Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 5 March 2021 01:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka was seen holding its policy rates on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% at its monetary policy announcement yesterday.

The Central Bank of Sri Lanka was seen holding its policy rates on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% at its monetary policy announcement yesterday.

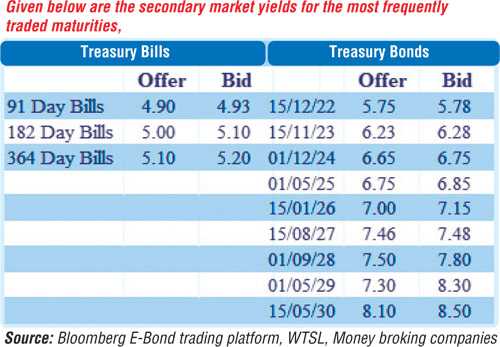

The activity in the secondary bond market moderated yesterday with yields increasing marginally, following the monetary policy announcement. Yields on the liquid maturities of 01.10.22, 01.09.23, 15.11.23 and 15.09.24 were seen hitting highs of 5.73%, 6.25%, 6.26% and 6.66% respectively, against its previous day’s closing levels of 5.65/73, 6.10/20, 6.18/22 and 6.60/65. In the secondary bill market, April 2021 and January 2020 maturities traded at levels of 4.65%-4.72% and 5.10%-5.13% respectively. The total secondary market Treasury bond/bill transacted volume for 3 March was Rs. 47.89 billion.

In the money market, weighted average rates on call money and repo was registered at 4.54% and 4.55% respectively, as the overnight surplus liquidity stood at Rs. 174.72 billion yesterday.

USD/LKR

In the Forex market, USD/LKR rate on the more active one-week forward contracts were seen closing the day at Rs. 196.00/197.00 against its previous day’s closing level of Rs. 196.50/197.00.

The total USD/LKR traded volume for 3 March was $ 43.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)