Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 26 October 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

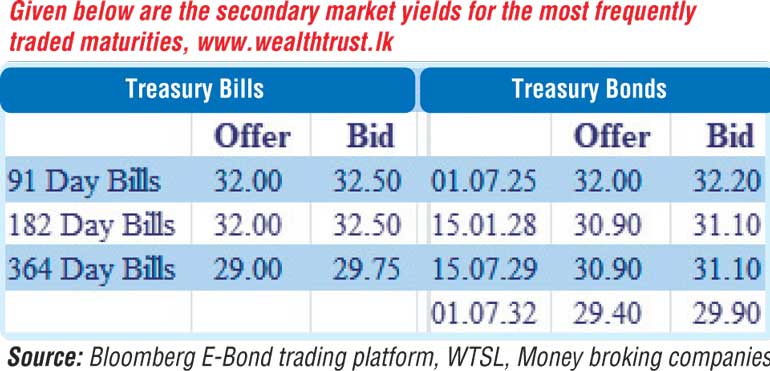

The secondary bond and bill market commenced the trading week on a dull note, ahead of the weekly Treasury bill auction, due today.

The secondary bond and bill market commenced the trading week on a dull note, ahead of the weekly Treasury bill auction, due today.

A total amount of Rs. 80 billion will be offered at today’s auction, consisting of Rs. 30 billion each on the 91-day and the 182-day maturities and a further Rs. 20 billion on the 364-day maturity.

The weighted average rates remained unchanged at last week’s auction, registering 33.05%, 32.53% and 29.60% respectively on the said maturities, with a total amount of Rs. 16.12 billion being accepted at the auction and a further amount of Rs. 25.68 billion on phase II.

The total secondary market Treasury bond/bill transacted volume for 21 October was Rs. 3.72 billion.

In money markets, the weighted average rates on Repo rate stood at 15.50% while an amount of Rs. 673.72 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 15.50%.

The net liquidity deficit stood at Rs. 353.09 billion yesterday as an amount of Rs. 320.63 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.38 yesterday.

The total USD/LKR traded volume for 21 October was $ 15.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)