Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 3 December 2020 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

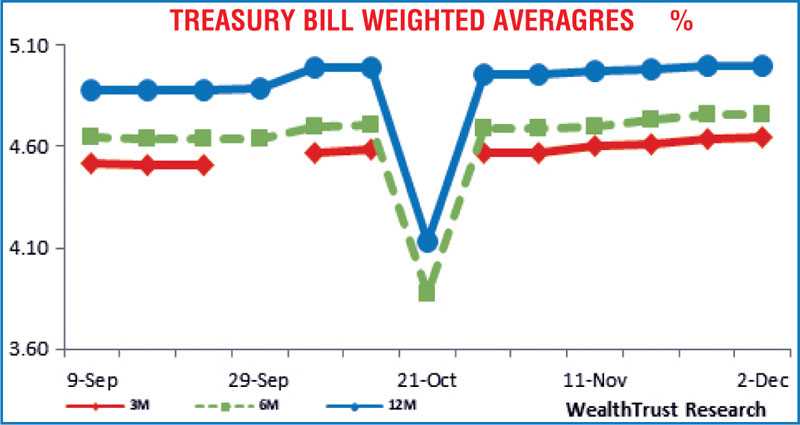

The total accepted amount at yesterday’s bill auction was Rs. 34.32 billion or 85.79% of its total offered amount of Rs. 40 billion. The weighted averages were recorded at its cut of rates of 4.65%, 4.76% and 5% respectively. The bids to offer ratio stood at 1.56:1.

The total accepted amount at yesterday’s bill auction was Rs. 34.32 billion or 85.79% of its total offered amount of Rs. 40 billion. The weighted averages were recorded at its cut of rates of 4.65%, 4.76% and 5% respectively. The bids to offer ratio stood at 1.56:1.

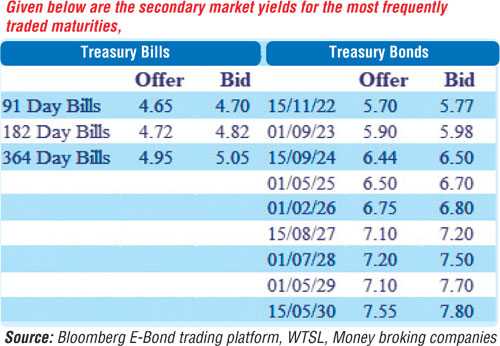

In the secondary bond market, activity was rather muted yesterday with limited trades witnessed on the maturities of 15.12.22, 2023’s (i.e. 15.01.23 & 01.09.23) and 15.10.27 at levels of 5.77%, 5.82%, 5.95% and 7.20% respectively. On the very short end of the curve, short dated bond maturities of 01.03.21 and 01.08.21 were seen changing hands at levels of 4.75% and 4.84% to 4.90% while February 2021 bills changes hands at 4.65%.

The total secondary market Treasury bond/bill transacted volumes for 1 December was Rs. 13.16 billion.

The overnight surplus liquidity continued to remain high at Rs. 237.04 billion yesterday while call money and repo remained steady to average 4.54% and 4.60% respectively.

Rupee continues to dip

In the absence of spot contracts, spot next contracts were seen closing the day lower at Rs. 186.60/00 in comparison to its previous day’s closing of Rs. 186.00/20 on the back of continued buying interest by banks.

The total USD/LKR traded volume for 1 December was $ 52.85 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)