Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 20 March 2018 00:00 - - {{hitsCtrl.values.hits}}

1. The concept of retirement planning

Retirement planning is the process of identifying one’s retirement income needs and managing a savings/investment program that could eventually support such retirement income needs. The ultimate objective of retirement planning is to reach financial independence where one does not need to rely on work or others for his/her financial needs.

2. The importance of retirement planning in Sri Lankan context

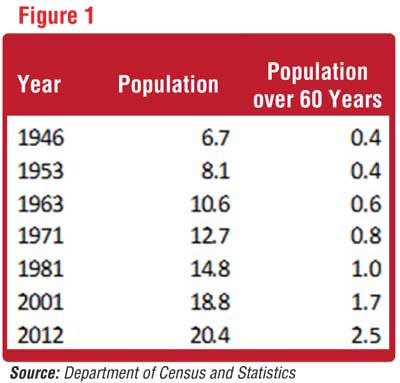

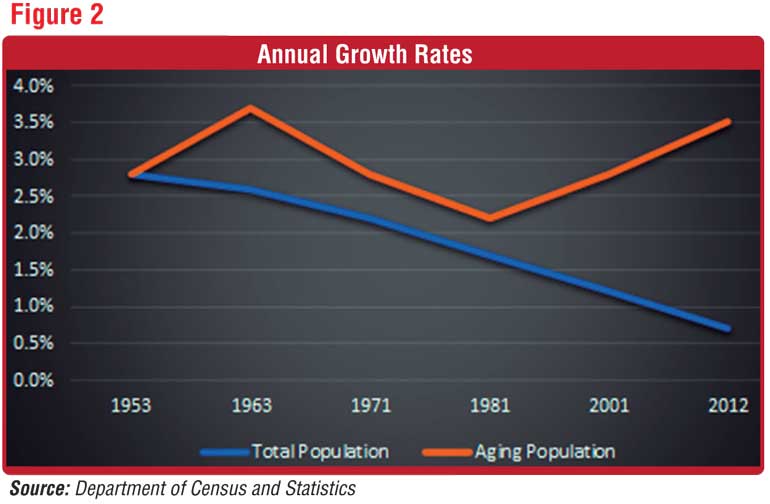

Retirement planning is becoming an extremely important (but neglected) concept for Sri Lanka given the aging population and social and cultural changes taking place in the society. The data related to the general population and the aging population is tabulated in the figures 1 and 2 below.

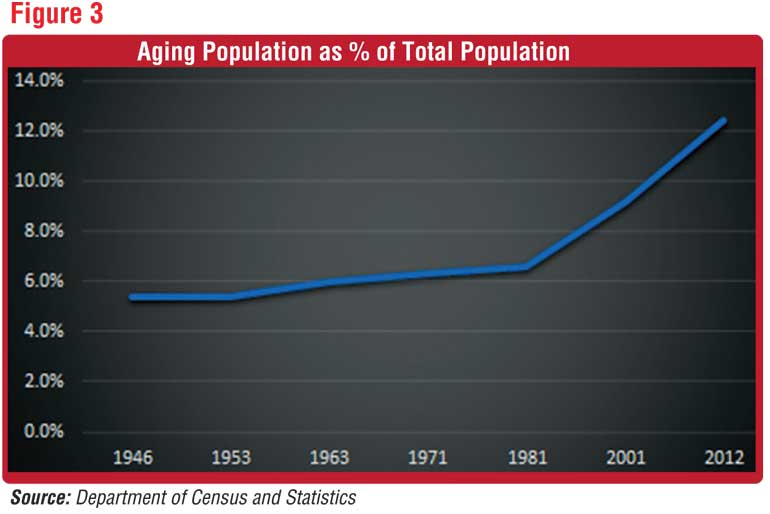

The Sri Lankan population has increased by 222% from 1946 to 2012 while the aging population recorded an increase of 638% from 0.4 million to 1.7 million during the same period. This disproportionate increase in the aging population has nearly doubled the proportion of aging population to 12.4% by 2012 from 6.6% in 1981 as indicated in the figure 3.

What is alarming being the fact that the growth of the total population is at a decelerating pace while the aging population is growing at a rapid pace that would further increase the proportion of aging population in the country. According to some estimates, nearly 25% of the total population would consist of aging population category by 2052. This means, every 1 out of 4 people in the country by 2052 would be considered as “aged” who would soon need the support (including financial support) of rest of the society in the absence of a well-managed retirement planning practices in the country.

This issue would get further complicated due to changing social and cultural developments in the society where we move away from extended family structure to nuclear families which makes elderly population financially (and otherwise too) more vulnerable at their retirement, which is exacerbated by improving life expectancy.

