Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 13 April 2022 00:00 - - {{hitsCtrl.values.hits}}

The unprecedented challenges that arose in the post-COVID-19 era has continuously posed questions on the role and responsibilities of audit committees on a global scale. The demanding times such as this has increased the

|

| KPMG Sri Lanka Partner – Head of Audit/KPMG Audit Committee Forum Leader Suren Rajakarier |

|

| SLID Chairman Faizal Salieh |

expectations of Board Audit Committees (BACs) from the finance function. The evolving expectations from the finance function paves a way forward for the transformation of the finance function to benefit the Board of Directors (BODs) inclusive of the BACs.

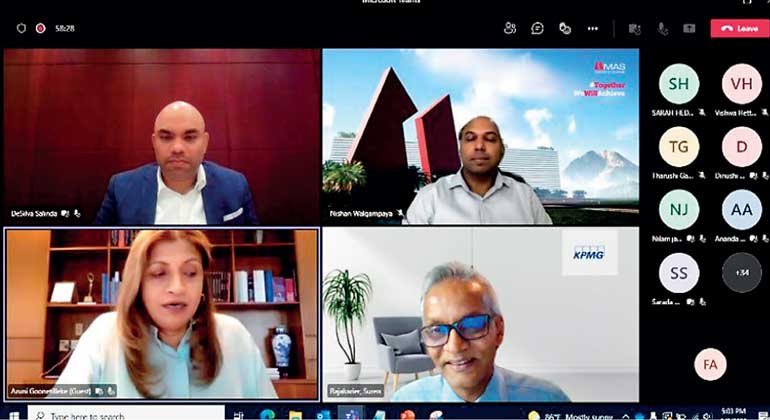

With the theme set on a future fit finance function to aid better oversight of the BACs, the panellists presented their ideas on different topics related to how a finance function should transform to be future fit. Panellists for the evening were Hatton National Bank PLC Chairperson Aruni Goonetilleke, McDonald’s Operations Asia Business Unit – Finance Head Salinda De Silva, MAS Holdings Group Director – Finance Operations Nishan Walgampaya, and the session was introduced and moderated by KPMG in Sri Lanka Partner – Head of Audit Suren Rajakarier.

The session commenced with Suren sharing his insights on the transformation of finance function to benefit the BACs. In his introduction, he highlighted some of the key areas of discussion for the session. Some of them were:

•Why should a finance function be future fit to assist BACs? And what are the expectations of the BACs from the finance function?

•Evaluation of the finance function for the benefit of BACs.

•Transformation of finance function to assist BODs and BACs.

•Transformation of finance function from a Business Support function to a Business Partnering function.

He emphasised on how the finance department needs to evolve from being descriptive to a more predictive and self-learning function, why data is important, but talent management is just as important, and finally why CFOs need to start thinking like venture capitalists whereas venture capitalists spend money on high growth potential businesses and processes.

Nishan shared his views on MAS Holdings’ ‘Journey to a Future Fit Finance Function’. As stated by Nishan, the journey consisted of three key pillars, namely: Long Term Strategy, People & Processes, and Technology. He also emphasised on the need to leverage untapped technologies as a long-term investment that finance functions need to commit to in order to enable a future fit transformation.

To conclude the presentation, Nishan shared the basic aims of being a future fit finance function. The key aims were to increase efficiency and cost effectiveness, become a better business partner, and maintaining integrity of financials and governance. In supporting this transformation, BAC should ask challenging questions on maintaining the integrity of financial reporting, understand the talent strategy, changes to the processes and controls, and consistently monitor progress of the transformation.

Salinda shared his views on what the McDonalds group was able to achieve by transforming their finance function. He said, to be forward looking as a finance function it is important to inculcate a growth mindset, clear vision in terms of financial risk and most significantly brand risk. These elements create a culture driven to transform in demanding times.

Ensuring that the company’s human capital is ready for the evolution through value-based training and development is critical for success he said and creating a culture of transparency, good governance, accountability and change anticipation are also fundamental in driving change.

Aruni provided the audience with her experience and expectations of the finance function from the financial services sector. Some of the key takeaways were:

•In navigating the current business complexities, the finance function should expand beyond the traditional scope of budgeting, financial review and regulatory reporting to facilitate strategic alignment across the enterprise.

•Boards and BAC expect CFOs to look beyond internal factors at external risks and competitive threats and provide input in formulating competitive strategies.

•With the increasing focus on digitalisation, finance functions have to play a key role in enabling a data driven culture and utilise modelling and analytical tools to provide real-time insights to the Board.

•CFOs should also ensure that non-financial performance indicators including socio-economic impacts and environmental footprints are measured, monitored and reported to the Board.

•The finance function should play the role of a collaborator, working with other functions in designing an optimal business model that generates sustainable returns to all stakeholders.

•Boards and BAC should ensure that the company adds new capabilities to the finance function, including data scientists and data analysts.

•ESG (Environmental, Social and Governance) factors should be considered in KPIS in order to ensure long-term sustainability of the corporate.

The final item of the agenda was the panel discussion and the key points discussed to improve governance were:

•The finance team should take measures to ensure the conciseness and the clarity of information that is presented to the BAC. Efforts are made to present information visually, graphically and in summarised form to increase understandability. Effective dashboards are recommended.

•Boards are reluctant to commit to the investment required to drive integrated automation. This has been a key challenge in banks, which typically operate several legacy systems. New investments are directed mainly towards customer-facing processes, while back-end systems remain outdated and not fit for purpose.

•To recommend new systems or a transformation process and to obtain approval, it is important to demonstrate the business case for such investments with customer-driven data and research.

•Insufficient time allocated to BACs to discuss key matters. It is important to frame the agenda based on value-adding discussions which should also be supplemented with regular reporting to the BAC.

•While the finance function has to evolve, a similar transformation should happen at BAC where Directors engage in the assessment of broader risks. Internal audit should also be risk-based, which in turn would provide a solid starting point for BAC to improve controls over financial reporting.

SLID has been at the forefront of corporate governance in Sri Lanka bringing together the largest community of Boardroom Leaders comprising of Directors representing the private and public sectors in Sri Lanka. The Institute is committed towards creating “Better Directors, Better Boards and Better Companies” through its ‘best in class’ Board Leadership training and wide range of Forums and Committees focused on key areas of corporate governance. In line with this commitment SLID has partnered with KPMG by way of a MOU to use KPMG’s Audit Committee Institute to build better audit committee governance in Sri Lanka.

KPMG’s Audit Committee Institute is committed to providing valuable insight via discussions with BACs in delivering practical experiences, resources, and exchange knowledge to continuously improve financial reporting and audit quality and is also focused on bringing about emerging technologies that need to be leveraged to overcome challenges in dynamic ecosystems. KPMG Sri Lanka facilitates the Audit Committee forum which seeks to bring together Audit Committee Members to discuss key issues and challenges in a way that is meaningful and relevant to them and helps them become more effective in their roles.