Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 23 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

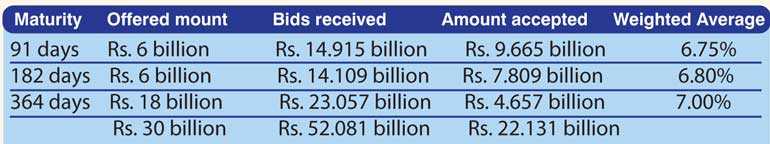

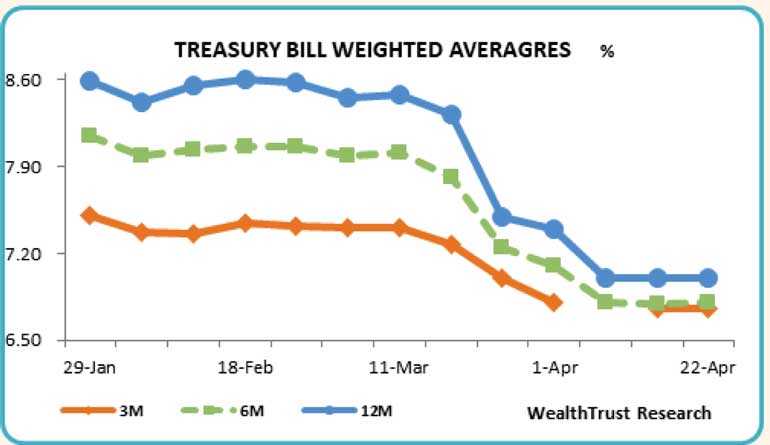

The weighted average yields on the 91-day and 364-day maturities remained steady at 6.75% and  7.00% respectively at its auctions yesterday with a total amount of Rs. 22.13 billion being accepted, increasing from its previous weeks accepted amount of Rs. 9.91 billion.

7.00% respectively at its auctions yesterday with a total amount of Rs. 22.13 billion being accepted, increasing from its previous weeks accepted amount of Rs. 9.91 billion.

Nevertheless, the weighted average yield on the 182-day bill increased by 01 basis point to 6.80%. The bids to offer ratio at the auction increased to 1.74:1.

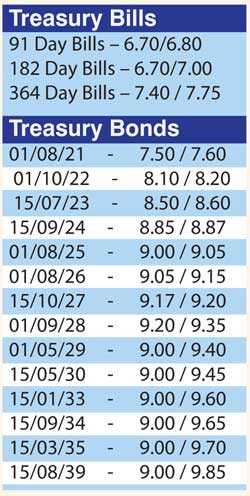

In the secondary bond market yesterday, yields were seen closing the day mostly unchanged once again on the back of limited trades, as overall activity moderated.

Trades were witnessed on the liquid maturities of 01.01.22, 01,09.23 and 15.09.24 at levels of 8.18%, 8.60% to 8.62% and 8.85% respectively against its previous day’s closing levels of 8.10/20, 8.58/65 and 8.84/88. In secondary bills, June, August and January 2021 maturities traded at levels of 6.92%, 7.00% and 7.30% to 7.35% respectively.

The total secondary market Treasury bond/bill transacted volume for 21 April was Rs. 5.07 billion.

In money markets, the weighted average rates on overnight call money and repo decreased marginally to 6.43% and 6.56% respectively as the overnight net liquidity surplus increased to Rs. 135.05 billion yesterday. Attempts to infuse liquidity by the Domestic Operations Department (DOD) of Central Bank for overnight and seven days were not successful as no bids were received.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at Rs. 192.40 yesterday.

The total USD/LKR traded volume for 21 April was $ 54.60 million.