Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 26 January 2023 01:49 - - {{hitsCtrl.values.hits}}

Following is a review of the insurance industry performance in the third quarter of 2022 and from 2017 to 2021 done by the industry regulator Insurance Regulatory Commission of Sri Lanka.

Gross Written Premium

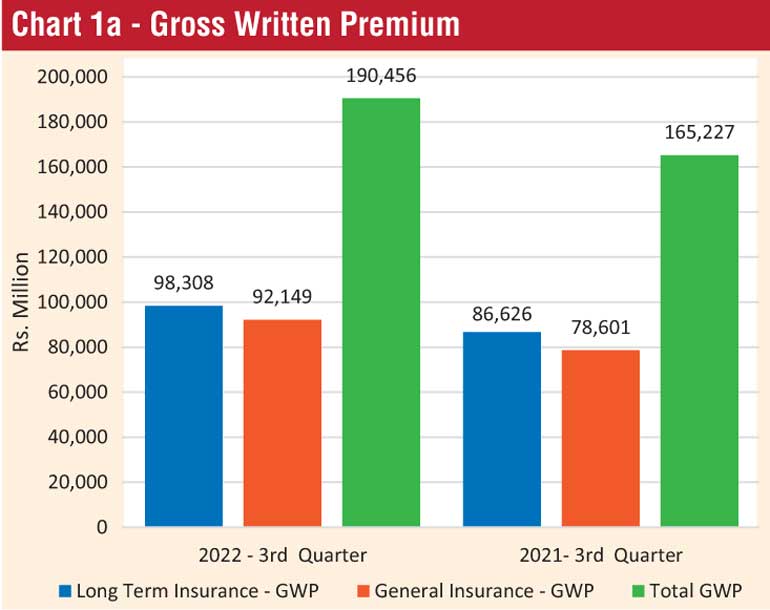

The total Gross Written Premium (GWP) of the insurance industry for long term and general insurance businesses for the period ended 30 September 2022 was Rs. 190,456 million (Q3, 2021: Rs. 165,227 million), recoding a growth of 15.27%, and a premium increase of Rs. 25,229 million when compared to the same period in the year 2021. The GWP of long-term insurance business was Rs. 98,308 million (Q3, 2021: Rs. 86,626 million) recording a growth of 13.49%. The GWP of general insurance business was Rs. 92,149 million (Q3, 2021: Rs. 78,601 million) recording a growth of 17.24%.

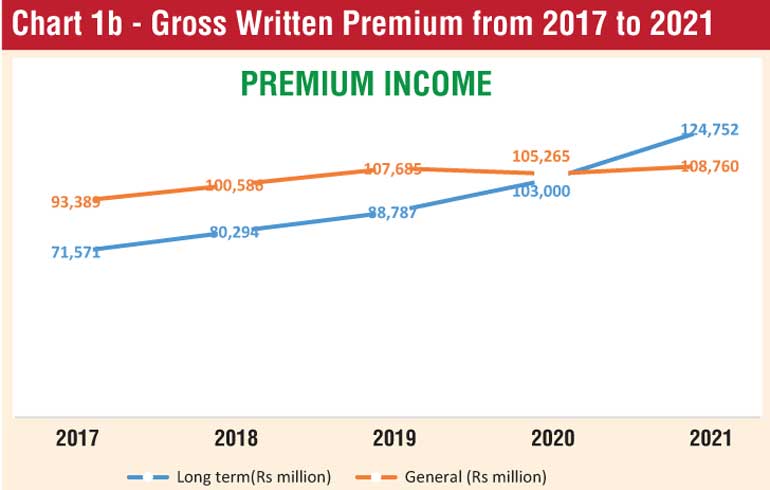

The Chart 1b depicts the performance of the insurance industry over the last five years from 2017 to 2021. The GWP of the industry had increased to Rs. 233,512 million in year 2021 when compared to Rs. 164,960 million recorded in 2017 and displayed a growth of 41.55%.