3. The retirement planning process

The retirement planning process is briefly outlined below.

a) Work out the required retirement fund

The starting point of the retirement planning process is estimation of the required fund at retirement which can self-sustain the post retirement life. The key factors that needs to be considered in determining the retirement fund include the intended retirement age, health condition, life expectancy, estimated post retirement monthly expenses and post retirement financial commitments (if any).

b) Estimate funds available

for investment

The next step is to estimate the funds available for investment from now till retirement taking into account future income, expenses, financial commitments/liabilities, savings, assets/investments available for disposal, etc. In addition, expected future inflation needs to be factored. This step would lead to projecting periodic (say monthly or annually) cash flows from now till retirement and arriving at investable cash.

c) Structure the investment plan

Based on the outcome of the above two steps, the investment plan can be devised taking into account the investment horizon (time till retirement), risk tolerance and timing of cash available for investments. One important aspect in this exercise is the determination of the asset allocation which involves allocating funds to different investment options. The probable investment options include fixed deposits, listed shares, government securities and corporate debt securities. One may even include alternative investments such as real estate, gold (precious metal) and private equity depending on the risk appetite and the length of the investment horizon. Each such investment option carries different level of risk and hence different return potential. It is important that the investment portfolio has adequate level of diversification to minimise the investment risk.

In determining the asset allocation and investment strategy, another important consideration is tax implications of different investment options. A tax efficient investment strategy would help to achieve a higher retirement fund.

Retirement planning is an iterative process, where one need to repeat the steps a, b and c until the desired retirement fund can be achieved.

d) Periodically review

First three steps are based on various estimates and assumptions of future income, expenses, retirement income needs, health condition, risk tolerance and investment returns. Therefore, the entire process needs to be reviewed at regular intervals to ensure that the investment portfolio is on right track to reach the desired level at retirement. For example, in case of deteriorating health, one may need a higher retirement fund than originally anticipated which requires rebalancing of the investment portfolio.

4. A few important tips

a) Start early

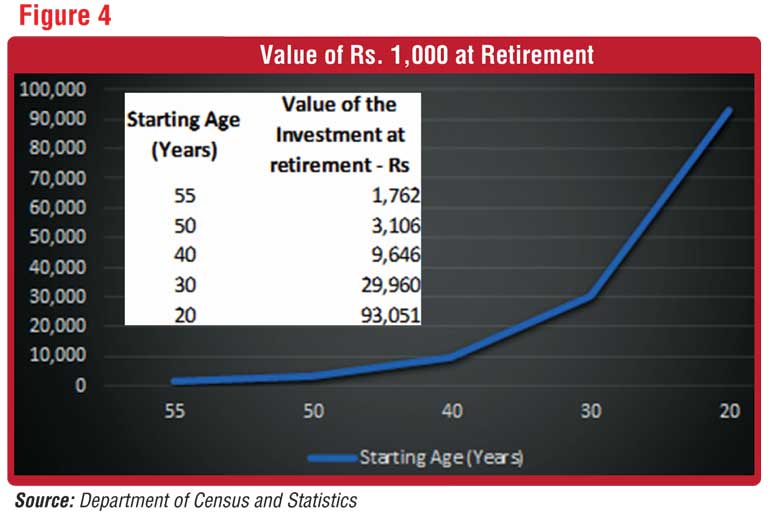

It is important that one starts investing for retirement early in his/her life. This helps to get the benefit of “compounding effect” of interest. The following diagram and the table depict the value of Rs. 1,000 invested till retirement at the different ages of a person (assuming an interest rate of 12% p.a. and retirement at the age of 60).

As the above graph and the table demonstrate, the value of Rs. 1,000 at retirement increases exponentially with the time. Earlier you start investing, longer the investment period and higher the value of investment at retirement. In the above example, a person who invests Rs. 1,000 at the age of 20 years will have Rs. 93,051 at retirement as opposed to Rs. 29,960 by a person who made the investment 10 years later at the age of 30. Therefore, starting investing early for retirement is important no matter how small the investment amount may be.

b) Be disciplined

Another important aspect to achieve one’s retirement goals is disciplined investment approach. This means, keeping to one’s periodic investment commitments. For example, one may need to set aside monthly Rs. 10,000 over the next 10-20 years to build up the retirement fund. One needs to have the discipline to keep such commitment throughout the investment period despite difficulties that may arise at times.

c) Get professional help and advice

Retirement planning requires a fair amount of technical knowledge related to finance. Further, a good retirement plan has to be tax efficient. Hence, it would be useful to get the assistance of a qualified investment professional or a wealth manager in structuring and periodically reviewing a retirement plan.

d) Pay down your debts

It will give a good psychological comfort to stay debt free post retirement. Therefore, paying off all debts is important prior to reaching retirement.

e) Build contingencies

It would be prudent to build some contingencies in retirement planning for any unforeseen expenses or financial commitments.

f) Make use of pension plans

Insurance companies, investment managers and banks offer various pension plans which pay regular monthly payments after the retirement. This is a convenient option for retirement planning which can also be combined with other investment options in your investment portfolio.

5. Final thoughts

Sri Lankan population is undergoing a dramatic change in its composition. The proportion of aging population is estimated to reach 25% by 2052. This requires enhanced awareness creation and focus on retirement planning to avoid a major social issue in a few decades.

The retirement planning is a scientific process. It involves building an investment portfolio that would reach the desired level at retirement. Such retirement fund would self sustain to cover the expenses of a person after the retirement without any income or external financial support. It is advisable to start the retirement planning early.

(The writer is a CFA Charterholder with over two decades of experience in corporate finance and investment management and can be reached via [email protected] for any comments on the article.)