Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 15 November 2021 00:52 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

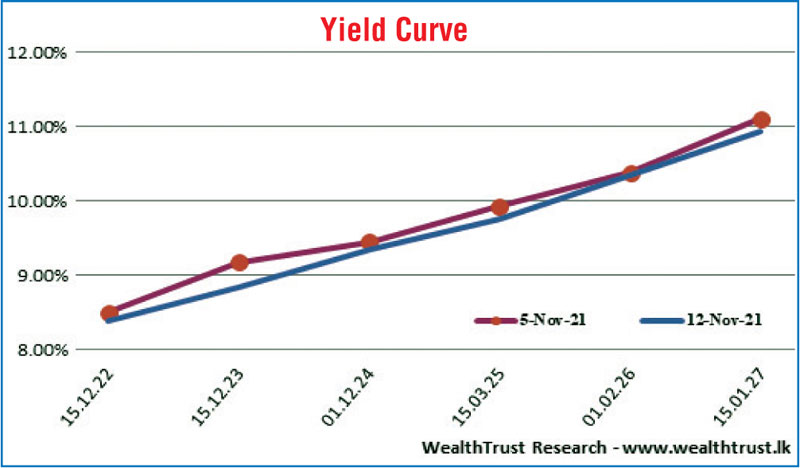

The sentiment in the secondary bond market turned positive during the week ending 12 November due the declining trend in weighted averages at the weekly Treasury bill auction and the robust outcome at the Treasury bond auctions. This led to a shift downwards of the yield curve on a week on week basis and on the back of moderate activity in the secondary market.

The sentiment in the secondary bond market turned positive during the week ending 12 November due the declining trend in weighted averages at the weekly Treasury bill auction and the robust outcome at the Treasury bond auctions. This led to a shift downwards of the yield curve on a week on week basis and on the back of moderate activity in the secondary market.

At the weekly bill auction, the weighted average rate of the market favourite 91 day bill decreased further by 20 basis points to 7.98% while the total offered amount at the auction was fully subscribed for a fourth consecutive week.

The primary Treasury bond auctions too produced impressive results as its weighted averages were recorded well below or similar to its pre-auction market rates while both maturities were fully subscribed at its first phase of the auction for the first in seven auctions.

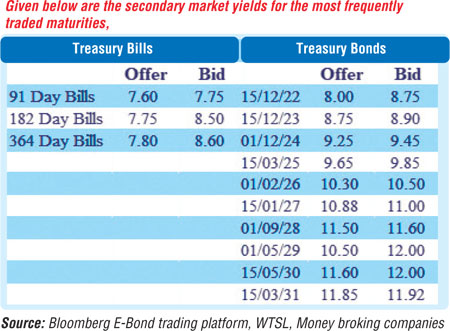

Renewed buying interest in the secondary bond market, mainly on the maturities 15.12.23, 01.12.24, 15.01.27, 01.09.28 and 15.05.30 saw its yields dip to intraweek lows of 9.00%, 9.40%, 10.90%, 11.53% and 11.68% respectively against its previous weeks closing levels of 9.10/25, 9.40/70, 11.05/15, 11.50/60 and 11.50/12.00. In addition, maturities of 15.11.23, 15.03.24, 15.01.26 and 15.03.31 traded at levels of 9.00%, 9.16% to 9.22%, 10.50% and 11.85% to 11.91% as well.

In secondary bills, 21 January, 28 January and 4 February 2022 maturities traded at a low of 7.50%, 7.55% and 7.60% respectively. Nevertheless, selling interest towards the later part of the week saw two-way quotes increasing once again to close the week marginally higher in comparison to its weekly lows.

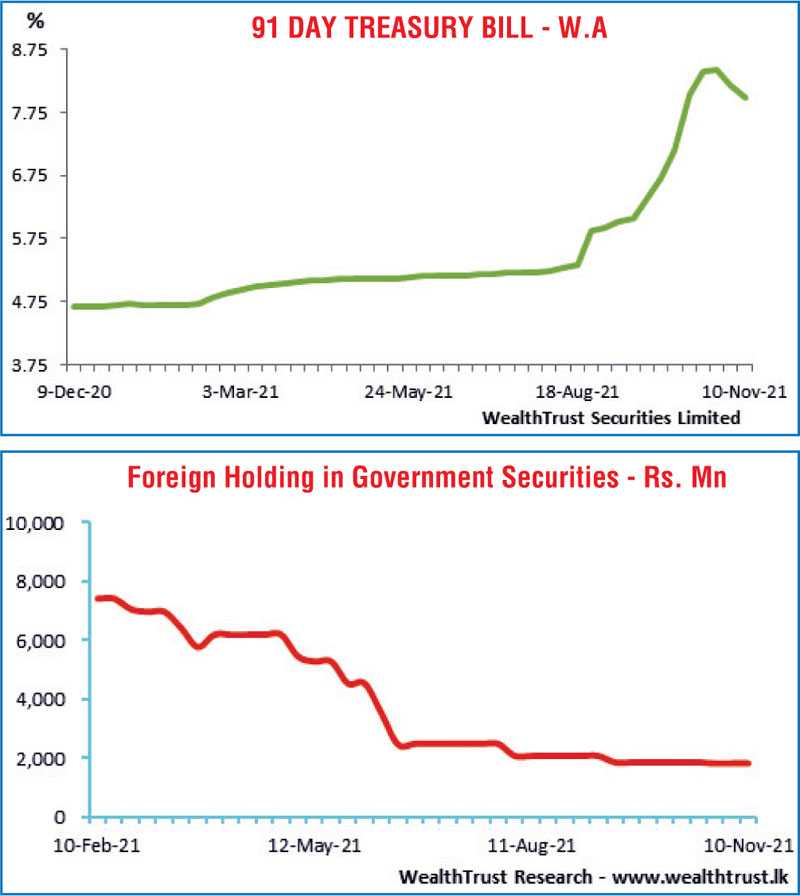

The foreign holding in rupee bonds remained steady at Rs. 1.83 billion for the week ending 10 November while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 15.02 billion.

In money markets, the total outstanding liquidity deficit was seen increasing further during the week to a substantial shortfall of Rs. 249.70 billion by the end of the week against its previous weeks of Rs. 222.50 billion.

The Domestic Operations Department (DOD) of Central Bank was seen draining out liquidity during the week by way of overnight to 14 day repo auctions at weighted average yields ranging from 5.97% to 6.05% while a historically high amount exceeding Rs. 300 billion was accessed from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6% during the week.

The weighted average rates on overnight call money and repo was 5.93% and 5.95% respectively for the week while CBSL’s holding of Government Securities decreased further to Rs. 1,447.73 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at levels of Rs. 202.97 to Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 57.90 million.

(References: Central Bank of Sri Lanka, Bloomberg e-bond trading platform, money broking companies)