The growth in GWP of long-term insurance business has been steady over the last five years, with over 10% growth in each year. The GWP of general insurance business witnessed premium growth of 17.34%, 7.71% and 7.06% in 2017, 2018 and 2019 respectively. However, the general insurance business exhibited a negative premium growth of 2.25% in 2020. In contrast, the long-term insurance business displayed a positive momentum in 2020 and increased by 16.01% as the outbreak of the pandemic heightened the risk awareness of the public and enhanced the need for life protection. The general insurance business rebounded in 2021 and achieved a moderate growth of 3.32%.

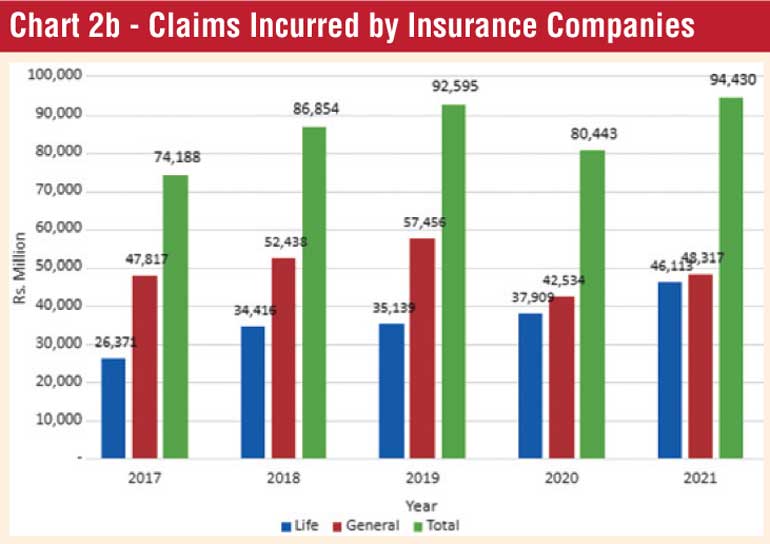

Claims incurred by insurance companies

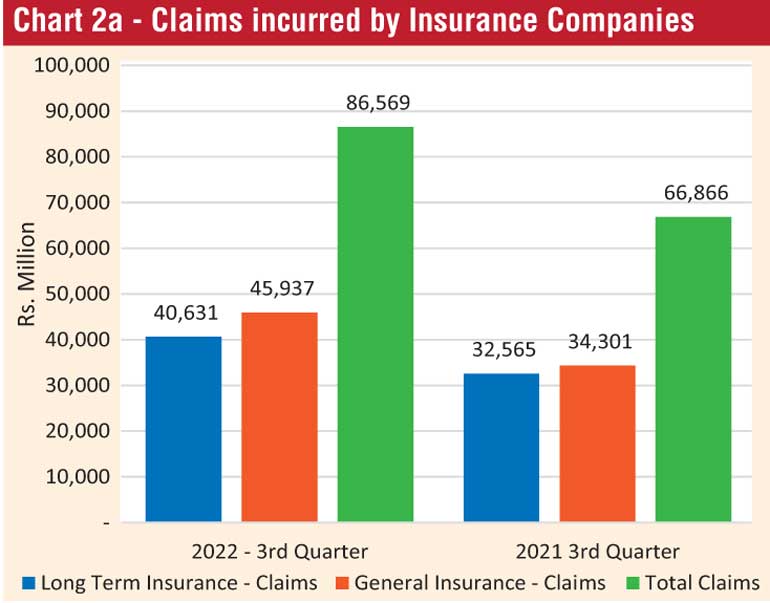

Claims incurred by insurance companies during the 3rd quarter of 2022 in both long-term and general insurance business was Rs. 86,569 million (Q3, 2021: Rs. 66,866 million) showing a significant increase of 29.47% year-on-year. The long-term insurance claims, including maturity and death claims, amounted to Rs. 40,631 million (Q3, 2021: Rs. 32,565 million) showing a growth rate of 24.77%. The claims incurred in general insurance business, including motor, fire, marine and other categories, amounted to Rs. 45,937 million (Q3, 2021: Rs. 34,301 million) with a growth rate of 33.92%.

