Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 12 November 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Treasury bond auctions conducted yesterday recorded impressive outcomes as its weighted average rates were well below or similar to its pre-auction market rates while the total offered amount of Rs.40 billion was fully accepted at its 1st phase of the auctions.

The 15.03.2024 maturity recorded a weighted average rate of 9.16% against a pre-auction rate of 9.30/60 on a 01.12.24 maturity. The 15.03.2031 fetched a weighted average rate of 11.91% against a closing rate of 11.70/75 on a 15.05.30 maturity. The bids to offer ratio stood at 2.45:1.

An Issuance window of 20% of the offered amount on each maturity was opened until close of business of the day prior to settlement (i.e. 4 p.m. on 12.11.2021).

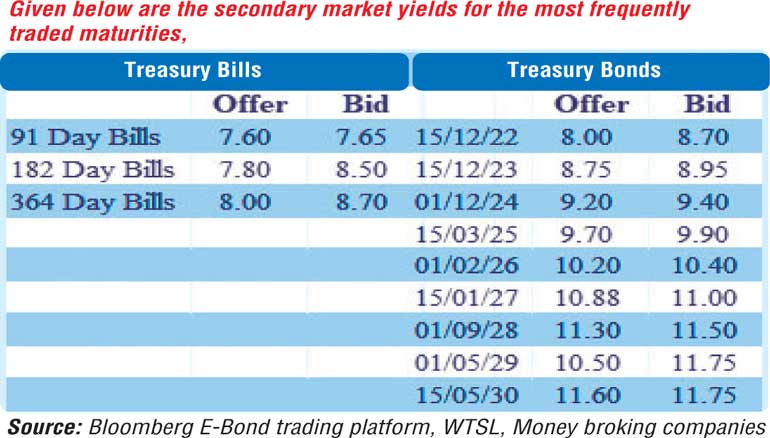

The secondary bond market yields declined further yesterday, mainly following the auction outcomes as the liquid maturity of 15.01.27 hit an intraday low of 10.90% against its previous day’s closing levels of 10.97/03. In secondary bills, the 21st January 2022 maturity traded at a low of 7.50%. The total secondary market Treasury bond/bill transacted volume for 10 November was Rs. 46.15 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out amounts of Rs. 50.00 billion and Rs. 5.00 billion by way of overnight and 6 day repo auctions at weighted average rates of 5.97% and 5.99% respectively. It further drained out an amount of Rs. 3.00 billion by way of a 14 day repo auction at a weighted average rate of 6.04%, valued today.

The net liquidity deficit increased to Rs. 200.09 billion yesterday as an amount of Rs. 66.98 billion was deposited at Central Banks Standard Deposit Facility Rate (SDFR) of 5.00% against an amount of Rs. 322.07 billion withdrawn from Central Banks Standard Deposit Facility Rate (SLFR) of 6.00%. The weighted average rates on overnight Call money and REPO remained steady at 5.93% and 5.94% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at level of Rs. 203 while the overall market remained inactive yesterday.

The total USD/LKR traded volume for 10 November was $ 59.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)