Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 21 April 2020 01:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week commenced on a positive note as yields were seen decreasing from its opening highs on the back of continued buying interest.

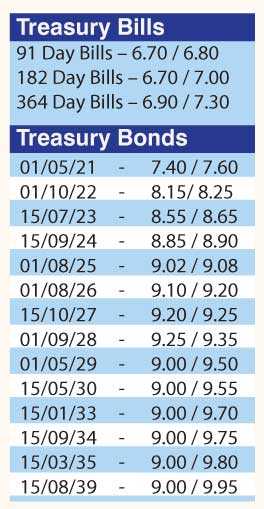

The liquid maturities of 01.01.22, 2023s (i.e. 01.09.23 and 15.12.23), 2024s (i.e. 15.03.24, 15.06.24, 01.08.24 and 15.09.24), 2025s (i.e. 15.03.25 and 01.08.25) and 15.10.27 changed hands at levels of 8.20% to 8.25%, 8.60% to 8.70%, 8.85% to 8.95%, 9.00% to 9.05% and 9.21% to 9.30% respectively.

In secondary bills, October and November 2020 maturities traded at levels of 7.12% and 7.20% to 7.25% respectively.

In money markets, the weighted average rates on overnight call money and repo stood at 6.46% and 6.53% respectively as the overnight net liquidity surplus stood at a high of Rs. 129.45 billion yesterday. An injection by the DOD (Domestic Operations Department) of Central Bank for amounts of Rs. 15 billion each on overnight and seven days drew no bids.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts was seen trading within the range of Rs.191.72 to 196 yesterday.

The total USD/LKR traded volume for 17 April was $ 47.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)