Net claims incurred by Insurance companies over the last five years from 2017 to 2021 are illustrated in Chart 2b.

The total net claims incurred by the long-term insurance sector amounted to Rs. 46,113 million in 2021 when compared to Rs. 26,371 million recorded in 2017. The total claims incurred by life insurers continued to grow over the last five years. Claims incurred to policyholders by the long-term insurers can be categorised into disability benefits, death, surrenders, maturity benefits and other benefits.

The net claims incurred by the general insurance sector increased by 20.16% from 2017 to 2019. However, year 2020 recorded the lowest claims incurred value for the past five years with a drop of 25.97%. Major factors behind this noticeable slump of net incurred claims were mobility restrictions imposed during the first and second waves of COVID-19 which directly reduced the motor claims and sharp decline in travel and tourism industries in the wake of the pandemic. However, the total net claims incurred by the general insurance sector increased to Rs. 48,317 million excluding SRCC & T in 2021, showing an increase of 13.60% compared to Rs. 42,534 million in 2020.

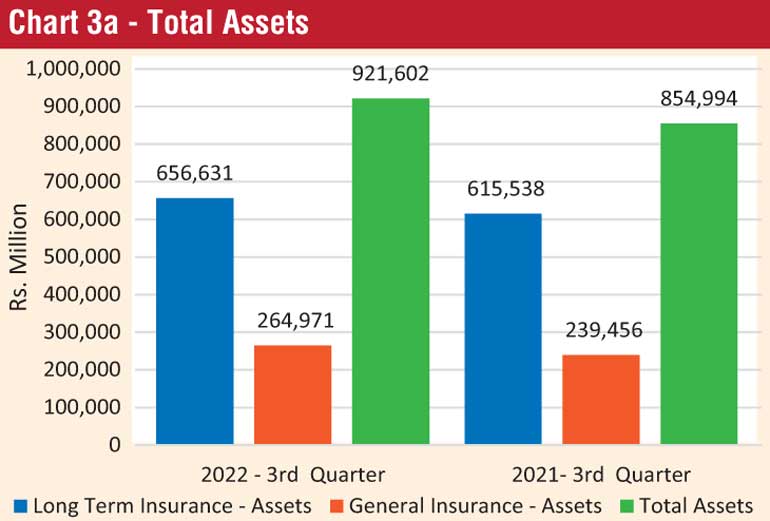

Total assets

The value of total assets of insurance companies has increased to Rs. 921,602 million as of 30 September 2022, when compared to Rs. 854,994 million recorded as at end of 30 September 2021 reflecting a growth of 7.79%. The assets of the long-term insurance business amounted to Rs. 656,631 million (Q3, 2021: Rs. 615,538 million) indicating a growth rate of 6.68%. The assets of the general insurance business amounted to Rs. 264,971 million (Q3, 2021: Rs. 239,456 million) depicting a growth rate of 10.66% at the end of 3rd quarter 2022.

