Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 25 February 2021 01:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The four Treasury bond auctions conducted yesterday saw in total an amount of Rs. 90.95 billion been successfully accepted against its total offered amount of Rs. 125 billion with the offered amount of Rs. 30 billion on the 15.01.2026 maturity been fully subscribed at its phase 01 of the auction.

The four Treasury bond auctions conducted yesterday saw in total an amount of Rs. 90.95 billion been successfully accepted against its total offered amount of Rs. 125 billion with the offered amount of Rs. 30 billion on the 15.01.2026 maturity been fully subscribed at its phase 01 of the auction.

The said maturity recorded a weighted average rate of 7.07% against its maximum yield rate for acceptance of 7.10%. Nevertheless, the other three maturities were seen progressing to its 2nd phase of the auction while it recorded weighted average rates of 6.25%, 6.70% and 7.57% on the 15.11.2023, 15.09.2024 and 01.07.2028 maturities respectively against its maximum yield rates for acceptance of 6.25%, 6.70% and 7.60%.

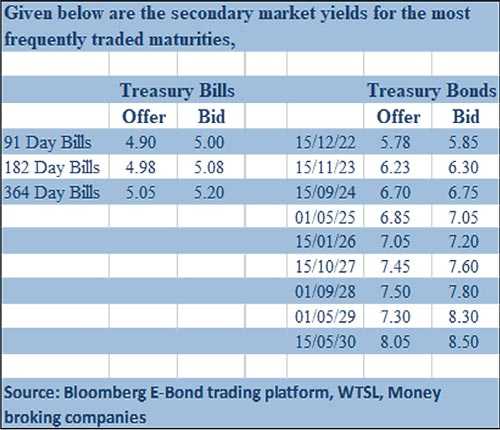

The secondary bond market witnessed continued selling interest during morning hours of trading leading to the auctions which saw yields on the 15.12.22, 15.01.23, 01.09.23, 15.12.23 and 15.09.24 hitting intraday highs of 5.85%, 5.90%, 6.35%, 6.45% and 6.78% respectively against its previous day’s closing levels of 5.80/90 each, 6.00/15 each and 6.68/75. Nevertheless, buying interest at these levels curtailed any further upward movement as yields closed the day marginally lower than its peaks once again. In addition, 15.12.21 maturity traded at level of 5.10% while 16 April 2021 bill changed hands at a level of 4.70% in the secondary bill market.

The total secondary market Treasury bond/bill transacted volumes for 23 February 2021 was Rs. 22.61 billion.

In the money market, overnight surplus liquidity stood at Rs. 155.16 billion yesterday while the weighted average rates on call money and repo was registered at 4.54% and 4.57% respectively.

USD/LKR

In Forex markets, the USD/LKR rate on spot contracts was seen trading at Rs. 194.25 before closing the day at Rs. 194.50/195.00 in comparison to its previous day’s closing level of Rs. 194.00/194.50.

The total USD/LKR traded volume for 23 February 2021 was $ 43.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)