Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 13 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

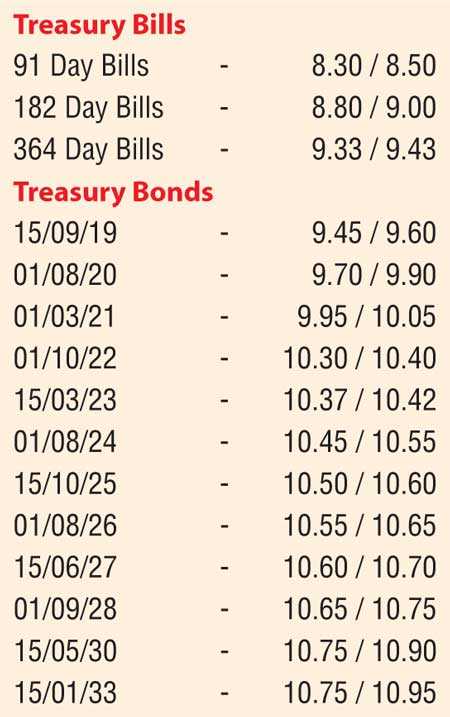

The two Treasury bond auctions conducted yesterday recorded impressive weighted averages with the total offered amount of Rs. 80.00 billion being successfully subscribed.

The seven-year and three-month maturity of 15.10.2025 recorded a weighted average of 10.53% while the 14 years and six-month maturity of 15.01.33 recorded a weighted average of 10.88%.

Activity in the secondary bond market picked up yesterday as yields eased marginally, mainly on the 15.03.23 maturity to an intraday low of 10.38%.

In addition, on the short end of the curve, the maturities of 01.07.19 and 15.09.19 changed hands within the range of 9.45% to 9.55% respectively while on Treasury bills, February and April 2019 maturities changed hands at levels of 9.10% and 9.25% respectively.

The total volume of Treasury bonds/bills transacted in the secondary market on 11 July 2018 was Rs. 3.8 billion.

In money markets, the overnight call money and repo rates averaged 8.48% and 8.35% respectively as the OMO Department of Sri Lanka injected an amount of Rs. 15.00 billion on an overnight basis by way of a reverse repo auction at a weighted average of 8.46%. The net liquidity shortage stood at Rs. 17.83 billion yesterday.

Rupee depreciates marginally

The rupee on spot contracts was seen depreciating once again to close the day at Rs. 159.35/50 against its previous day’s closing levels of Rs. 159.25/35 on the back of renewed importer demand.

The total USD/LKR traded volume for 11 July 2018 was $ 54.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 160.20/40; three months - 161.85/15 and six months - 164.25/55.