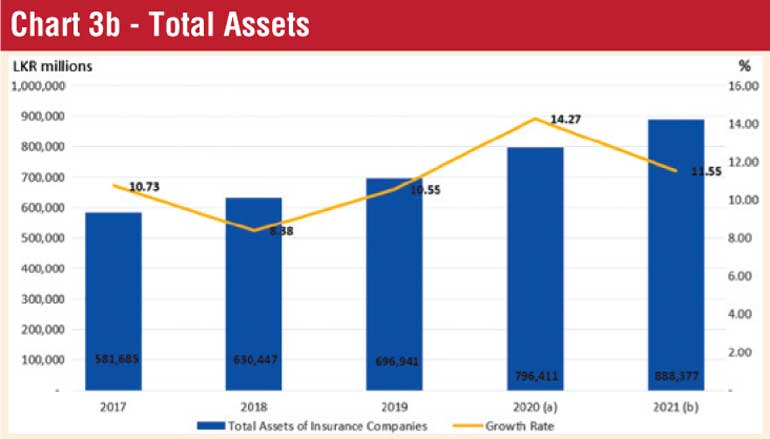

Chart 3b illustrates, the total asset portfolio of the insurance industry over the last five years from 2017 to 2021. The total asset portfolio of the insurance industry reached Rs. 888,377 million by the end of 2021, displaying growth over 10% each year over the last five years. An increase in the overall asset base was mainly attributable to expansion in the business volumes and resultant elevation in liability reserves.

However, the rate of growth has slowed in 2021 due to increased dividend distributions by insurers during the year after lifting dividend restrictions imposed in 2020 and the resultant usage of assets to fund such distributions made a notable impact on the asset growth of the industry.

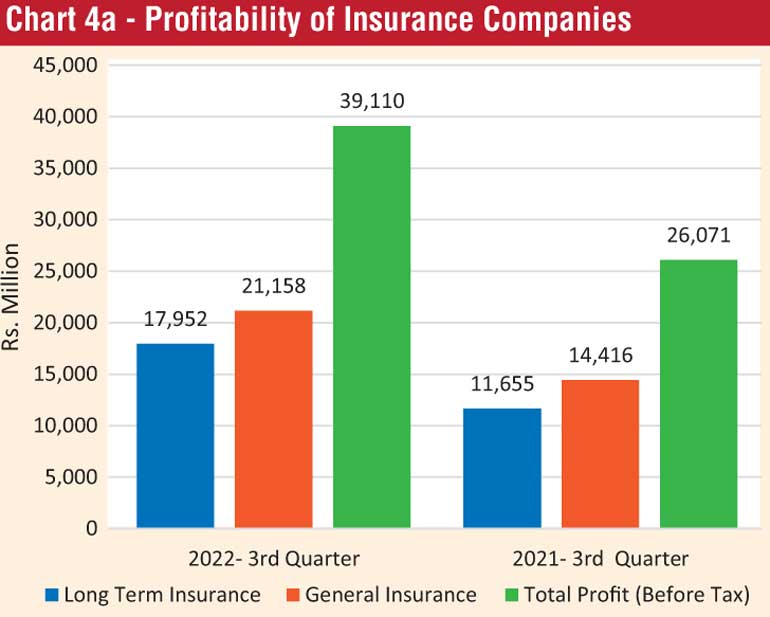

Profit (before tax) of insurance companies

The profit (before tax) of insurance companies as at end of 3rd quarter 2022 in both long term insurance business and general insurance business amounted to Rs. 39,110 million (Q3, 2021: Rs. 26,071 million) showing an increase in total profit by 50.01%. The profit (before tax) of the long-term insurance business amounted to Rs. 17,952 million (Q3, 2021: Rs. 11,655 million) while the profit (before tax) of the general insurance business amounted to Rs. 21,158 million (Q3, 2021: Rs. 14,416 million). Thus, profit (before tax) of the long-term insurance business and general insurance business have increased by 54.02% and 46.77% respectively.

