6 March was $ 81.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 179.40/60; three months - 181.20/50 and six months - 184.20/50.