Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 9 July 2018 00:00 - - {{hitsCtrl.values.hits}}

The Securities and Exchange Commission (SEC) and the Colombo Stock Exchange (CSE) last week initiated a ground-breaking move to empower the country’s economic backbone, Small and Medium Enterprises (SMEs), launching an easy platform for listing and raise zero-cost capital.

The new SME Board is titled ‘Empower’, the CSE’s latest listing platform dedicated to the economic force which accounts for over 75% of the country’s enterprises providing 45% of employment and contributing 52% of the GDP.

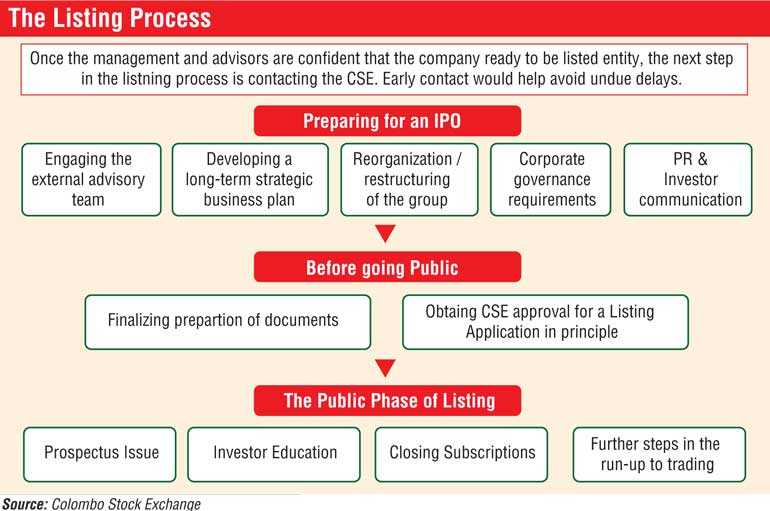

SEC and CSE said ‘Empower’ was for progressive SMEs seeking a range of new equity-based capital raising methods such as Initial Public Offerings (IPOs) and further share issues once listed. IPO oversubscriptions at the CSE in recent years indicate encouraging fundraising prospects for SMEs. The CSE’s initial and continuous listing requirements encourage good corporate governance practices and the basis for a positive business transformation. Additionally, SMEs will benefit from pre- and post-listing support.

The SEC and CSE maintain that technological progress, the expansion of trade and the evolution of global value chains is opening up new growth opportunities for SMEs in Sri Lanka. Sri Lankan SMEs are stepping up and are aiming to be globally competitive, dynamic, innovative and sustainable. If an SME is looking to step up, recognise that capital is a key growth enabler and that access to formal credit can at times be challenging. Via ‘Empower’, the CSE offers a new and compelling avenue for SMEs around Sri Lanka to access a deep pool of international and domestic capital.

The eligibility to list on the CSE ‘Empower’ Board is a stated capital of over Rs. 25 million and below Rs. 100 million at the time of listing. In the event of an IPO, the applicant entity shall have a Stated Capital of not less than Rs. 10 million as at the date of the Listing Application.

To qualify for listing, the SME should have an operating history of at least two years immediately preceding the date of application.

The SME’s total assets must be of or below Rs. 600 million as at the date of the Initial Listing Application.

SMEs should also have a Positive Net Assets as per the audited financial statements for the financial year immediately preceding the date of application. In the event the applicant entity is a parent entity, Positive Net Assets as per the consolidated audited financial statements for the financial year immediately preceding the date of application.

They also require an unmodified audit opinion for the financial year immediately preceding the date of the Initial Listing Application or an audit opinion which does not contain an emphasis of matter on “going concern” as set out in the Independent Auditor’s Report of audited financial statements contained in the annual report of the entity.

The cost of listing has been made attractive with the Initial Listing Fee of Rs. 75,000 and the Annual Listing Fee at 0.003% of the market capitalisation of the listed entity as at 31 December of the year immediately preceding. CSE may waive the annual listing fee payable by an entity listing on the Empower Board in respect of the year immediately after the initial listing. In terms of CDS Annual Clearance Fees, it is an annual payment at the rate of Rs. 15 per transaction (on the Automated Trading System), subject to a minimum of Rs. 25,000 and a maximum of Rs. 750,000 per annum.

The application to list Securities shall be made through a ‘Sponsor’ approved by the CSE or a party approved by the CSE as an individual or organisation with expertise in the area of listings on the stock exchange and corporate finance. The assistance of the sponsor will help SMEs obtain an optimum value for their business and make a strong investment case to local and international investors.

In addition to the sponsor, the listing process will also pave the way for SMEs to engage with a number of other credible capital market stakeholders.

The listing SMEs will have to comply with specific regulatory requirements, to be fulfilled periodically, provide an opportunity for the company to engage stakeholders with updates on the progress made since the listing and communicate success. They will be required to make a timely disclosure to the CSE of any information related to the company (or its shareholders) which is likely to affect the share price. Another is periodic reporting, including publishing an annual financial report within five months of the end of the relevant financial year as well as publishing interim financial statements semi-annually with the first two years of listing and on a quarterly basis subsequently.

Additionally, listed entities will also need to follow specific corporate governance practices published by the CSE including requirements related to nonexecutive directors, independent directors and the audit committees.

Speaking at the event, Finance and Media Minister Mangala Samaraweera welcomed the initiative that can could support the Government’s policy to promote SMEs.

“This is an important step in the empowerment of private enterprise in Sri Lanka, which is a key tenet of the Government’s economic program. The SME Board will be an important complement to the Enterprise Sri Lanka initiative which was launched recently at developing entrepreneurs and the SME sector of the country,” he said.

The SME Board will play a crucial role as Sri Lankan entrepreneurs graduate to the next step from a start-up economy to capital markets, the Minister said.

Samaraweera, advocating a move away from State-led development, said that the Government would support companies in their early stages.

“But eventually companies must evolve to stand on their own feet and grow into larger enterprises,” he said.

“I understand that the SME Board will provide the necessary flexibility to encourage the listing of small businesses and gradually expose them to the expectations of mature capital markets. The launch of the SME Board is indeed a crucial step in the evolution and development of Sri Lanka’s capital markets. It will also play a major role in expanding access to finance in Sri Lanka,” he said.

SEC Chairman Ranel T. Wijesinha urged banking and professional bodies to engage and assist entrepreneurs in the sector.

“We intend to bring together all these arms of this nation’s Charted Accountants, the banking community and the chambers to bring much more than value,” Wijesinha said.

“I am seeking a dividend on behalf of the Small and Medium Enterprises community of the country. We need to recognise and have our feet firmly planted in Sri Lanka. We cannot have the best of blue chips alone being provided with the best of advice from you. If I discounted 60% of my fees for SMEs when working overseas because it was the policy of my firm, I don’t see any reason the same cannot happen in Sri Lanka. That would be, in my mind, an inherent corporate social responsibility initiative,” he said, speaking at the Small and Medium Enterprise Board launch event.

Quoting from the strategy for industrialisation written in December 1989, advocating the first ever set of incentives for capital market development given by the Premadasa Government, Wijesinha said the need for incentives was still there.

“We have forgotten how these incentives propelled the market almost 29 years ago. Those incentives were realised only because they were presented with the purpose of empowering entrepreneurship and incentivising Small and Medium Enterprises, which 29 years ago we felt were needed and even today we feel there is a compelling need,” Wijesinha added.

- Pix by Shehan Gunasekara