Sunday Mar 01, 2026

Sunday Mar 01, 2026

Wednesday, 6 September 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

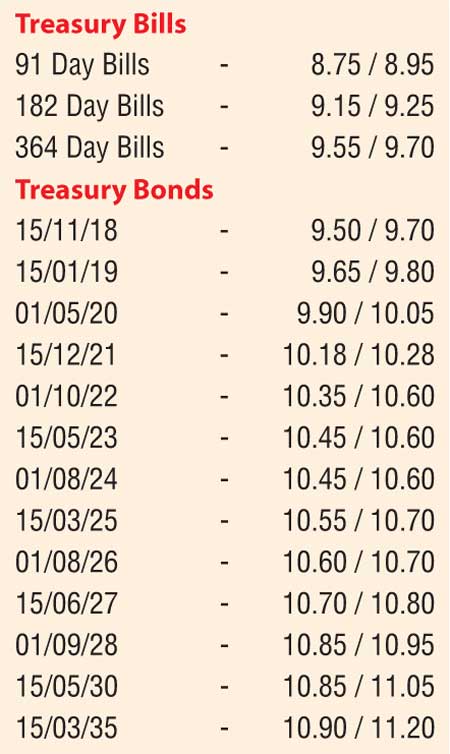

Activity in the secondary bond market dried up considerably on Monday, as a result of the two public holidays. Limited trades were witnessed of the 01.08.21 and 15.06.27 maturities at levels of 10.40% to 10.43% and 10.80% respectively.

Meanwhile, today’s weekly bill auction will have on offer a total amount of Rs. 18 billion, consisting of Rs. 10 billion of the 182 day and Rs.8 billion of the 364 day maturities. At last week’s auction, the weighted averages continued to increase for a third consecutive week with the 182 day and 364 day maturities reflecting increases of 03 and 02 basis points respectively to 9.30% and 9.67%.

The total secondary market Treasury bond/bill transacted volumes for 31 August was Rs.3.61 billion.

Meanwhile in money markets, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen mopping up excess liquidity by way of the outright sale of Treasury bills.

The auctions drained out an amount of Rs.3.75 billion for a period of 37 days at a weighted average of 8.53% while all bids received for the 44 day bill were rejected.

In addition it drained out a further amount of Rs.7.07 billion on an overnight basis at a weighted average of 7.29% as the net surplus liquidity in the system stood at Rs.34.39 billion. The overnight call money and repo rates averaged at 8.11% and 8.13% respectively.

In Forex markets, the spot rate was seen appreciating further yesterday to close the day at Rs.152.42/50 when compared against the previous day’s closing levels of Rs.152.65/75.

The total USD/LKR traded volume for 31 August was $ 35.34 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 153.10/20; three months – 154.75/85; six months – 157.10/20.