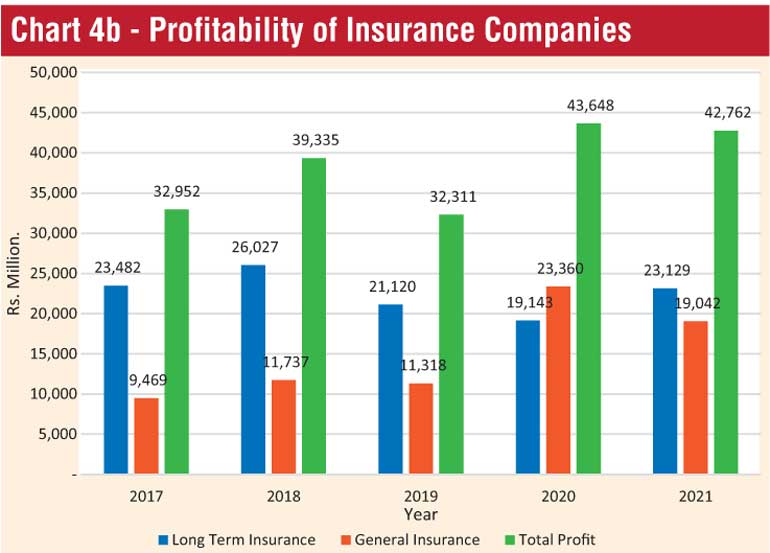

The profitability of the insurance industry over the last five years, from 2017 to 2021 is illustrated in Chart 4b. The highest recorded profitability was in 2017, while the lowest was in 2019. Unfavourable economic conditions prevailed in the country, coupled with negative effects created by Easter Sunday attacks challenged the performance of the insurance industry during the year 2019. During 2020, the insurance industry displayed a significant financial performance by posting a year-on-year profit growth of 35.08%. Contrast to previous years, the contribution of general insurers to overall profitability exceeded the long-term insurers in 2020. The profits of the long-term insurance business contracted by 9.36% in 2020 as a result of decreased surplus transfers and enlarged claim provisions of major long-term insurers.

In terms of performance, the long-term insurance business rebounded strongly during 2021, and achieved a profitability growth of 20.82%. In overall, the strong growth in GWP, favourable net investment income generated during the year and stringent cost optimisation and containment measures adopted by many long-term insurers were primary contributors to the uplift in profitability in 2021.

Number of insurance companies

As of 30 September 2022, 28 insurers were registered with the insurance regulatory commission of Sri Lanka. Two of them were composite companies transacting both long term insurance and general insurance business, whilst 14 of them engaged in long term insurance business and 12 companies engaged only in general insurance business.

Insurance brokers

77 insurance brokering companies were registered with the Commission as of 30 September 2022. Total assets of insurance brokering companies have increased to Rs. 8,425 million as at the end of 3rd quarter of 2022, compared to Rs. 7,701 million recorded as at the 3rd quarter of 2021, indicating a growth of 9.41%.

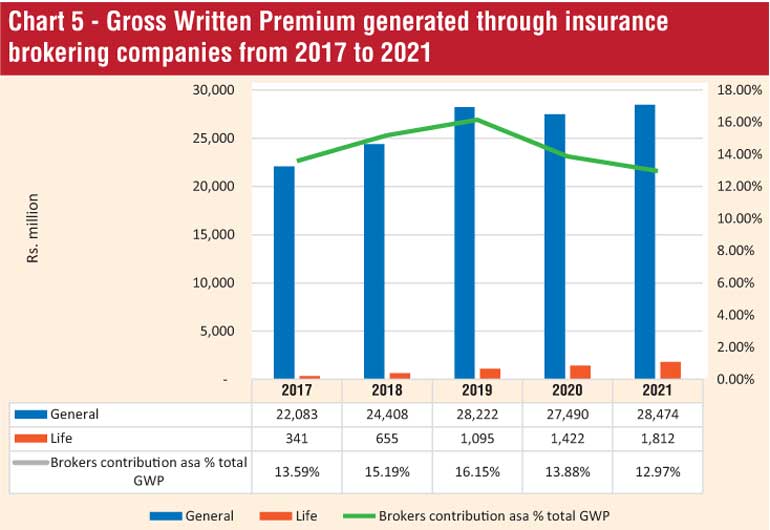

The Chart 5 depicts the GWP generated through insurance brokering companies over the last five years from 2017 to 2021.

The GWP generated through insurance brokering companies has increased over the last five years, displaying over 12% contribution each year from 2017 to 2021.

Notes